Exam 3: Determining Gross Income

Exam 1: Introduction to Taxation109 Questions

Exam 2: The Tax Practice Environment111 Questions

Exam 3: Determining Gross Income132 Questions

Exam 4: Employee Compensation101 Questions

Exam 5: Deductions for Individuals and Tax Determination120 Questions

Exam 6: Business Expenses116 Questions

Exam 7: Property Acquisitions and Cost Recovery Deductions114 Questions

Exam 8: Property Dispositions116 Questions

Exam 9: Tax-Deferred Exchanges112 Questions

Exam 10: Taxation of Corporations111 Questions

Exam 11: Sole Proprietorships and Flow-Through Entities133 Questions

Exam 12: Estates, Gifts, and Trusts116 Questions

Select questions type

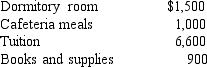

Natasha graduated at the top of her high school class and received a $10,000 scholarship to attend the college of her choice. Natasha decided to attend State University and spent her $10,000 as follows:  How much of the $10,000 should Natasha report as gross income?

How much of the $10,000 should Natasha report as gross income?

(Multiple Choice)

4.8/5  (36)

(36)

Kimberly gave 100 shares of stock to her 24-year-old son, Brandon. Kimberly purchased the stock 9 months ago for $10 per share. On the gift date, the stock was worth $40 per share. Two months later, Brandon sells the 100 shares of stock for $60 per share. Kimberly and Brandon are in the 24 percent and 10 percent marginal tax brackets, respectively. How much family tax savings is achieved through this transaction?

(Multiple Choice)

4.7/5  (33)

(33)

George and Georgette divorced in 2017. George was ordered to pay (and does pay) Georgette $600 per month alimony and $800 per month child support. In addition, George transferred title to his half of their stock to Georgette last year. The stock had a basis of $120,000 and a fair market value of $260,000 at the date of the transfer. This year Georgette sells the stock for $280,000. What is Georgette's income for this year if she has no other income items?

(Multiple Choice)

4.7/5  (32)

(32)

In 1992, when Sherry was 56 years old with an additional life expectancy of 20 years, she purchased a single life annuity for $200,000 that was to pay her $15,000 per year for life starting in 1995. Sherry just received her $15,000 payment for 2018. How much of the $15,000 must Sherry include in income?

(Multiple Choice)

4.8/5  (41)

(41)

Fannie purchased ten $1,000 bonds from her broker this year. The bonds were issued four years ago and mature in six years. Due to a change in interest rates, the purchase price of the bonds was only $8,200. If the issuing company redeems the bonds for $10,000 at maturity, how will Fannie treat the $10,000 proceeds?

(Multiple Choice)

4.8/5  (42)

(42)

George can invest $10,000 in a tax-exempt bond paying 6 percent interest or a $10,000 corporate bond paying 8 percent interest. What is the lowest marginal tax rate at which George will be better off investing in the tax-exempt bond?

(Multiple Choice)

4.8/5  (37)

(37)

Explain the basic difference between the common law and community property states related to earned income.

(Essay)

4.9/5  (40)

(40)

Jabo Corporation has its home office and manufacturing facilities in Peru. It sells products via the Internet in both Brazil and Chile, although it has a small sales and manufacturing facility in Santiago, Chile.

(Multiple Choice)

5.0/5  (37)

(37)

How does an alien achieve residency status for taxation in the United States?

(Essay)

4.7/5  (37)

(37)

Which of the following doctrines does not affect the timing of income recognition for a cash basis taxpayer?

(Multiple Choice)

4.9/5  (39)

(39)

Carol attends State U. and received a $10,000 scholarship for her senior year that began in September, year 1. Up to the time of her graduation in May, year 2, Carol had paid the following expenses for the two semesters:

1st semester: $3,000 tuition; $1,550 room and board in a dormitory; $400 for books and fees.

2nd semester: $3,000 tuition; $1,700 living expenses in an apartment; $250 for books and fees.

She used the remaining money from the scholarship to purchase clothes for job hunting in April, year 2.

Does Carol have any income as a result of the scholarship? If yes, how much is her income and in what years would it be included in income?

(Essay)

4.8/5  (43)

(43)

Showing 121 - 132 of 132

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)