Exam 6: Property Acquisitions and Cost Recovery Deductions

Exam 1: Introduction to Taxation113 Questions

Exam 2: The Tax Practice Environment92 Questions

Exam 3: Determining Gross Income66 Questions

Exam 4: Employee Compensation62 Questions

Exam 5: Business Expenses88 Questions

Exam 6: Property Acquisitions and Cost Recovery Deductions84 Questions

Exam 7: Property Dispositions63 Questions

Exam 8: Tax-Deferred Exchanges71 Questions

Exam 9: Taxation of Corporations75 Questions

Exam 10: Sole Proprietorships and Flow-Through Entities90 Questions

Exam 11: Income Taxation of Individuals100 Questions

Exam 12: Wealth Transfer Taxes101 Questions

Select questions type

On November 7,2015,Wilson Corporation acquires 7-year property for $35,000.This is the only property acquired this year and Section 179 expensing is elected.What is Wilson's total depreciation deduction for 2015?

(Multiple Choice)

4.8/5  (52)

(52)

William has decided to purchase a large apartment complex.He pays $100,000 cash,obtains a loan on the property for $500,000,and assumes the first mortgage balance of $250,000.He also gives the sellers $100,000 of marketable securities that he purchased three years ago for $125,000.He paid a finder's fee of $5,000,legal fees of $6,000,and transfer taxes of $12,000.What is William's acquisition basis for the building? Does he have any other tax consequences as a result of this purchase?

(Essay)

4.7/5  (38)

(38)

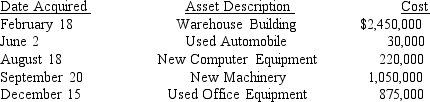

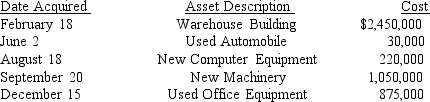

Sanjuro Corporation (a calendar-year corporation)purchased and placed in service the following assets during 2014:  All assets are used 100% for business use.The warehouse building does not include the cost of the land on which it is located which was an additional $1,000,000.The corporation has $3,000,000 income from operations before calculating depreciation deductions.Sanjuro Corporation made whatever elections were necessary to maximize its overall depreciation deduction for 2014.

What is Sanjuro Corporation's cost recovery deduction for the warehouse for 2016 if it is sold in November of 2016?

All assets are used 100% for business use.The warehouse building does not include the cost of the land on which it is located which was an additional $1,000,000.The corporation has $3,000,000 income from operations before calculating depreciation deductions.Sanjuro Corporation made whatever elections were necessary to maximize its overall depreciation deduction for 2014.

What is Sanjuro Corporation's cost recovery deduction for the warehouse for 2016 if it is sold in November of 2016?

(Multiple Choice)

4.9/5  (27)

(27)

Jeremy purchased an asset for $12,000 at the beginning of the year.Assuming the asset is depreciated over three years on a straight-line basis,no averaging conventions apply,Jeremy's tax rate is 35 percent,and he uses a 6 percent discount rate,what is the after-tax cost of the asset?

(Essay)

4.9/5  (46)

(46)

Momee Corporation,a calendar-year corporation,bought only one asset in 2010,a crane it purchased for $700,000 on November 24.It disposed of the asset in April,2015.What is its depreciation deduction for this asset in 2015 if cost recovery was determined using only regular MACRS?

(Multiple Choice)

5.0/5  (41)

(41)

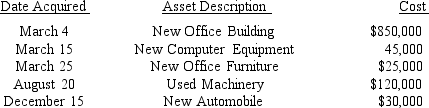

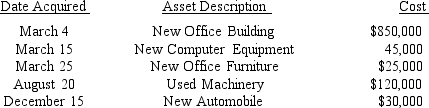

YumYum Corporation (a calendar-year corporation)moved into a new office building adjacent to its manufacturing plant in 2015.It purchased and placed in service the following assets during 2015:  All assets are used 100% for business use.The office building does not include the cost of the land on which it is located that was an additional $300,000.The corporation had $900,000 income from operations before calculating depreciation deductions.If YumYum Corporation made all elections available to maximize its overall depreciation deduction for 2015,what would its maximum cost recovery deduction be for 2015?

All assets are used 100% for business use.The office building does not include the cost of the land on which it is located that was an additional $300,000.The corporation had $900,000 income from operations before calculating depreciation deductions.If YumYum Corporation made all elections available to maximize its overall depreciation deduction for 2015,what would its maximum cost recovery deduction be for 2015?

(Multiple Choice)

4.9/5  (45)

(45)

YumYum Corporation (a calendar-year corporation)moved into a new office building adjacent to its manufacturing plant in 2015.It purchased and placed in service the following assets during 2015:  All assets are used 100% for business use.The office building does not include the cost of the land on which it is located that was an additional $300,000.The corporation had $900,000 income from operations before calculating depreciation deductions.What is YumYum's Section 179 deduction for 2015?

All assets are used 100% for business use.The office building does not include the cost of the land on which it is located that was an additional $300,000.The corporation had $900,000 income from operations before calculating depreciation deductions.What is YumYum's Section 179 deduction for 2015?

(Multiple Choice)

4.7/5  (37)

(37)

The first year's depreciation for equipment acquired in October by a calendar-year business would be based on 1½ months if it was the only asset acquired that year.

(True/False)

4.9/5  (36)

(36)

If a business acquired a new machine in 2014,explain how it could have recovered its cost most efficiently.How does this differ from the maximum cost recovery deduction if the new machine is instead acquired in 2015?

(Essay)

4.8/5  (35)

(35)

What limitations applied to the use of Section 179 expensing in 2014? What changes took effect on January 1,2015?

(Essay)

4.7/5  (36)

(36)

What is the difference between depreciation,depletion,and amortization?

(Essay)

4.8/5  (38)

(38)

What is a mixed-use asset? What adjustment must be made for depreciating a mixed-use asset?

(Essay)

4.7/5  (36)

(36)

Soledad left her son Juan property valued at $700,000 when she died.Soledad paid $825,000 for the property but its adjusted basis when she died was $450,000.Juan did not want the building so he authorized the administrator to sell the building 6 months after Soledad's death for $650,000.Due to the decline in value of a number of Soledad's other assets after her death,the administrator elected the alternate valuation date for the assets.What is the realized and recognized gain or loss on the sale of the asset? Explain your answer.

(Essay)

4.9/5  (39)

(39)

Sanjuro Corporation (a calendar-year corporation)purchased and placed in service the following assets during 2014:  All assets are used 100% for business use.The warehouse building does not include the cost of the land on which it is located which was an additional $1,000,000.The corporation has $3,000,000 income from operations before calculating depreciation deductions.Sanjuro Corporation made whatever elections were necessary to maximize its overall depreciation deduction for 2014.

What is Sanjuro Corporation's cost recovery deduction for the office equipment for 2015?

All assets are used 100% for business use.The warehouse building does not include the cost of the land on which it is located which was an additional $1,000,000.The corporation has $3,000,000 income from operations before calculating depreciation deductions.Sanjuro Corporation made whatever elections were necessary to maximize its overall depreciation deduction for 2014.

What is Sanjuro Corporation's cost recovery deduction for the office equipment for 2015?

(Multiple Choice)

4.8/5  (44)

(44)

If more than 40 percent of all personalty purchased during the year is placed in service during the last quarter of the year,the mid-quarter convention must be used.

(True/False)

4.8/5  (43)

(43)

Conrad Corporation has a June 30 year end.What is the MACRS depreciation percentage deduction for the first year for a 5-year asset acquired October 15 under the mid-quarter convention.

(Multiple Choice)

4.8/5  (36)

(36)

Section 179 expenses exceeding the annual cost limitation may be carried forward for five years only.

(True/False)

4.7/5  (39)

(39)

Showing 61 - 80 of 84

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)