Exam 6: Property Acquisitions and Cost Recovery Deductions

Exam 1: Introduction to Taxation113 Questions

Exam 2: The Tax Practice Environment92 Questions

Exam 3: Determining Gross Income66 Questions

Exam 4: Employee Compensation62 Questions

Exam 5: Business Expenses88 Questions

Exam 6: Property Acquisitions and Cost Recovery Deductions84 Questions

Exam 7: Property Dispositions63 Questions

Exam 8: Tax-Deferred Exchanges71 Questions

Exam 9: Taxation of Corporations75 Questions

Exam 10: Sole Proprietorships and Flow-Through Entities90 Questions

Exam 11: Income Taxation of Individuals100 Questions

Exam 12: Wealth Transfer Taxes101 Questions

Select questions type

Research and experimentation expenditures can be:

Free

(Multiple Choice)

4.7/5  (34)

(34)

Correct Answer:

C

The MACRS life for all realty is 27½ years.

Free

(True/False)

4.9/5  (44)

(44)

Correct Answer:

False

The basis in property acquired by inheritance is normally its fair market value at the date of the

decedent's death.

Free

(True/False)

4.9/5  (35)

(35)

Correct Answer:

True

Research expenditures must be capitalized and amortized over the period the research is expected to benefit the business.

(True/False)

4.8/5  (34)

(34)

Depletion is the term used for the cost allocation of wasting assets.

(True/False)

4.9/5  (44)

(44)

Cora,a calendar-year corporation,purchased a new machine for $35,000 and some used office furniture for $180,000 in July 2015.What is Cora's maximum cost recovery deduction for 2015?

(Multiple Choice)

4.8/5  (33)

(33)

Gregory Corporation,a calendar-year corporation,purchased an office building in March of year 1.In September of year 17,it sold the building.What fraction must be applied to the MACRS percentage to determine the year 17 depreciation?

(Multiple Choice)

5.0/5  (48)

(48)

On June 20,2015 Baker Corporation (a calendar-year taxpayer)acquired 5-year equipment cost $30,000 and on October 28,2015,it acquired 7-year equipment cost $160,000.Baker did not elect Section 179 expensing and no other assets were acquired during the year.Baker's depreciation for 2015 is:

a.$28,864

b.$27,152

c.$13,212

d.$7,212

(Essay)

4.9/5  (28)

(28)

Useful lives for realty include all of the following except:

(Multiple Choice)

4.9/5  (44)

(44)

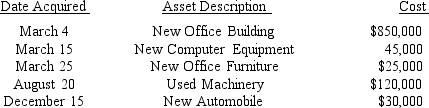

YumYum Corporation (a calendar-year corporation)moved into a new office building adjacent to its manufacturing plant in 2015.It purchased and placed in service the following assets during 2015:  All assets are used 100% for business use.The office building does not include the cost of the land on which it is located that was an additional $300,000.The corporation had $900,000 income from operations before calculating depreciation deductions.If YumYum does not use Section 179 expensing and it elects to use straight-line depreciation on all of its assets,how much is its 2015 depreciation deduction?

All assets are used 100% for business use.The office building does not include the cost of the land on which it is located that was an additional $300,000.The corporation had $900,000 income from operations before calculating depreciation deductions.If YumYum does not use Section 179 expensing and it elects to use straight-line depreciation on all of its assets,how much is its 2015 depreciation deduction?

(Multiple Choice)

4.8/5  (35)

(35)

When would it be advisable to use the alternative depreciation system? Which properties must be depreciated by the alternative depreciation system?

(Essay)

4.9/5  (40)

(40)

YumYum Corporation (a calendar-year corporation)moved into a new office building adjacent to its manufacturing plant in 2015.It purchased and placed in service the following assets during 2015:  All assets are used 100% for business use.The office building does not include the cost of the land on which it is located that was an additional $300,000.The corporation had $900,000 income from operations before calculating depreciation deductions.If YumYum Corporation made all elections available to maximize its overall depreciation deduction for 2015.What is YumYum's maximum depreciation deduction for the office building in 2015?

All assets are used 100% for business use.The office building does not include the cost of the land on which it is located that was an additional $300,000.The corporation had $900,000 income from operations before calculating depreciation deductions.If YumYum Corporation made all elections available to maximize its overall depreciation deduction for 2015.What is YumYum's maximum depreciation deduction for the office building in 2015?

(Multiple Choice)

4.9/5  (30)

(30)

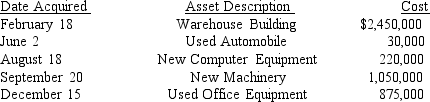

Sanjuro Corporation (a calendar-year corporation)purchased and placed in service the following assets during 2014:  All assets are used 100% for business use.The warehouse building does not include the cost of the land on which it is located which was an additional $1,000,000.The corporation has $3,000,000 income from operations before calculating depreciation deductions.Sanjuro Corporation made whatever elections were necessary to maximize its overall depreciation deduction for 2014.To maximize its total cost recovery deduction,what was Sanjuro Corporation's cost recovery deduction for the automobile for 2014?

All assets are used 100% for business use.The warehouse building does not include the cost of the land on which it is located which was an additional $1,000,000.The corporation has $3,000,000 income from operations before calculating depreciation deductions.Sanjuro Corporation made whatever elections were necessary to maximize its overall depreciation deduction for 2014.To maximize its total cost recovery deduction,what was Sanjuro Corporation's cost recovery deduction for the automobile for 2014?

(Multiple Choice)

4.9/5  (39)

(39)

In May 2014,Stephen acquired a used automobile for $12,000 and used the automobile 75% for business.No Sec.179 election was made.In 2015,Stephen's business use of the automobile decreases to 45%.As a result of this change in business use:

(Multiple Choice)

4.9/5  (37)

(37)

Allen Corporation acquired 5-year property costing $150,000 on September 10,2015.This is the only property acquired this year and Allen elects to expense the maximum amount under Section 179.Allen's income before deducting depreciation is $15,000.What is the maximum amount that Allen can deduct in 2015 for Section 179 expensing?

(Multiple Choice)

4.9/5  (33)

(33)

In a basket purchase of a group of assets,the purchaser and the seller can agree to the value of the separate assets.

(True/False)

4.9/5  (29)

(29)

YumYum Corporation (a calendar-year corporation)moved into a new office building adjacent to its manufacturing plant in 2015.It purchased and placed in service the following assets during 2015:  All assets are used 100% for business use.The office building does not include the cost of the land on which it is located that was an additional $300,000.The corporation had $900,000 income from operations before calculating depreciation deductions.YumYum Corporation made any elections available to maximize its overall depreciation deduction for 2015.What is its maximum depreciation deduction on the new automobile in 2015?

All assets are used 100% for business use.The office building does not include the cost of the land on which it is located that was an additional $300,000.The corporation had $900,000 income from operations before calculating depreciation deductions.YumYum Corporation made any elections available to maximize its overall depreciation deduction for 2015.What is its maximum depreciation deduction on the new automobile in 2015?

(Multiple Choice)

4.8/5  (26)

(26)

Showing 1 - 20 of 84

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)