Multiple Choice

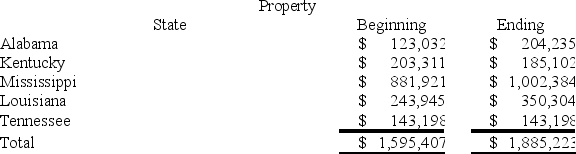

Lefty provides demolition services in several southern states. Lefty has property as follows:  Lefty is a Mississippi Corporation. Lefty also rents property in Mississippi and Tennessee with annual rents of $50,000 and $15,000, respectively. What is Lefty's Mississippi property numerator? (Round your answer to the nearest whole number.)

Lefty is a Mississippi Corporation. Lefty also rents property in Mississippi and Tennessee with annual rents of $50,000 and $15,000, respectively. What is Lefty's Mississippi property numerator? (Round your answer to the nearest whole number.)

A) $942,153

B) $1,002,384

C) $1,052,384

D) $1,342,153

Correct Answer:

Verified

Correct Answer:

Verified

Q4: Delivery of tangible personal property through common

Q12: A unitary return includes only companies included

Q29: Mighty Manny, Incorporated manufactures and services deli

Q29: Commercial domicile is the location where a

Q42: The property factor is generally calculated as

Q78: Mahre, Incorporated, a New York corporation, runs

Q79: Carolina's Hats has the following sales, payroll

Q88: Hoosier Incorporated is an Indiana corporation. It

Q101: Businesses must pay income tax in their

Q108: Purchases of inventory for resale are typically