Exam 3: Adjusting Accounts and Preparing Financial Statements

Exam 1: Accounting in Business233 Questions

Exam 2: Analyzing and Recording Transactions200 Questions

Exam 3: Adjusting Accounts and Preparing Financial Statements161 Questions

Exam 4: Completing the Accounting Cycle106 Questions

Exam 5: Accounting for Merchandising Operations131 Questions

Exam 6: Inventories and Cost of Sales133 Questions

Exam 7: Accounting Information Systems112 Questions

Exam 8: Cash and Internal Controls131 Questions

Exam 9: Accounting for Receivables117 Questions

Exam 10: Plant Assets, Natural Resources, and Intangibles161 Questions

Exam 11: Current Liabilities and Payroll Accounting149 Questions

Exam 12: Accounting for Partnerships136 Questions

Exam 13: Accounting for Corporations205 Questions

Exam 14: Long-Term Liabilities187 Questions

Exam 15: Investments and International Operations188 Questions

Exam 16: Reporting the Statement of Cash Flows194 Questions

Exam 17: Analysis of Financial Statements194 Questions

Exam 18: Managerial Accounting Concepts and Principles205 Questions

Exam 19: Job Order Cost Accounting164 Questions

Exam 20: Process Cost Accounting179 Questions

Exam 21: Cost-Volume-Profit Analysis167 Questions

Exam 22: Master Budgets and Planning177 Questions

Exam 23: Flexible Budgets and Standard Costs177 Questions

Exam 24: Performance Measurement and Responsibility Accounting162 Questions

Exam 25: Capital Budgeting and Managerial Decisions158 Questions

Exam 26: Appendix B: Time Value of Money27 Questions

Exam 27: Appendix C: Activity-Based Costing50 Questions

Select questions type

___________________ is the process of allocating the cost of plant assets to the income statement over their expected useful lives.

(Essay)

4.8/5  (37)

(37)

Under the alternative method for recording prepaid expenses,which is the correct set of journal entries?

(Multiple Choice)

4.7/5  (34)

(34)

A company records the fees for legal services paid in advance by its clients in an account called Unearned Legal Fees.If the company fails to make the end-of-period adjusting entry to move the portion of these fees that has been earned to a revenue account,one effect will be:

(Multiple Choice)

4.8/5  (41)

(41)

On December 31,Chu Company had performed $3,000 of management services for clients that had not yet been billed.Prepare Chu's adjusting entry to record these fees earned.

(Essay)

4.7/5  (42)

(42)

All of the following are true regarding unearned revenues except:

(Multiple Choice)

4.8/5  (36)

(36)

On April 1,Griffith Publishing Company received $1,548 from Santa Fe,Inc.for 36-month subscriptions to several different magazines.The company credited Unearned Fees for the amount received and the subscriptions started immediately.What is the adjusting entry that should be recorded by Griffith Publishing Company on December 31 of the first year?

(Multiple Choice)

4.7/5  (37)

(37)

The correct adjusting entry for accrued and unpaid employee salaries of $9,000 on December 31 is:

(Multiple Choice)

4.8/5  (39)

(39)

On January 1 a company purchased a five-year insurance policy for $1,800 with coverage starting immediately.If the purchase was recorded in the Prepaid Insurance account,and the company records adjustments only at year-end,the adjusting entry at the end of the first year is:

(Multiple Choice)

4.8/5  (39)

(39)

In accrual accounting,accrued revenues are recorded as liabilities.

(True/False)

4.8/5  (38)

(38)

Under the alternative method for accounting for unearned revenue,which of the following pairs of journal entry formats is correct?

(Multiple Choice)

4.8/5  (33)

(33)

On April 1,Santa Fe,Inc.paid Griffith Publishing Company $1,548 for 36-month subscriptions to several different magazines.Santa Fe debited the prepayment to a Prepaid Subscriptions account,and the subscriptions started immediately.What amount should appear in the Prepaid Subscription account for Santa Fe,Inc.after adjustments on December 31 of the first year assuming the company is using a calendar reporting period and no previous adjustment has been made?

(Multiple Choice)

4.8/5  (32)

(32)

On November 1,Jovel Company loaned another company $100,000 at a 6.0% interest rate.The note receivable plus interest will not be collected until March 1 of the following year.The company's annual accounting period ends on December 31.The adjusting entry needed on December 31 is:

(Multiple Choice)

4.9/5  (37)

(37)

A company purchased a new delivery van at a cost of $45,000 on July 1.The truck is estimated to have a useful life of 6 years and a salvage value of $3,000.The company uses the straight-line method of depreciation.How much depreciation expense will be recorded for the van during the first year ended December 31?

(Multiple Choice)

4.9/5  (34)

(34)

Sanborn Company rents space to a tenant for $2,200 per month.The tenant currently owes rent for November and December.The tenant has agreed to pay the November,December,and January rents in full on January 15 and has agreed not to fall behind again.The adjusting entry needed on December 31 is:

(Multiple Choice)

4.7/5  (39)

(39)

On May 1,Sellers Marketing Company received $1,500 from Franco Marcelli for a marketing campaign effective from May 1 this year to April 30 of the following year.The Cash receipt was recorded as unearned fees and at year-end on December 31,$1,000 of the fees had been earned.The adjusting entry on December 31 would be:

(Multiple Choice)

4.7/5  (39)

(39)

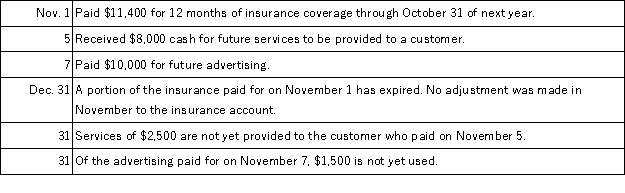

Gracio Co.had the following transactions in the last two months of its year ended December 31.Prepare entries for these transactions under the method that records prepaid expenses as expenses and records unearned revenues as revenues.Also prepare adjusting entries at the end of the year.

(Essay)

4.9/5  (38)

(38)

Companies experiencing seasonal variations in sales often choose a fiscal year corresponding to their ________________________ year.

(Essay)

4.9/5  (43)

(43)

On April 1,Griffith Publishing Company received $1,548 from Santa Fe,Inc.for 36-month subscriptions to several different magazines.The subscriptions started immediately.What is the amount of revenue that should be recorded by Griffith Publishing Company for the second year of the subscription assuming the company uses a calendar reporting period?

(Multiple Choice)

4.8/5  (40)

(40)

On July 1 Plum Co.paid $7,500 cash for management services to be performed over a two-year period.Plum follows a policy of recording all prepaid expenses to asset accounts at the time of cash payment.On July 1 Plum should record:

(Multiple Choice)

4.9/5  (36)

(36)

Showing 61 - 80 of 161

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)