Multiple Choice

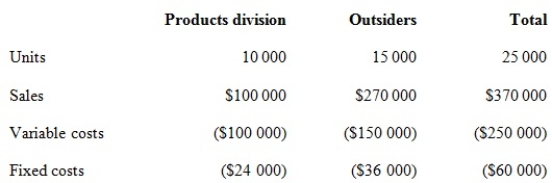

Corporate policy at Weber Pty Ltd requires that all transfers between divisions be recorded at variable cost as a transfer price. Divisional managers have complete autonomy in choosing their sources of customers and suppliers. The Milling Division sells a product called RK2. Forty per cent of the sales of RK2 are to the Products Division, while the remainder of the sales are to outside customers. The manager of the Milling Division is evaluating a special offer from an outside customer for 10 000 units of RK2 at a per unit price of $15. If the special offer were accepted, the Milling Division would be unable to supply those units to the Products Division. The Products Division could purchase those units from another supplier for $17 per unit. Annual capacity for the Milling Division is 25 000 units. The 2014 budget information for the Milling Division, based on full capacity, is presented below.

Assume the company permits the division managers to negotiate a transfer price. The managers agree to a $15 transfer price adjusted to share equally the additional gross margin to Milling Division resulting from the sale to the Products Division. What is the agreed transfer price?

A) $14.00

B) $13.50

C) $12.50

D) $10.50

Correct Answer:

Verified

Correct Answer:

Verified

Q56: The difference between establishing a shared service

Q57: Fruities Ltd has two divisions, Durian Division

Q58: When a company manager's behaviour is aimed

Q59: The budgeted and actual amount of a

Q60: Which of the following is not an

Q62: Which of the following managers is held

Q63: Which of the following managers is held

Q64: When management is using performance reports to

Q65: Which of the following are risks associated

Q66: Which of the following is not a