Short Answer

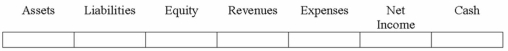

An asset purchased for $12,000 with a $3,000 salvage and a 5 year life is depreciated using straight line depreciation for two years. At the beginning of the third year the useful life of the asset is revised to 4 years. Show how the revision of depreciation expense in the third year of the asset's life will affect the financial statements (compared to the financial statements if the revision in estimate had not been made).

Correct Answer:

Verified

(D) (N) (D) (N) (I) (D) (N)

Explanation:...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Explanation:...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q12: Geode Company paid cash to purchase mineral

Q13: Which of the following would be classified

Q14: On May 4, 2013, Strauss Company purchased

Q15: When Company X purchases Company Y, X

Q21: On January 1, 2013, Fritz Company purchased

Q37: What items are included in the cost

Q47: A trademark is a tangible asset with

Q75: Generally accepted accounting principles require that,when the

Q86: Describe what is meant by the term

Q89: When depreciation is recorded on equipment,Depreciation Expense