Exam 24: Performance Measurement and Responsibility Accounting

Exam 1: Accounting in Business233 Questions

Exam 2: Analyzing and Recording Transactions200 Questions

Exam 3: Adjusting Accounts and Preparing Financial Statements161 Questions

Exam 4: Completing the Accounting Cycle106 Questions

Exam 5: Accounting for Merchandising Operations131 Questions

Exam 6: Inventories and Cost of Sales133 Questions

Exam 7: Accounting Information Systems112 Questions

Exam 8: Cash and Internal Controls131 Questions

Exam 9: Accounting for Receivables117 Questions

Exam 10: Plant Assets, Natural Resources, and Intangibles161 Questions

Exam 11: Current Liabilities and Payroll Accounting149 Questions

Exam 12: Accounting for Partnerships136 Questions

Exam 13: Accounting for Corporations205 Questions

Exam 14: Long-Term Liabilities187 Questions

Exam 15: Investments and International Operations188 Questions

Exam 16: Reporting the Statement of Cash Flows194 Questions

Exam 17: Analysis of Financial Statements194 Questions

Exam 18: Managerial Accounting Concepts and Principles205 Questions

Exam 19: Job Order Cost Accounting164 Questions

Exam 20: Process Cost Accounting179 Questions

Exam 21: Cost-Volume-Profit Analysis167 Questions

Exam 22: Master Budgets and Planning177 Questions

Exam 23: Flexible Budgets and Standard Costs177 Questions

Exam 24: Performance Measurement and Responsibility Accounting162 Questions

Exam 25: Capital Budgeting and Managerial Decisions158 Questions

Exam 26: Appendix B: Time Value of Money27 Questions

Exam 27: Appendix C: Activity-Based Costing50 Questions

Select questions type

Allocating joint costs to products using a value basis method is based on their relative:

(Multiple Choice)

4.9/5  (40)

(40)

Expenses that are easily traced and assigned to a specific department because they are incurred for the sole benefit of that department are called:

(Multiple Choice)

4.8/5  (39)

(39)

Which of the following is not true regarding a responsibility accounting system?

(Multiple Choice)

5.0/5  (37)

(37)

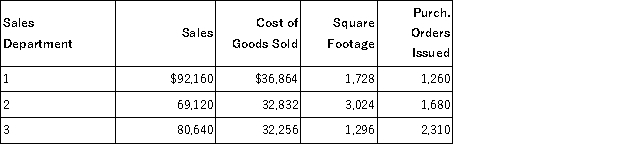

Arkansas Toys,a retail store,has three sales departments supported by two service departments.Cost and operational data for each department follow:

Determine the service department expenses to be allocated to Sales Department 1 for (round answers to whole dollars):

Advertising ___________________

Purchasing ___________________

Determine the service department expenses to be allocated to Sales Department 1 for (round answers to whole dollars):

Advertising ___________________

Purchasing ___________________

(Essay)

4.8/5  (42)

(42)

In a decentralized organization,decisions are made by managers throughout the company rather than by a few top executives.

(True/False)

4.8/5  (46)

(46)

Carter Company reported the following financial numbers for one of its divisions for the year;average total assets of $4,100,000;sales of $4,525,000;cost of goods sold of $2,550,000;and operating expenses of $1,372,000.Assume a target income of 10% of average invested assets.Compute residual income for the division:

(Multiple Choice)

4.8/5  (30)

(30)

Departmental salary expenses are direct expenses of that department.

(True/False)

4.9/5  (45)

(45)

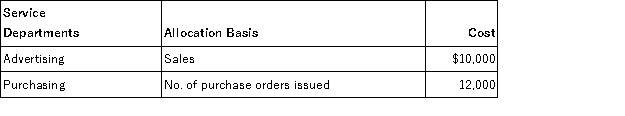

Ultimo Co.operates three production departments as profit centers.The following information is available for its most recent year.Department 2's contribution to overhead in dollars is:

(Multiple Choice)

4.8/5  (34)

(34)

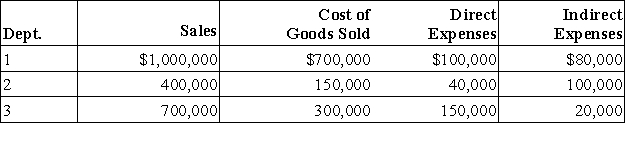

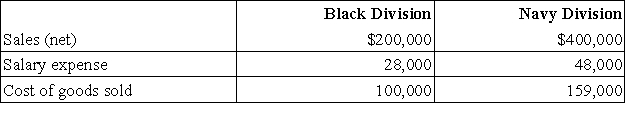

Marian Corporation has two separate divisions that operate as profit centers.The following information is available for the most recent year:  The Black Division occupies 20,000 square feet in the plant.The Navy Division occupies 30,000 square feet.Rent is an indirect expense and is allocated based on square footage.Rent expense for the year was $50,000.Compute departmental income for the Black and Navy Divisions,respectively.

The Black Division occupies 20,000 square feet in the plant.The Navy Division occupies 30,000 square feet.Rent is an indirect expense and is allocated based on square footage.Rent expense for the year was $50,000.Compute departmental income for the Black and Navy Divisions,respectively.

(Multiple Choice)

4.8/5  (46)

(46)

Since service departments do not generate revenues,it is unnecessary to accumulate and allocate their costs.

(True/False)

4.8/5  (37)

(37)

Within an organizational structure,the person most likely to be evaluated in terms of controllable costs would be:

(Multiple Choice)

4.8/5  (37)

(37)

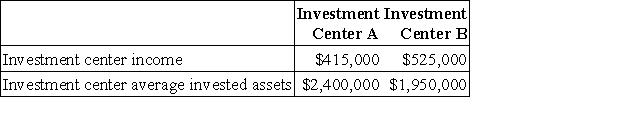

Two investment centers at Marshman Corporation have the following current-year income and asset data:  The return on investment (ROI)for Investment Center B is:

The return on investment (ROI)for Investment Center B is:

(Multiple Choice)

5.0/5  (41)

(41)

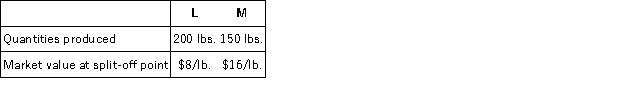

Data pertaining to a company's joint production for the current period follows:  Compute the cost to be allocated to Product L for this period's $660 of joint costs if the value basis is used.

Compute the cost to be allocated to Product L for this period's $660 of joint costs if the value basis is used.

(Multiple Choice)

4.8/5  (30)

(30)

Decentralization refers to companies that have multiple locations.

(True/False)

4.9/5  (37)

(37)

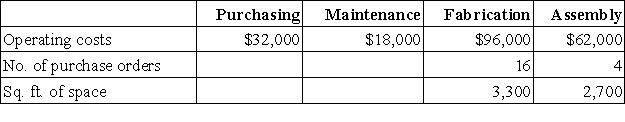

The following is a partially completed lower section of a departmental expense allocation spreadsheet for Brickland.It reports the total amounts of direct and indirect expenses for the four departments.Purchasing department expenses are allocated to the operating departments on the basis of purchase orders.Maintenance department expenses are allocated based on square footage.Compute the amount of Purchasing department expense to be allocated to Fabrication.

(Multiple Choice)

4.8/5  (37)

(37)

A company has two departments,Y and Z that incur delivery expenses.An analysis of the total delivery expense of $9,000 indicates that Dept.Y had a direct expense of $1,000 for deliveries and Dept.Z had no direct expense.The indirect expenses are $8,000.The analysis also indicates that 40% of regular delivery requests originate in Dept.Y and 60% originate in Dept.Z.Departmental delivery expenses for Dept.Y and Dept.Z,respectively,are:

(Multiple Choice)

4.8/5  (38)

(38)

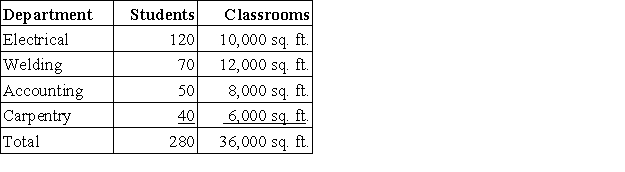

Canfield Technical School allocates administrative costs to its respective departments based on the number of students enrolled,while maintenance and utilities are allocated per square feet of the classrooms.Based on the information below,what is the total amount allocated to the Welding Department (rounded to the nearest dollar)if administrative costs for the school were $50,000,maintenance fees were $12,000,and utilities were $6,000?

(Multiple Choice)

4.9/5  (39)

(39)

Direct expenses require allocation across departments because they cannot be readily traced to one department.

(True/False)

4.8/5  (42)

(42)

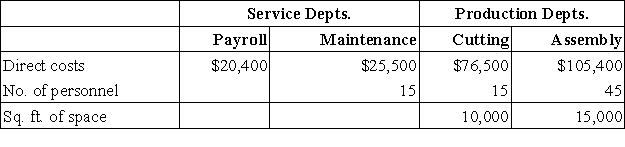

Brownley Company has two service departments and two operating (production)departments.The Payroll Department services all three of the other departments in proportion to the number of employees in each.The Maintenance Department costs are allocated to the two operating departments in proportion to the floor space used by each.Listed below are the operating data for the current period:  The total cost of operating the Cutting Department for the current period is:

The total cost of operating the Cutting Department for the current period is:

(Multiple Choice)

4.8/5  (36)

(36)

Part 7B costs the Midwest Division of Frackle Corporation $30 to make,of which $21 is variable.Midwest Division sells Part 7B to other companies for $47.The Northern Division of Frackle Corporation can use Part 7B in one of its products.The Midwest Division has enough idle capacity to produce all of the units of Part 7B that the Northern Division would require.What is the lowest transfer price at which the Midwest Division should be willing to sell Part 7B to the Northern Division?

(Multiple Choice)

4.8/5  (36)

(36)

Showing 141 - 160 of 162

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)