Multiple Choice

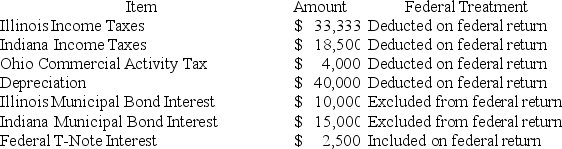

Hoosier Incorporated is an Indiana corporation. It properly included, deducted, or excluded the following items on its federal tax return in the current year:  State depreciation expense was $50,000. Hoosier's Federal Taxable Income was $150,300. Calculate Hoosier's Illinois state tax base.

State depreciation expense was $50,000. Hoosier's Federal Taxable Income was $150,300. Calculate Hoosier's Illinois state tax base.

A) $171,300

B) $173,800

C) $204,633

D) $207,133

Correct Answer:

Verified

Correct Answer:

Verified

Q7: Interest and dividends are allocated to the

Q12: A unitary return includes only companies included

Q29: Commercial domicile is the location where a

Q42: The property factor is generally calculated as

Q71: Physical presence does not always create sales

Q83: Lefty provides demolition services in several southern

Q85: Gordon operates the Tennis Pro Shop in

Q92: PWD Incorporated is an Illinois corporation. It

Q108: Purchases of inventory for resale are typically

Q114: Which of the following isn't a requirement