Exam 9: Employee Expenses and Deferred Compensation

Exam 1: An Introduction to Taxation104 Questions

Exam 2: Determination of Tax138 Questions

Exam 3: Gross Income: Inclusions132 Questions

Exam 4: Gross Income: Exclusions107 Questions

Exam 5: Property Transactions: Capital Gains and Losses133 Questions

Exam 6: Deductions and Losses130 Questions

Exam 7: Itemized Deductions114 Questions

Exam 8: Losses and Bad Debts114 Questions

Exam 9: Employee Expenses and Deferred Compensation135 Questions

Exam 10: Depreciation, Cost Recovery, Amortization, and Depletion93 Questions

Exam 11: Accounting Periods and Methods107 Questions

Exam 12: Property Transactions: Nontaxable Exchanges115 Questions

Exam 13: Property Transactions: Section 1231 and Recapture100 Questions

Exam 14: Special Tax Computation Methods, Tax Credits, and Payment of Tax117 Questions

Exam 15: Tax Research127 Questions

Exam 16: Corporations137 Questions

Exam 17: Partnerships and S Corporations133 Questions

Exam 18: Taxes and Investment Planning81 Questions

Select questions type

"Associated with" entertainment expenditures generally must occur on the same day that business is discussed.

(True/False)

4.8/5  (44)

(44)

Fiona is about to graduate college with a management degree. She has been offered a job as a sales representative for a pharmaceutical company. The job will require significant travel and entertainment expenses for which she will be given a salary supplement. What tax issues should Fiona consider in her decision?

(Essay)

4.9/5  (36)

(36)

Incremental expenses of an additional night's lodging and additional day's meals that are incurred to obtain "excursion" air fare rates with respect to employees whose business travel extends over Saturday night are not deductible business expenses.

(True/False)

4.8/5  (35)

(35)

Deferred compensation refers to methods of compensating employees based upon their current service where the benefits are deferred until future periods.

(True/False)

4.8/5  (38)

(38)

Sarah incurred employee business expenses of $5,000 consisting of $3,000 business meals and $2,000 customer entertainment. She provided an adequate accounting to her employer's accountable plan and received reimbursement for one-half of the total expenses. How much of the meals and entertainment will be deductible by Sarah without consideration of the 2% of AGI limit?

(Multiple Choice)

4.7/5  (37)

(37)

A gift from an employee to his or her superior does not qualify as a business gift.

(True/False)

4.9/5  (34)

(34)

In addition to the general requirements for in-home office expenses, employees must also prove that the exclusive use of the office is for the convenience of the employer.

(True/False)

4.9/5  (40)

(40)

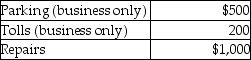

Brittany, who is an employee, drove her automobile a total of 20,000 business miles in 2014. This represents about 75% of the auto's use. She has receipts as follows:  Brittany's AGI for the year of $50,000, and her employer does not provide any reimbursement. She uses the standard mileage rate method. After application of any relevant floors or other limitations, Brittany can deduct

Brittany's AGI for the year of $50,000, and her employer does not provide any reimbursement. She uses the standard mileage rate method. After application of any relevant floors or other limitations, Brittany can deduct

(Multiple Choice)

4.8/5  (44)

(44)

Which of the following statements is incorrect regarding unfunded deferred compensation plans?

(Multiple Choice)

4.8/5  (39)

(39)

Dues paid to social or athletic clubs are deductible if they meet a primary-use test, requiring that more than 50% of the use of the facility be for business purposes.

(True/False)

5.0/5  (37)

(37)

Norman traveled to San Francisco for four days on vacation, and while there spent another two days conducting business for his employer. Norman's plane fare for the trip was $500; meals cost $150 per day; hotels cost $300 per day; and a rental car cost $150 per day that was used for all six days. Norman was not reimbursed by his employer for any expenses. Norman's AGI for the year is $40,000 and he did not have any other miscellaneous itemized deductions. Norman may deduct (after limitations)

(Multiple Choice)

4.9/5  (33)

(33)

Alex is a self-employed dentist who operates a qualifying office in his home. Alex has $180,000 gross income from his practice and $160,000 of expenses directly related to the business, i.e., non-home office expenses. Alex's allocable home office expenses for mortgage interest expenses and property taxes are $14,000 and other home office expenses are $9,000. What is Alex's total allowable home office deduction?

(Multiple Choice)

4.8/5  (35)

(35)

If the purpose of a trip is primarily personal and only secondarily related to business, the transportation costs to and from the destination are deductible.

(True/False)

4.7/5  (30)

(30)

Sam retired last year and will receive annuity payments for life from his employer's qualified retirement plan of $30,000 per year starting this year. During his years of employment, Sam contributed $130,000 to the plan on an after-tax basis. Based on IRS tables, his life expectancy is 260 months. All of the contributions were on a pre-tax basis. This year, Sam will include what amount in income?

(Multiple Choice)

4.9/5  (35)

(35)

The following individuals maintained offices in their home: (1)Dr. Austin is a self-employed surgeon who performs surgery at four hospitals. He uses his home for administrative duties as he does not have an office in any of the hospitals.

(2)June, who is a self-employed plumber, earns her living in her customer's homes. She maintains an office at home where she bills clients and does other paperwork related to her plumbing business.

(3)Cassie, who is an employee of Montgomery Electrical, is provided an office at the work but does significant administrative work at home. Her employer does not require her to do extra work but she feels it is necessary.

Who is entitled to a home office deduction?

(Multiple Choice)

4.8/5  (31)

(31)

Educational expenses incurred by a CPA for courses necessary to meet continuing education requirements are fully deductible.

(True/False)

4.9/5  (45)

(45)

Characteristics of profit-sharing plans include all of the following with the exception of:

(Multiple Choice)

4.8/5  (32)

(32)

Showing 21 - 40 of 135

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)