Multiple Choice

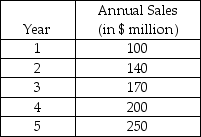

Innovative Inc.is experiencing a boom for the products it has introduced recently.The estimated annual sales projected for the next five years are given in the following table.The current capacity is equivalent to only $100 million sales.The company is considering the alternative of expanding capacity to an equivalent of $250 million sales.Assume a 25 percent pretax profit margin.What is the increase in total pretax cash flow (summed over all years) that would be enjoyed because of the expansion?

A) less than or equal to $40 million

B) more than $40 million but less than or equal to $70 million

C) more than $70 million but less than or equal to $100 million

D) more than $100 million

Correct Answer:

Verified

Correct Answer:

Verified

Q13: The lock box department at Bank 21

Q26: A manufacturing plant is capable of producing

Q29: Table 6.2<br>High Tech,Inc.is producing two types of

Q31: Table 6.6<br>Burdell Labs is a diagnostic laboratory

Q32: Expand Test Center A at the end

Q36: The Southeast Manufacturing Company is producing two

Q37: Capacity decisions should be made separately from

Q39: A lumber mill is capable of producing

Q69: _ are useful capacity analysis tools when

Q76: What is a waiting line model, and