Essay

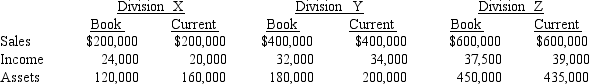

O'Malley Company requires a return on capital of 15 percent. The following information is available for 2016:

Required:

Required:

a. Compute return on investment using both book and current values for each division. (Round answer to three decimal places.)

b. Compute residual income for both book and current values for each division.

c. Does book value or current value provide the better basis for performance evaluation?

d. Which division do you consider the most successful?

Correct Answer:

Verified

c. When available, current values are t...

c. When available, current values are t...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q17: The records for the Venusian Division show

Q18: Cornwall Company has two divisions, A and

Q20: In the Bombadier Company, Division A has

Q21: Olden Company has a tax rate of

Q26: Omikron Division had the following information: <img

Q27: Cornwall Company has two divisions, A and

Q30: Worldwide Inc., is a multinational company with

Q56: Division A produces a component and wants

Q86: Compare and discuss the advantages and disadvantages

Q115: _ is after-tax operating profit minus the