Exam 20: External Growth Through Mergers

Exam 1: The Goals and Functions of Financial Management106 Questions

Exam 2: Review of Accounting150 Questions

Exam 3: Financial Analysis124 Questions

Exam 4: Financial Forecasting95 Questions

Exam 5: Operating and Financial Leverage106 Questions

Exam 6: Working Capital and the Financing Decision124 Questions

Exam 7: Current Asset Management148 Questions

Exam 8: Sources of Short-Term Financing117 Questions

Exam 9: The Time Value of Money100 Questions

Exam 10: Valuation and Rates of Return115 Questions

Exam 11: Cost of Capital144 Questions

Exam 12: The Capital Budgeting Decision131 Questions

Exam 13: Risk and Capital Budgeting97 Questions

Exam 14: Capital Markets128 Questions

Exam 15: Investment Underwriting112 Questions

Exam 16: Long-Term Debt and Lease Financing192 Questions

Exam 17: Common and Preferred Stock Financing111 Questions

Exam 18: Dividend Policy and Retained Earnings110 Questions

Exam 19: Derivative Securities146 Questions

Exam 20: External Growth Through Mergers107 Questions

Exam 21: International Financial Management126 Questions

Select questions type

One potential advantage of a merger to the acquiring firm is the portfolio effect which attempts to achieve risk reduction while perhaps maintaining the rate of return for the firm.

(True/False)

4.9/5  (39)

(39)

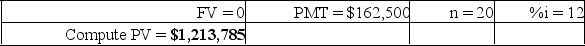

The King Solomon Mining Company is contemplating a cash tender offer for the outstanding shares of Roanoke Coal Corporation. Roanoke Coal is expected to provide $162,500 in after-tax cash flow (after tax income plus CCA) each year for the next 20 years. In addition, Roanoke has a $630,000 tax loss carry-forward that King Solomon Mining can use over the next two years ($315,000 per year).

If King Solomon Mining's corporate tax rate is 34% and its cost of capital is 12%, what is the maximum cash price it should be willing to pay to acquire Roanoke?

Present value of after-tax cash flows:

(Essay)

4.9/5  (42)

(42)

When one company offers a large premium for another company, most of the upward movement in share price occurs after the public announcement of the merger offer and thus offers the best opportunity for profit to small investors.

(True/False)

4.8/5  (39)

(39)

Following a merger, the change in the risk profile of the merged companies may influence the P/E ratio as much as the change in the overall growth rate.

(True/False)

4.9/5  (33)

(33)

When negotiating a merger offer, management and shareholders may disagree on whether a bid should be accepted.

(True/False)

4.9/5  (37)

(37)

Existing management of a firm is almost always ready to accept an offer for the purchase of the firm at a price above the market.

(True/False)

4.8/5  (35)

(35)

Which of the following is not a potential benefit of a merger?

(Multiple Choice)

4.9/5  (40)

(40)

-Assume Alpha pays a 20% premium for Beta in a pooling of interests' transaction. Calculate the post-merger EPS for Alpha.

-Assume Alpha pays a 20% premium for Beta in a pooling of interests' transaction. Calculate the post-merger EPS for Alpha.

(Multiple Choice)

4.9/5  (35)

(35)

"Poison pills" are strategies that reduce the value of a firm if it is taken over by a corporate raider.

(True/False)

4.7/5  (47)

(47)

In light of accounting considerations, the acquiring company has some inducement to offer cash, and the acquired company would rather receive cash than face possible dilution.

(True/False)

4.8/5  (30)

(30)

A tax loss carry-forward is a benefit to the acquired firm's shareholders.

(True/False)

4.9/5  (44)

(44)

All of the following are potential benefits to a corporation in offering share purchases rather than non-equity compensation except:

(Multiple Choice)

4.8/5  (35)

(35)

If the potential buyer cannot come to agreement on merger terms with the potential seller's management and board of directors describe which two alternatives are still open to the potential buyer.

(Essay)

4.9/5  (30)

(30)

The financial motives for merger activity include all of the following except:

(Multiple Choice)

4.9/5  (36)

(36)

Vertical integration is usually prohibited or severely restricted by government competition regulations.

(True/False)

4.8/5  (40)

(40)

The stock market reaction to divestitures may actually be positive if the divestiture is perceived to rid the company of an unprofitable business, or if it seems to sharpen the company's focus.

(True/False)

4.7/5  (36)

(36)

In a merger, the short-term and long-term effect on EPS varies according to the relative P/E ratios and the differential future growth rates of the two firms.

(True/False)

4.8/5  (37)

(37)

Simon Manufacturing Co. is planning to acquire Garfunkel Engineering in a cash plus stock buyout. Garfunkel has 2,000,000 shares of common stock currently outstanding, and the market price is currently at $25 per share. The buyout would offer to purchase Garfunkel Engineering common stock for $19.50 per share, plus a newly issued share of Simon Manufacturing convertible preferred stock, valued at $13.75 per share.

Simon Manufacturing's investment dealer has suggested, as an alternative, a single-stage buyout at $32.50 per share for all of Garfunkel's common stock.

A) What is the total cost of the cash plus stock buyout?

B) What is the total cost of the cash only proposal?

C) If it wants to minimize the total cost of the acquisition, what should Simon Manufacturing do?

(Essay)

4.9/5  (36)

(36)

Showing 61 - 80 of 107

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)