Exam 6: Property Acquisitions and Cost Recovery Deductions

Exam 1: Introduction to Taxation113 Questions

Exam 2: The Tax Practice Environment92 Questions

Exam 3: Determining Gross Income66 Questions

Exam 4: Employee Compensation62 Questions

Exam 5: Business Expenses88 Questions

Exam 6: Property Acquisitions and Cost Recovery Deductions84 Questions

Exam 7: Property Dispositions63 Questions

Exam 8: Tax-Deferred Exchanges71 Questions

Exam 9: Taxation of Corporations75 Questions

Exam 10: Sole Proprietorships and Flow-Through Entities90 Questions

Exam 11: Income Taxation of Individuals100 Questions

Exam 12: Wealth Transfer Taxes101 Questions

Select questions type

Josephine Company purchases five-year MACRS property in mid-year for $12,000.What is its after-tax cost of this asset if it has a 35 percent tax rate and uses a 6 percent discount rate for project evaluation? No Section 179 expensing or bonus depreciation is claimed for this property.

(Essay)

4.8/5  (39)

(39)

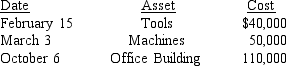

During the year,Garbin Corporation (a calendar-year corporation that manufactures furniture)purchased the following assets:  In computing depreciation of these assets,which of the following averaging conventions will be used?

In computing depreciation of these assets,which of the following averaging conventions will be used?

(Multiple Choice)

4.8/5  (37)

(37)

Showing 81 - 84 of 84

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)