Multiple Choice

Division A transfers a profitable subassembly to Division B, where it is assembled into a final product. Division A is located in New Zealand, which has a high tax rate. Division B is located in Thailand, which has a low tax rate. Ideally, (1) which type of before tax income should each division report from the transfer and (2) what type of transfer price should be set for the subassembly?

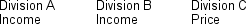

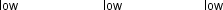

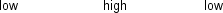

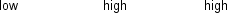

A)

B)

C)

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q48: Which of the following statements about the

Q49: Senior managers use performance measures to:<br>A) target

Q50: Delegating decision making to lower-level managers, thereby

Q51: When a contribution margin format is used

Q52: Which of the following statements best completes

Q54: Which of the following might you expect

Q55: Fragrance Pty Ltd has two divisions: the

Q56: The difference between establishing a shared service

Q57: Fruities Ltd has two divisions, Durian Division

Q58: When a company manager's behaviour is aimed