Exam 2: Analyzing and Recording Transactions

Exam 1: Accounting in Business233 Questions

Exam 2: Analyzing and Recording Transactions200 Questions

Exam 3: Adjusting Accounts and Preparing Financial Statements161 Questions

Exam 4: Completing the Accounting Cycle106 Questions

Exam 5: Accounting for Merchandising Operations131 Questions

Exam 6: Inventories and Cost of Sales133 Questions

Exam 7: Accounting Information Systems112 Questions

Exam 8: Cash and Internal Controls131 Questions

Exam 9: Accounting for Receivables117 Questions

Exam 10: Plant Assets, Natural Resources, and Intangibles161 Questions

Exam 11: Current Liabilities and Payroll Accounting149 Questions

Exam 12: Accounting for Partnerships136 Questions

Exam 13: Accounting for Corporations205 Questions

Exam 14: Long-Term Liabilities187 Questions

Exam 15: Investments and International Operations188 Questions

Exam 16: Reporting the Statement of Cash Flows194 Questions

Exam 17: Analysis of Financial Statements194 Questions

Exam 18: Managerial Accounting Concepts and Principles205 Questions

Exam 19: Job Order Cost Accounting164 Questions

Exam 20: Process Cost Accounting179 Questions

Exam 21: Cost-Volume-Profit Analysis167 Questions

Exam 22: Master Budgets and Planning177 Questions

Exam 23: Flexible Budgets and Standard Costs177 Questions

Exam 24: Performance Measurement and Responsibility Accounting162 Questions

Exam 25: Capital Budgeting and Managerial Decisions158 Questions

Exam 26: Appendix B: Time Value of Money27 Questions

Exam 27: Appendix C: Activity-Based Costing50 Questions

Select questions type

Identify the correct formula below used to calculate the debt ratio.

(Multiple Choice)

4.8/5  (29)

(29)

A company's list of accounts and the identification numbers assigned to each account is called a:

(Multiple Choice)

4.7/5  (38)

(38)

A customer's promise to pay on credit is classified as an account payable by the seller.

(True/False)

4.9/5  (36)

(36)

A record in which the effects of transactions are first recorded and from which transaction amounts are posted to the ledger is a(n):

(Multiple Choice)

4.8/5  (34)

(34)

The second step in the analyzing and recording process is to record the transactions and events in the book of original entry,called the ______________.

(Essay)

4.9/5  (41)

(41)

When a company provides services for which cash will not be received until some future date,the company should record the amount charged as accounts receivable.

(True/False)

4.9/5  (32)

(32)

A report that lists a business's accounts and their balances,in which the total debit balances should equal the total credit balances,is called a(n):

(Multiple Choice)

4.7/5  (39)

(39)

A ____________ gives a complete record of each transaction in one place,and shows debits and credits for each transaction.

(Essay)

4.9/5  (36)

(36)

A general journal gives a complete record of each transaction in one place,and shows the debits and credits for each transaction.

(True/False)

4.8/5  (38)

(38)

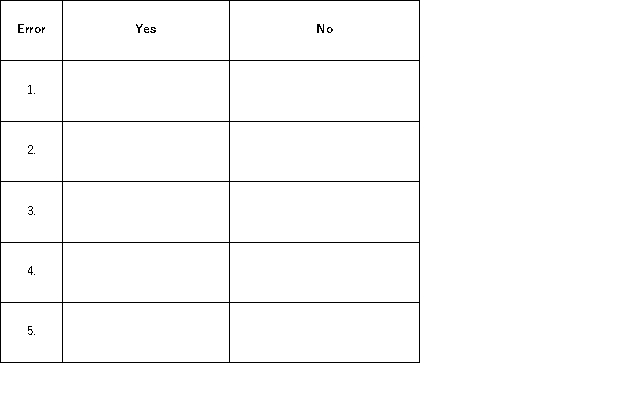

After preparing an (unadjusted)trial balance at year-end,R.Chang of Chang Window Company discovered the following errors:

1.Cash payment of the $225 telephone bill for December was recorded twice.

2.Cash payment of a note payable was recorded as a debit to Cash and a debit to Notes Payable for $1,000.

3.A $900 cash withdrawal by the owner was recorded to the correct accounts as $90.

4.An additional investment of $5,000 cash by the owner was recorded as a debit to R,Chang,Capital and a credit to Cash.

5.A credit purchase of office equipment for $1,800 was recorded as a debit to the Office Equipment account with no offsetting credit entry.

Using the form below,indicate whether the error would cause the trial balance to be out of balance by placing an X in either the yes or no column.Would the error cause the trial balance to be out of balance?  Would the error cause the trial balance to be out of balance?

Would the error cause the trial balance to be out of balance?

(Essay)

5.0/5  (42)

(42)

A company's chart of accounts is a list of all the accounts used and includes an identification number assigned to each account.

(True/False)

4.8/5  (36)

(36)

Rowdy Bolton began Bolton Office Services in October and during that month completed these transactions:

a.Invested $10,000 cash,and $15,000 of computer equipment.

b.Paid $500 cash for an insurance premium covering the next 12 months.

c.Completed a word processing assignment for a customer and collected $1,000 cash.

d.Paid $200 cash for office supplies.

e.Paid $2,000 for October's rent.

Prepare journal entries to record the above transactions.Explanations are unnecessary.

(Essay)

4.8/5  (28)

(28)

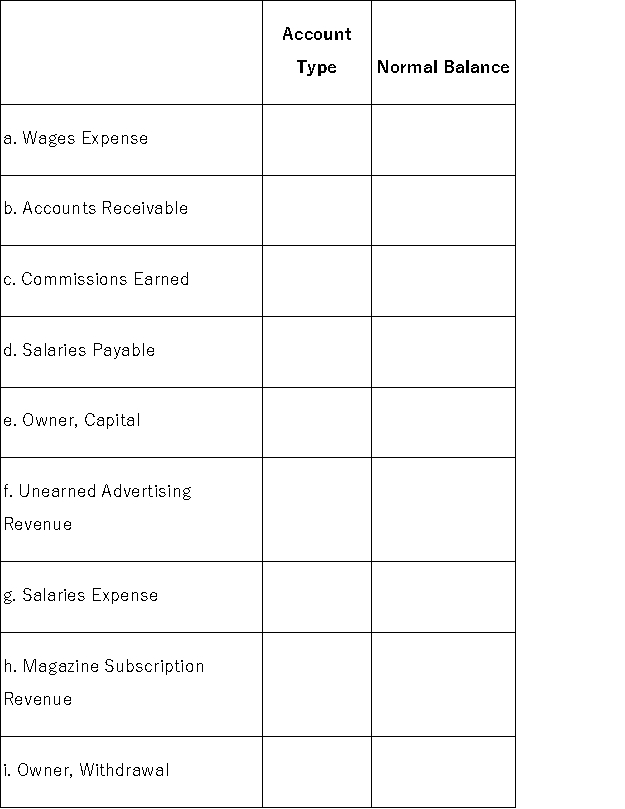

For each of the accounts in the following table (1)identify the type of account as an asset,liability,equity,revenue,or expense,and (2)identify the normal balance of the account.

(Essay)

4.9/5  (32)

(32)

Transactions are recorded first in the ledger and then transferred to the journal.

(True/False)

4.7/5  (26)

(26)

A credit is used to record an increase in all of the following accounts except:

(Multiple Choice)

4.7/5  (38)

(38)

Showing 101 - 120 of 200

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)