Exam 5: Property Transactions: Capital Gains and Losses

Exam 1: An Introduction to Taxation109 Questions

Exam 2: Determination of Tax151 Questions

Exam 3: Gross Income: Inclusions143 Questions

Exam 4: Gross Income: Exclusions116 Questions

Exam 5: Property Transactions: Capital Gains and Losses147 Questions

Exam 6: Deductions and Losses142 Questions

Exam 7: Itemized Deductions130 Questions

Exam 8: Losses and Bad Debts122 Questions

Exam 9: Employee Expenses and Deferred Compensation151 Questions

Exam 10: Depreciation, cost Recovery, amortization, and Depletion103 Questions

Exam 11: Accounting Periods and Methods121 Questions

Exam 12: Property Transactions: Nontaxable Exchanges122 Questions

Exam 13: Property Transactions: Section 1231 and Recapture115 Questions

Exam 14: Special Tax Computation Methods, tax Credits, and Payment of Tax145 Questions

Exam 15: Tax Research112 Questions

Exam 16: Corporations146 Questions

Exam 17: Partnerships and S Corporations149 Questions

Exam 18: Taxes and Investment Planning84 Questions

Select questions type

Abra Corporation generated $100,000 of taxable income from operations this year and realized a $4,000 loss on the sale of Starbucks stock.Abra Corporation will pay taxes on $97,000 of taxable income.

Free

(True/False)

4.8/5  (49)

(49)

Correct Answer:

False

All of the following are capital assets with the exception of

Free

(Multiple Choice)

4.9/5  (33)

(33)

Correct Answer:

C

Arthur,age 99,holds some stock purchased many years ago for $10,000 which is now worth $100,000.He is trying to plan for the eventual disposition of this stock.Arthur's only remaining family member is his grandson.For income tax purposes,Arthur should

Free

(Multiple Choice)

4.9/5  (36)

(36)

Correct Answer:

C

Joel has four transactions involving the sale of capital assets during the year resulting in a STCG of $5,000,a STCL of $12,000,a LTCG of $1,800 and a LTCL of $1,000.As a result of these transactions,Joel will

(Multiple Choice)

4.7/5  (38)

(38)

Erik purchased qualified small business corporation stock on December 1,2010 and sold it for a $500,000 gain on December 12,2016.The gain subject to tax is

(Multiple Choice)

4.8/5  (40)

(40)

Margaret died on September 16,2016,when she owned securities with a basis of $50,000 and a FMV of $60,000.Caroline inherited the property and sold it on December 19,2016 for $67,000.What is Caroline's reported gain on this sale?

(Multiple Choice)

4.9/5  (42)

(42)

With regard to taxable gifts after 1976,no gift tax is added to the basis of the property if the donor's basis is greater than the FMV of the property.

(True/False)

4.9/5  (40)

(40)

Five different capital gain tax rates could apply to long-term capital assets sold by noncorporate taxpayers.

(True/False)

4.8/5  (32)

(32)

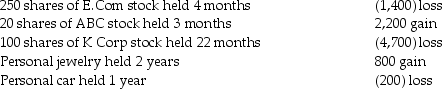

Max sold the following capital assets this year:

What is the amount of and nature of (LT or ST)capital gain or loss?

What is the amount of and nature of (LT or ST)capital gain or loss?

(Essay)

4.9/5  (35)

(35)

Allison buys equipment and pays cash of $50,000,signs a note of $10,000 and assumes a liability on the property for $3,000.In addition,Allison pays an installation cost of $500 and a delivery cost of $800.Allison's basis in the asset is

(Multiple Choice)

4.9/5  (41)

(41)

Emma Grace acquires three machines for $80,000,which have FMVs of $32,000,$28,000,and $20,000 respectively.The delivery cost is $500,and installation costs amount to $2,500.What is the basis of each machine?

(Essay)

4.8/5  (33)

(33)

Rana purchases a 5%,$100,000 corporate bond at issuance on January 1,2016 for $91,500.The bond matures in five years.In 2016 Rana will recognize interest income of

(Multiple Choice)

4.8/5  (39)

(39)

The gain or loss on an asset purchased on March 31,2015,and sold on March 31,2016,is classified as short-term.

(True/False)

4.9/5  (37)

(37)

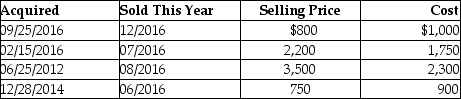

This year,Lauren sold several shares of stock held for investment.The following is a summary of her capital transactions for 2016:  What are the amounts of Lauren's capital gains (losses)for this year?

What are the amounts of Lauren's capital gains (losses)for this year?

(Multiple Choice)

4.8/5  (42)

(42)

If the shares of stock sold or exchanged are not specifically identified,the FIFO (first-in,first-out)method of identification must be used.

(True/False)

4.9/5  (36)

(36)

Darla sold an antique clock in 2016 for $3,000.She had purchased the clock in 2009 for $2,000.If she is otherwise in the 33% marginal tax bracket,what is the maximum tax rate on the capital gain on the sale of the clock?

(Multiple Choice)

4.8/5  (37)

(37)

Courtney sells a cottage at the lake that the family had used for their summer vacations.The purchaser paid Courtney $100,000 and assumed the mortgage which had a principal balance of $50,000.Courtney had purchased the cottage five years ago for $170,000.Courtney will recognize

(Multiple Choice)

4.9/5  (36)

(36)

Showing 1 - 20 of 147

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)