Exam 7: Accounting for Sales and Accounts Receivable

Exam 1: Accounting: the Language of Business82 Questions

Exam 2: Analyzing Business Transactions93 Questions

Exam 3: Analyzing Business Transactions Using T Accounts107 Questions

Exam 4: The General Journal and the General Ledger85 Questions

Exam 5: Adjustments and the Worksheet76 Questions

Exam 6: Closing Entries and the Postclosing Trial Balance80 Questions

Exam 7: Accounting for Sales and Accounts Receivable76 Questions

Exam 8: Accounting for Purchases and Accounts Payable89 Questions

Exam 9: Cash Receipts, Cash Payments, and Banking Procedures88 Questions

Exam 10: Payroll Computations, Records, and Payment79 Questions

Exam 11: Payroll Taxes, Deposits, and Reports82 Questions

Exam 12: Accruals, Deferrals, and the Worksheet84 Questions

Exam 13: Financial Statements and Closing Procedures38 Questions

Exam 14: Accounting Principles and Reporting Standards67 Questions

Exam 15: Accounts Receivable and Uncollectible Accounts65 Questions

Exam 16: Notes Payable and Notes Receivable83 Questions

Exam 17: Merchandise Inventory91 Questions

Exam 18: Property, Plant, and Equipment118 Questions

Exam 19: Accounting for Partnerships106 Questions

Exam 20: Corporations: Formation and Capital Stock Transactions76 Questions

Exam 21: Corporate Earnings and Capital Transactions99 Questions

Exam 22: Long-Term Bonds105 Questions

Exam 23: Financial Statement Analyses107 Questions

Exam 24: The Statement of Cash Flows114 Questions

Exam 25: Departmentalized Profit and Cost Centers103 Questions

Exam 26: Accounting for Manufacturing Activities103 Questions

Exam 27: Job Order Cost Accounting102 Questions

Exam 28: Process Cost Accounting94 Questions

Exam 29: Controlling Manufacturing Costs: Standard Costs118 Questions

Exam 30: Cost-Revenue Analysis for Decision Making124 Questions

Select questions type

The entry to record a sale of merchandise on credit that is subject to sales tax includes a(n)____________________ to Sales Tax Payable.

(Essay)

4.7/5  (34)

(34)

The amount used by wholesalers to record sales in its sales journal is

(Multiple Choice)

4.8/5  (46)

(46)

Which of the following describes Sales Returns and Allowances?

(Multiple Choice)

4.7/5  (37)

(37)

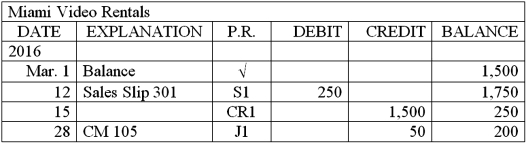

One of the customer accounts from the accounts receivable ledger for Paragon Consulting Services is shown below.Explain each of the entries that have been posted to this customer's subsidiary ledger account.

(Essay)

4.9/5  (38)

(38)

GiGi's Sporting Goods uses special journals.If a credit customer returns $400 of goods on which $24 of sales tax was charged,the journal entry to record the return would include:

(Multiple Choice)

4.8/5  (31)

(31)

ABC Skiing Essentials uses special journals.If a credit customer returns $8,000 of goods on which $560 of sales tax was charged,select the correct entry to record the return:

(Multiple Choice)

4.9/5  (43)

(43)

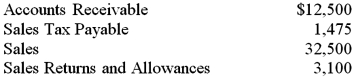

Selected balances from the general ledger of the All Star Video Rentals on July 31,2016,are listed below.Use the appropriate data to prepare the Revenue section of the firm's income statement for the month ended July 31,2016.

(Essay)

4.9/5  (43)

(43)

A wholesale firm made sales with a list price of $1,500 and trade discounts of 25 and 15 percent.Calculate the amount the firm will use to record the sale in the sales journal.

(Multiple Choice)

4.8/5  (45)

(45)

Hour Place Clock Shop sold a grandfather clock for $2,250 subject to a 9% sales tax.The entry in the sales journal will include a debit to Accounts Receivable for

(Multiple Choice)

4.8/5  (32)

(32)

On the Income Statement,Sales Returns and Allowances have the effect of

(Multiple Choice)

4.9/5  (36)

(36)

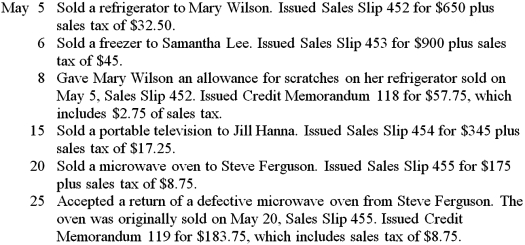

Bradley's Appliance Store had the following transactions during the month of May 2016.Record the transactions on page 5 of a sales journal and page 8 of a general journal.Total,prove,and rule the sales journal as of May 31.

(Essay)

4.8/5  (51)

(51)

A(n)____________________ business sells goods that it purchases in finished form for resale.

(Essay)

4.8/5  (39)

(39)

The reductions from list prices that many wholesale businesses offer their customers are called ____________________ discounts.

(Essay)

4.9/5  (36)

(36)

Hugh Snow returned merchandise to Farley Co.The entry on the books of Farley company to record the return of merchandise from Hugh Snow would include a:

(Multiple Choice)

4.8/5  (36)

(36)

On Deck Sports Memorabilia store sells a Babe Ruth rookie card for $4,600 on account.If the sales tax on the sale is 8%,what is the amount debited to Accounts Receivable.

(Multiple Choice)

4.7/5  (35)

(35)

The entry to record a return by a credit customer of defective merchandise on which no sales tax was charged includes

(Multiple Choice)

4.8/5  (32)

(32)

In a firm that uses special journals,the sale of merchandise for cash is recorded in the

(Multiple Choice)

4.9/5  (35)

(35)

Showing 21 - 40 of 76

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)