Essay

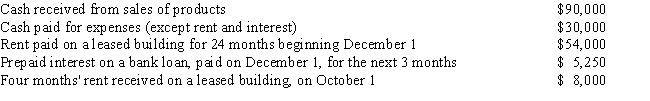

Polly is a cash basis taxpayer with the following transactions during the year:

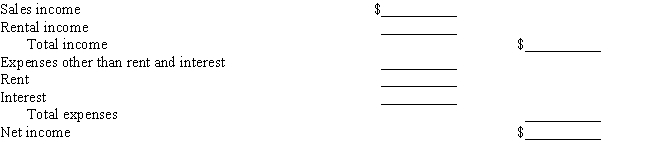

Calculate Polly's income from her business for this calendar year.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q10: Which one of the following is true

Q16: What is the minimum number of years

Q36: In applying the statutory rates from the

Q56: Give the depreciable or amortizable lives for

Q57: Betty purchases a used $12,000 car in

Q58: Jenny constructed a building for use as

Q59: Lanyard purchased office equipment (7-year property) for

Q91: Mark the correct answer. In calculating depreciation:<br>A)Straight-line

Q104: Perry develops a successful advertising business that

Q113: Taxpayers must use the straight-line method of