Essay

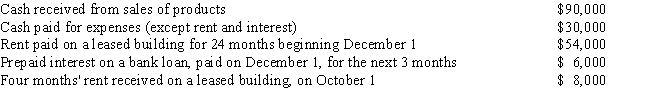

Polly is a cash basis taxpayer with the following transactions during the year:

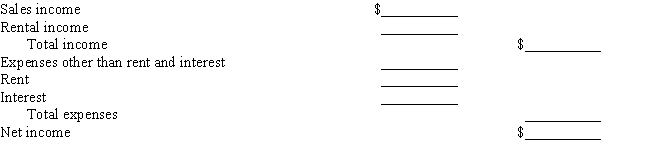

Calculate Polly's income from her business for this calendar year.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q1: All S corporations must use the accrual

Q32: Sales of property at a gain may

Q40: Which of the following is true with

Q46: If listed property is used more than

Q84: Depreciation refers to the physical deterioration or

Q101: An asset (not an automobile)put in service

Q103: The maximum annual Section 179 immediate expensing

Q104: Perry develops a successful advertising business that

Q106: Give the depreciable or amortizable lives for

Q116: If an automobile is purchased for 100