Short Answer

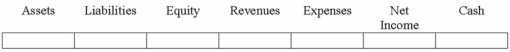

On May 16, 2013, Twin Peaks Corporation found it necessary to recognize an impairment loss of $25,000 of goodwill. The goodwill was originally recorded two years earlier in connection with the purchase of another company. Show how the impairment loss affected the financial statements in 2013.

Correct Answer:

Verified

(D) (N) (D) (N) (I) (D) (N)

Explanation:...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Explanation:...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q3: Which of the following is not classified

Q4: On January 1, 2013, Owens Company spent

Q5: On April 1, 2013, Texas Energy Company

Q6: Which of the following is considered an

Q8: The Jenkins Company purchased equipment for $15,000

Q10: At the end of 2018, the book

Q12: Geode Company paid cash to purchase mineral

Q15: Explain how a choice of depreciation methods

Q89: When depreciation is recorded on equipment,Depreciation Expense

Q151: Gains and losses are reported as non-operating