Essay

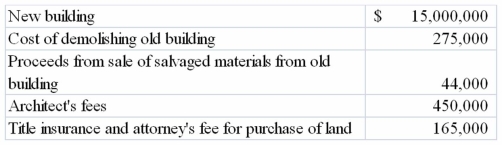

On May 4, 2013, Strauss Company purchased a tract of land as a factory site for $3,200,000. An existing building on the property was demolished, and construction was begun on a new factory building in July 2013 and completed December 15, 2013. Cost data are shown below.  Required:

Required:

Compute the capitalized cost of (1) the land and (2) the factory building.

Correct Answer:

Verified

Explanation: The cost of the building i...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Explanation: The cost of the building i...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q10: At the end of 2018, the book

Q12: Geode Company paid cash to purchase mineral

Q13: Which of the following would be classified

Q15: When Company X purchases Company Y, X

Q16: An asset purchased for $12,000 with a

Q37: What items are included in the cost

Q75: Generally accepted accounting principles require that,when the

Q86: Describe what is meant by the term

Q89: When depreciation is recorded on equipment,Depreciation Expense

Q151: Gains and losses are reported as non-operating