Exam 5: Property Transactions: Capital Gains and Losses

Exam 1: An Introduction to Taxation109 Questions

Exam 2: Determination of Tax151 Questions

Exam 3: Gross Income: Inclusions143 Questions

Exam 4: Gross Income: Exclusions116 Questions

Exam 5: Property Transactions: Capital Gains and Losses147 Questions

Exam 6: Deductions and Losses142 Questions

Exam 7: Itemized Deductions130 Questions

Exam 8: Losses and Bad Debts122 Questions

Exam 9: Employee Expenses and Deferred Compensation151 Questions

Exam 10: Depreciation, cost Recovery, amortization, and Depletion103 Questions

Exam 11: Accounting Periods and Methods121 Questions

Exam 12: Property Transactions: Nontaxable Exchanges122 Questions

Exam 13: Property Transactions: Section 1231 and Recapture115 Questions

Exam 14: Special Tax Computation Methods, tax Credits, and Payment of Tax145 Questions

Exam 15: Tax Research112 Questions

Exam 16: Corporations146 Questions

Exam 17: Partnerships and S Corporations149 Questions

Exam 18: Taxes and Investment Planning84 Questions

Select questions type

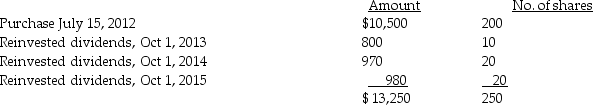

Joy purchased 200 shares of HiLo Mutual Fund on July 15,2012,for $10,500,and has been reinvesting dividends.On December 15,2016,she sells 100 shares.

What is the basis for the shares sold assuming (1)FIFO and (2)average cost method?

What is the basis for the shares sold assuming (1)FIFO and (2)average cost method?

(Essay)

4.7/5  (34)

(34)

An individual taxpayer who is not a dealer in real estate plans to subdivide a parcel of land into four lots and sell them at a substantial gain.The parcel of land had been held six years.In order to qualfiy for capital gain treatment,the individual must satisfy all of the requirements except

(Multiple Choice)

5.0/5  (42)

(42)

Unlike an individual taxpayer,the corporate taxpayer does not utilize the 25% and 28% specialty capital gain rates,but it does apply the 15% tax rate to adjusted net capital gain.

(True/False)

4.9/5  (34)

(34)

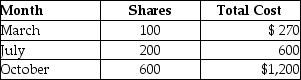

Edward purchased stock last year as follows:  In April of this year,Edward sells 80 shares for $250.Edward cannot specifically identify the stock sold.The basis for the 80 shares sold is

In April of this year,Edward sells 80 shares for $250.Edward cannot specifically identify the stock sold.The basis for the 80 shares sold is

(Multiple Choice)

4.8/5  (31)

(31)

If the shares of stock sold or exchanged are not specifically identified,the average cost method of identification must be used.

(True/False)

5.0/5  (37)

(37)

A nonbusiness bad debt is deductible only in the year in which the debt becomes totally worthless.

(True/False)

4.9/5  (37)

(37)

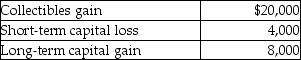

Kendrick,who has a 33% marginal tax rate,had the following results from transactions during the year:  After offsetting the STCL,what is (are)the resulting gain(s)?

After offsetting the STCL,what is (are)the resulting gain(s)?

(Multiple Choice)

4.9/5  (42)

(42)

Gina owns 100 shares of XYZ common stock with a $12,000 basis and a $25,000 FMV.She receives 100 stock rights with a total FMV of $15,000.Answer the following:

a.What is the basis of the 100 shares of stock?

b.What is the basis of the 100 stock rights?

(Essay)

4.9/5  (34)

(34)

Jamahl and Indira are married and live in a common law state.They jointly own real property with an adjusted basis of $200,000.When the property has a FMV of $450,000,Jamahl dies leaving all of the property to Indira.If she later sells the property for $700,000,what is Indira's gain on the sale?

(Multiple Choice)

4.9/5  (45)

(45)

Sanjay is single and has taxable income of $13,000 without considering the sale of a capital asset in November of 2016 for $15,000.That asset was purchased six years earlier and has a tax basis of $5,000.The tax liability applicable to only the capital gain is

(Multiple Choice)

4.7/5  (35)

(35)

Melody inherited 1,000 shares of Corporation Zappa stock from her mother who died on March 4 of the current year.Her mother paid $30 per share for the stock on September 2,2005.The FMV of the stock on the date of death was $65 per share.On September 4 of the current year,the FMV of the stock was $70 per share.Melody sold the stock for $85 per share on December 3.The estate qualified for,and the executor elected,the alternate valuation method for these and other assets in the estate.An estate tax return was filed.What was Melody's basis in the stock on the date of the sale?

(Multiple Choice)

4.9/5  (28)

(28)

Unless the alternate valuation date is elected,the basis of property received from a decedent is generally the property's fair market value at the date of decedent's death.

(True/False)

5.0/5  (34)

(34)

If an individual taxpayer's net long-term capital losses exceed the net short-term capital gains,the excess may be offset against ordinary income up to $3,000 per year.Any excess losses over $3,000 may be carried over indefinitely.

(True/False)

4.9/5  (40)

(40)

All recognized gains and losses must eventually be classified either as capital or ordinary.

(True/False)

5.0/5  (46)

(46)

Niral is single and provides you with the following tax information for 2016:

![Niral is single and provides you with the following tax information for 2016: Compute her tax liability.[Show all calculations in good form.]](https://storage.examlex.com/TB5640/11eac50f_35ba_d796_b234_17076e0de44a_TB5640_00.jpg) Compute her tax liability.[Show all calculations in good form.]

Compute her tax liability.[Show all calculations in good form.]

(Essay)

4.8/5  (33)

(33)

Jordan paid $30,000 for equipment two years ago and has claimed total depreciation deductions of $15,600 for the two years.The cost of repairs during the same time period was $2,000 while a major overhaul which extended the life of the equipment cost $7,000.What is Jordan's adjusted basis in the equipment at the end of the two-year period?

(Multiple Choice)

4.7/5  (39)

(39)

Funds borrowed and used to pay for an asset are not included in the cost until the borrowed funds are repaid.

(True/False)

4.8/5  (37)

(37)

Empire Corporation purchased an office building for $500,000 cash on April 1.Prior to renting it out to tenants on July 1,Empire spent $200,000 on materials and labor to renovate the property.It funded $50,000 of the renovation cost with its own funds and borrowed the remaining $150,000.As of July 1,$2,000 of interest had been paid to the bank,but none of the principal had been repaid.The basis of the building on July 1 is

(Multiple Choice)

4.9/5  (39)

(39)

A taxpayer purchased an asset for $50,000 several years ago.He is now planning to sell it.Under the recovery of basis doctrine the taxpayer will not recognize any gain or pay any related taxes unless he sells the asset for more than $50,000.

(True/False)

4.9/5  (29)

(29)

Showing 81 - 100 of 147

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)