Multiple Choice

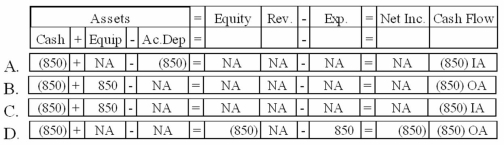

On January 1, 2013, Owens Company spent $850 on a plant asset to improve its quality. The asset had been purchased on January 1, 2010 for $4,200 and had an estimated salvage value of $600 and a useful life of five years. Owens uses the straight-line depreciation method. Which of the following correctly shows the effects of the 2013 expenditure on the financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Which of the following is not classified

Q5: On April 1, 2013, Texas Energy Company

Q6: Which of the following is considered an

Q7: On May 16, 2013, Twin Peaks Corporation

Q8: The Jenkins Company purchased equipment for $15,000

Q10: At the end of 2018, the book

Q15: Explain how a choice of depreciation methods

Q89: When depreciation is recorded on equipment,Depreciation Expense

Q136: What account is debited to record an

Q151: Gains and losses are reported as non-operating