Essay

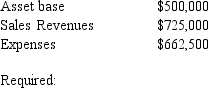

The records for the Venusian Division show the following data:

a. What is the margin, turnover, and ROI for Venusian Division?

b. Venusian has an option to make an additional investment that would add $100,000 to the asset base. It would generate an additional $50,000 in sales revenue and no additional expenses. What would be the effect on margin, turnover, and ROI?

c. Another alternative (independent of alternative 'b') for Venusian is to run an advertising campaign that would require additional advertising expenses of $37,500, but the best estimate is the campaign would generate an additional $75,000 of revenue. What would be the effect on margin, turnover, and ROI?

Correct Answer:

Verified

a b c

Asset base $500,000 $600,000 $500,...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Asset base $500,000 $600,000 $500,...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q16: Worldwide Inc., is a multinational company with

Q18: Cornwall Company has two divisions, A and

Q20: In the Bombadier Company, Division A has

Q21: The transfer pricing problem concerns finding a

Q21: Olden Company has a tax rate of

Q22: O'Malley Company requires a return on capital

Q105: A transfer price is the price charged

Q113: Economic value added (EVA) is after-tax operating

Q115: _ is after-tax operating profit minus the

Q117: The return on investment is computed as<br>A)operating