Exam 10: Depreciation, cost Recovery, amortization, and Depletion

Exam 1: An Introduction to Taxation109 Questions

Exam 2: Determination of Tax151 Questions

Exam 3: Gross Income: Inclusions143 Questions

Exam 4: Gross Income: Exclusions116 Questions

Exam 5: Property Transactions: Capital Gains and Losses147 Questions

Exam 6: Deductions and Losses142 Questions

Exam 7: Itemized Deductions130 Questions

Exam 8: Losses and Bad Debts122 Questions

Exam 9: Employee Expenses and Deferred Compensation151 Questions

Exam 10: Depreciation, cost Recovery, amortization, and Depletion103 Questions

Exam 11: Accounting Periods and Methods121 Questions

Exam 12: Property Transactions: Nontaxable Exchanges122 Questions

Exam 13: Property Transactions: Section 1231 and Recapture115 Questions

Exam 14: Special Tax Computation Methods, tax Credits, and Payment of Tax145 Questions

Exam 15: Tax Research112 Questions

Exam 16: Corporations146 Questions

Exam 17: Partnerships and S Corporations149 Questions

Exam 18: Taxes and Investment Planning84 Questions

Select questions type

Capital improvements to real property must be depreciated over the remaining life of the property on which the improvements were made.

(True/False)

4.7/5  (40)

(40)

Once the business use of listed property falls to 50% or below,the alternative depreciation system must be used for the current year and all subsequent years,even if the business use percentage increases to more than 50% in a subsequent year.

(True/False)

4.8/5  (40)

(40)

In order for an asset to be depreciated in the year of purchase,it must be placed in service before year's end.

(True/False)

4.8/5  (43)

(43)

Off-the-shelf computer software that is purchased for use in the taxpayer's trade or business is amortized over 36 months,or it can be immediately expensed under a Sec.179 election.

(True/False)

4.8/5  (36)

(36)

Why would a taxpayer elect to capitalize and amortize intangible drilling costs (IDCs)rather than expense such costs?

(Essay)

4.9/5  (29)

(29)

Under what circumstances might a taxpayer elect the alternative depreciation system for new equipment acquired this year?

(Multiple Choice)

4.8/5  (35)

(35)

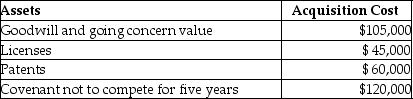

On January 1,2016,Charlie Corporation acquires all of the net assets of Rocky Corporation for $2,000,000.The following intangible assets are included in the purchase agreement:  What is the total amount of amortization allowed in 2016?

What is the total amount of amortization allowed in 2016?

(Multiple Choice)

4.8/5  (28)

(28)

For real property placed in service after 1986,depreciation under the MACRS system is calculated using the

(Multiple Choice)

4.8/5  (38)

(38)

If the business use of listed property is 50% or less of the total usage,the alternative depreciation system must be used.

(True/False)

4.8/5  (36)

(36)

In August 2016,Tianshu acquires and places into service 7-year business equipment (tangible personal property qualifying under Sec.179)for $70,000.This is the only asset that she purchased during the year;her taxable income from her trade or business is $23,000.She decides to limit her 179 election to the maximum amount currently deductible in her business for the current year.What is her maximum cost recovery (Sec.179 and depreciation)deduction for 2015?

(Essay)

4.8/5  (44)

(44)

Enrico is a self-employed electrician.In May of the current year,Enrico acquired a used van (5-year property)for $12,000.He used the van 80% for business and 20% for personal purposes.Enrico does not take any Sec.179 deduction.The maximum depreciation deduction for is

(Multiple Choice)

4.8/5  (39)

(39)

Caitlyn purchases and places in service property costing $450,000 in 2016.She wants to elect the maximum Sec.179 deduction allowed.The property does not qualify for bonus depreciation.Her business income is $400,000.What is the amount of her allowable Sec.179 deduction and carryover,if any?

(Multiple Choice)

4.8/5  (34)

(34)

Sec.179 tax benefits are recaptured if at any time an asset is converted to personal use.

(True/False)

4.8/5  (35)

(35)

Terra Corporation,a calendar-year taxpayer,purchases and places into service machinery with a 7-year life that cost $640,000.Neither the mid-quarter convention,nor bonus depreciation apply.Terra elects to depreciate the maximum under Sec.179.Terra's taxable income for the year before the Sec.179 deduction is $700,000.What is Terra's total depreciation deduction related to this property (rounded to the nearest dollar)?

(Multiple Choice)

4.8/5  (36)

(36)

In accounting for research and experimental expenditures,all of the following alternatives are available with the exception of

(Multiple Choice)

4.8/5  (40)

(40)

If the business use of listed property decreases to 50% or less of the total usage,the property is subject to depreciation recapture.

(True/False)

4.8/5  (32)

(32)

Intangible drilling and development costs (IDCs)may be deducted as an expense or may be capitalized.

(True/False)

4.9/5  (37)

(37)

In November 2016,Kendall purchases a computer for $4,000.She does not use Sec.179 expensing,and the property does not qualify for bonus depreciation.She only uses the most accelerated depreciation method possible.The computer is the only personal property which she places in service during the year.What is her total depreciation deduction for this year?

(Multiple Choice)

4.8/5  (36)

(36)

Land,buildings,equipment,and common stock are examples of tangible property.

(True/False)

4.8/5  (35)

(35)

Showing 61 - 80 of 103

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)