Exam 5: Employee Net Pay and Pay Methods

Exam 1: Payroll Practices and System Fundamentals70 Questions

Exam 2: Payroll System Procedures75 Questions

Exam 3: Gross Pay Computation83 Questions

Exam 4: Fringe Benefits and Voluntary Deductions75 Questions

Exam 5: Employee Net Pay and Pay Methods70 Questions

Exam 6: Employer Payroll Taxes and Labor Planning73 Questions

Exam 7: The Payroll Register, Employees Earnings Records, and Accounting System Entries72 Questions

Select questions type

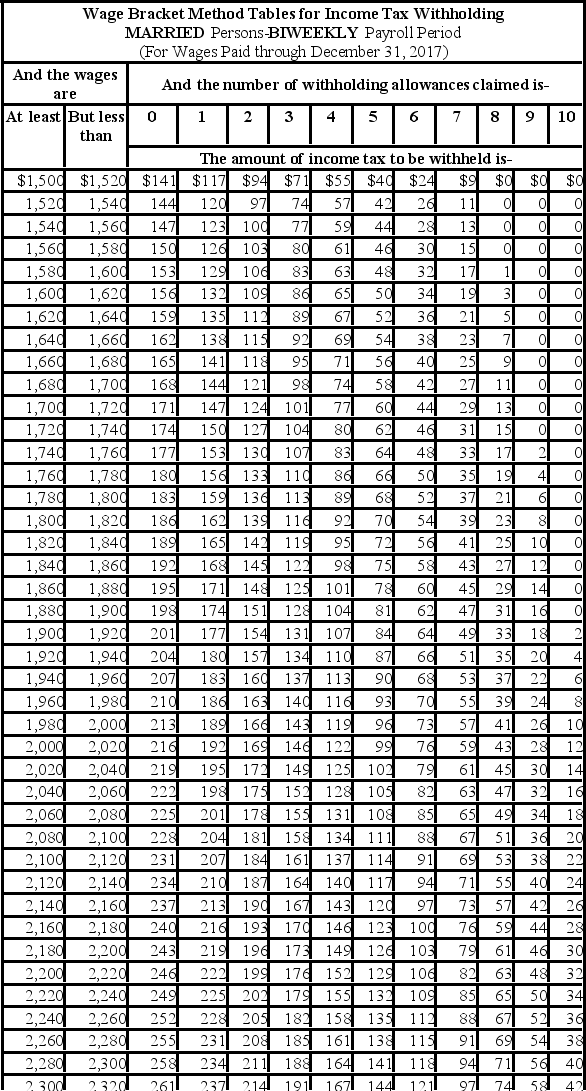

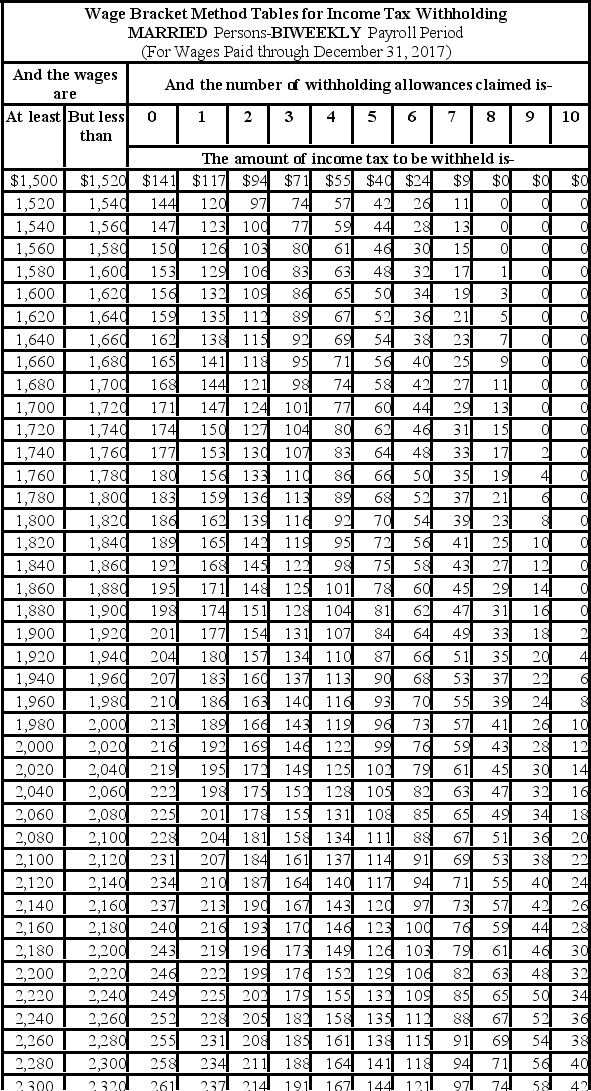

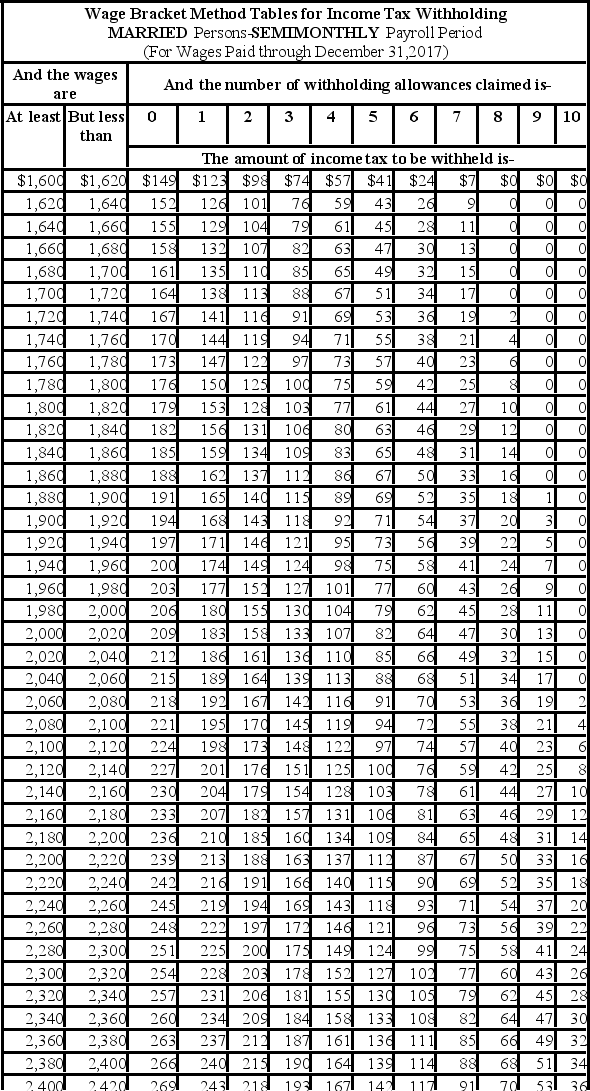

Ramani earned $1,698.50 during the most recent biweekly pay period. He contributes $100 to his 401(k) plan. He is married and claims 3 withholding allowances. Based on the following table, how much Federal income tax should be withheld from his pay?

(Multiple Choice)

4.8/5  (33)

(33)

Vivienne is a full-time exempt employee in DeKalb County, Indiana, and is paid biweekly. She earns $39,000 annually, and is married with 2 withholding allowances. Her state income tax deduction is $44.46, and the DeKalb County income tax deduction is $19.62. What is the total amount of her FICA, federal, state, and local taxes per pay period, assuming no Pre-Tax Deductions? (Use the wage-bracket table to determine the federal tax deduction. Do not round intermediate calculations, only round final answer to two decimal points.)

(Multiple Choice)

4.9/5  (33)

(33)

What is a disadvantage to using paycards as a method of transmitting employee compensation?

(Multiple Choice)

4.8/5  (36)

(36)

Steve is a full-time exempt employee at a local electricity co-operative. He earns an annual salary of $43,325 and is paid biweekly. What is his Social Security tax deduction for each pay period? (Do not round interim calculations, only round final answer to two decimal points.)

(Multiple Choice)

4.8/5  (42)

(42)

Which of the following federal withholding allowance scenarios will have the highest income tax?

(Multiple Choice)

4.9/5  (38)

(38)

A firm has headquarters in Indiana, but has offices in California and Utah. For employee taxation purposes, it may choose which of those three states income tax laws it wishes to use.

(True/False)

4.8/5  (34)

(34)

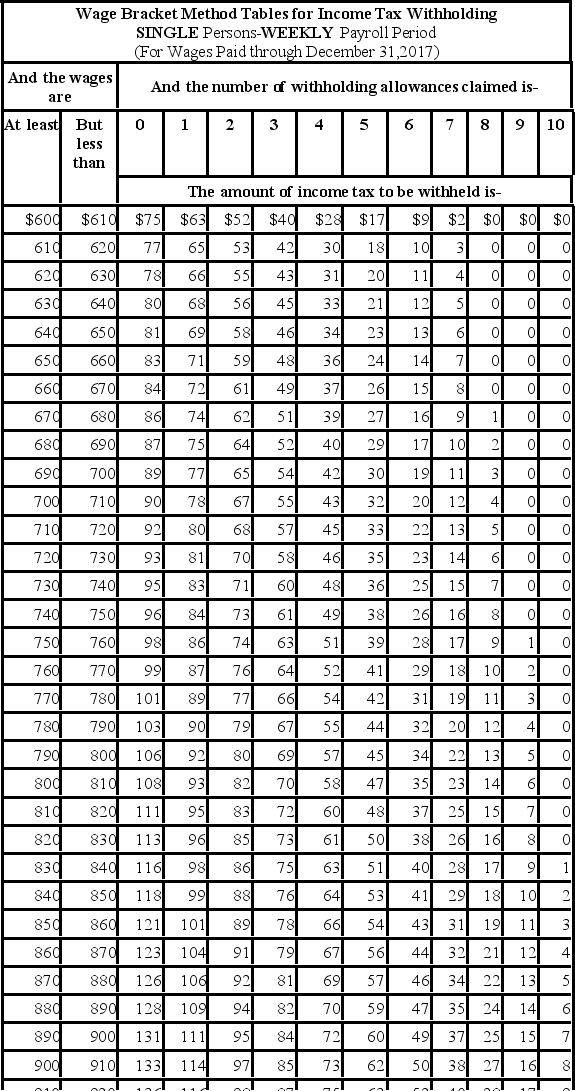

Andie earned $680.20 during the most recent weekly pay period. She is single with 3 withholding allowances and needs to decide between contributing 2.5% and $25 to her 401(k) plan. If she chooses the method that results in the lowest taxable income, how much will be withheld for Federal income tax (based on the following table)?

(Multiple Choice)

4.8/5  (37)

(37)

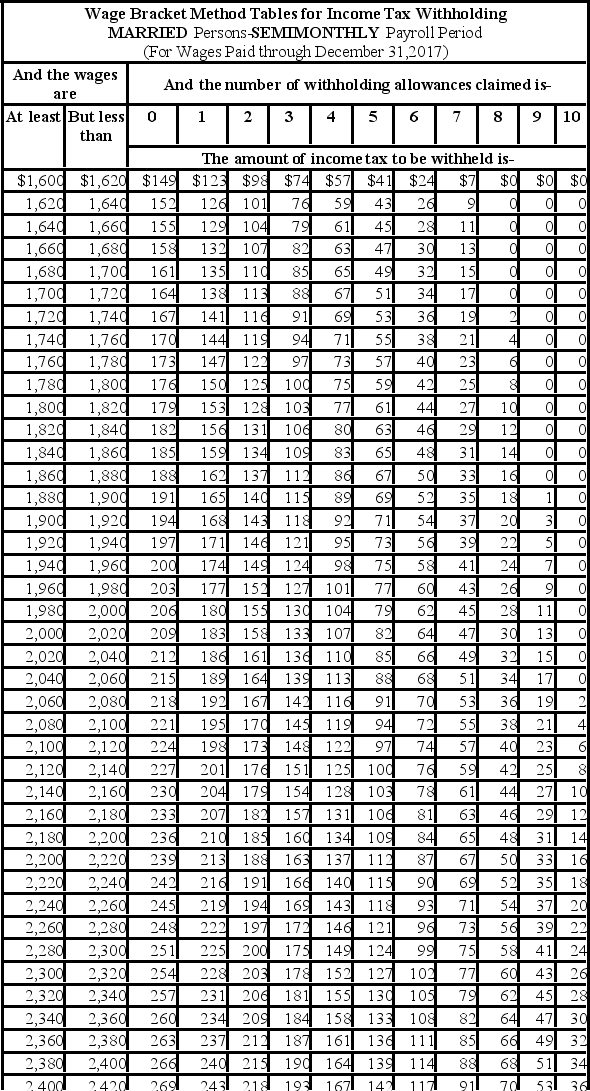

Melody is a full-time employee in Sioux City, South Dakota, who earns $3,600 per month and is paid semimonthly. She is married with 1 withholding allowance (use the wage-bracket tables). She has a qualified health insurance deduction of $50 per pay period and contributes 3% to her 401(k), both of which are pre-tax deductions. What is her net pay? (Round your intermediate calculations and final answer to 2 decimal places.)

(Multiple Choice)

4.9/5  (40)

(40)

Trish earned $1,734.90 during the most recent semimonthly pay period. She is married and has 3 withholding allowances and has no pre-tax deductions. Based on the following table, how much should be withheld from her gross pay for Federal income tax?

(Multiple Choice)

4.7/5  (43)

(43)

Showing 61 - 70 of 70

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)