Exam 5: Property Transactions: Capital Gains and Losses

Exam 1: An Introduction to Taxation104 Questions

Exam 2: Determination of Tax138 Questions

Exam 3: Gross Income: Inclusions132 Questions

Exam 4: Gross Income: Exclusions107 Questions

Exam 5: Property Transactions: Capital Gains and Losses133 Questions

Exam 6: Deductions and Losses130 Questions

Exam 7: Itemized Deductions114 Questions

Exam 8: Losses and Bad Debts114 Questions

Exam 9: Employee Expenses and Deferred Compensation135 Questions

Exam 10: Depreciation, Cost Recovery, Amortization, and Depletion93 Questions

Exam 11: Accounting Periods and Methods107 Questions

Exam 12: Property Transactions: Nontaxable Exchanges115 Questions

Exam 13: Property Transactions: Section 1231 and Recapture100 Questions

Exam 14: Special Tax Computation Methods, Tax Credits, and Payment of Tax117 Questions

Exam 15: Tax Research127 Questions

Exam 16: Corporations137 Questions

Exam 17: Partnerships and S Corporations133 Questions

Exam 18: Taxes and Investment Planning81 Questions

Select questions type

Gertie has a NSTCL of $9,000 and a NLTCG of $5,500 during the current taxable year. After gains and losses are offset, Gertie reports

(Multiple Choice)

4.8/5  (40)

(40)

On January 31 of this year, Mallory pays $800 for an option to acquire 100 shares of Mesa Corporation common stock for $85 per share. As a result of an increase in the market value of the Mesa stock, the market price of the option increases and Mallory sells the option for $1,000 on August 4. As a result of the sale, Mallory must recognize

(Multiple Choice)

4.9/5  (42)

(42)

Bob owns 100 shares of ACT Corporation common stock with a basis of $3,500 and a FMV of $12,000. Bob receives 10 stock rights as a nontaxable distribution, and no basis is allocated to the stock rights. With each stock right, Bob may acquire one share of stock for $25. Bob exercises all 10 stock rights. The total basis of the newly acquired stock is

(Multiple Choice)

4.9/5  (36)

(36)

Gain on sale of a patent by an inventor generally is ordinary income.

(True/False)

4.9/5  (30)

(30)

What type of property should be transferred to heirs at a decedent's death and why? Should estate planning also mean that some property is transferred prior to death? Why?

(Essay)

4.9/5  (30)

(30)

All of the following are capital assets with the exception of

(Multiple Choice)

4.8/5  (40)

(40)

Jordan paid $30,000 for equipment two years ago and has claimed total depreciation deductions of $15,600 for the two years. The cost of repairs during the same time period was $2,000 while a major overhaul which extended the life of the equipment cost $7,000. What is Jordan's adjusted basis in the equipment at the end of the two-year period?

(Multiple Choice)

4.9/5  (31)

(31)

A taxpayer sells an asset with a basis of $25,000 to an unrelated party for $28,000. The taxpayer has a realized gain of $3,000.

(True/False)

4.9/5  (39)

(39)

In a basket purchase, the total cost is apportioned among the assets purchased according to the relative adjusted basis of the assets.

(True/False)

4.8/5  (29)

(29)

Five different capital gain tax rates could apply to long-term capital assets sold by noncorporate taxpayers.

(True/False)

4.7/5  (39)

(39)

Richard exchanges a building with a basis of $35,000, and subject to a liability of $25,000, for land with a FMV of $50,000 owned by Bill. Bill takes the building subject to the liability. What is the amount of Richard's realized gain?

(Multiple Choice)

4.8/5  (40)

(40)

Tina purchases a personal residence for $278,000, but subsequently converts the property to rental property when its FMV is $275,000. Assume depreciation of $65,000 has been deducted after conversion to rental use. If Tina sells the property for $200,000, her realized gain or loss will be

(Multiple Choice)

4.8/5  (43)

(43)

In 2006, Regina purchased a home in Las Vegas which cost $280,000. Due to increase in the market value of the home, she refinanced her mortgage and her debt on the home totaled $300,000 at the end of 2007. Regina accepted a new job in Dallas in April 2012. Unable to sell her home, she rented it in November 2012, at which time its fair market value was $240,000. In June, 2014, she sold the home for $230,000. What tax issues should Regina consider?

(Essay)

4.7/5  (40)

(40)

During the current year, Don's aunt Natalie gave him a house. At the time of the gift, the house had a FMV of $144,000 and his aunt's adjusted basis was $133,000. After deducting the annual exclusion, the amount of the gift was $130,000. His aunt paid a gift tax of $20,000 on the house. What is Don's basis in the house for purposes of determining gain?

(Multiple Choice)

5.0/5  (39)

(39)

Joycelyn gave a diamond necklace to her granddaughter Emma. Joycelyn had purchased the necklace in 1980 for $15,000. The FMV of the necklace at the time of the gift was $44,000. After deducting the annual exclusion, the amount of the gift was $30,000. Gift taxes of $10,000 were paid. What is Emma's adjusted basis in the necklace?

(Multiple Choice)

4.9/5  (42)

(42)

The gain or loss on an asset purchased on March 31, 2013, and sold on March 31, 2014, is classified as short-term.

(True/False)

4.8/5  (39)

(39)

Unless the alternate valuation date is elected, the basis of property received from a decedent is generally the property's fair market value at the date of decedent's death.

(True/False)

4.8/5  (46)

(46)

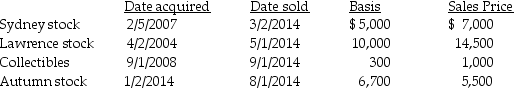

Chen had the following capital asset transactions during 2014:

What is the adjusted net capital gain or loss and the related tax due to the above transactions, assuming Chen has a 25% marginal tax rate?

What is the adjusted net capital gain or loss and the related tax due to the above transactions, assuming Chen has a 25% marginal tax rate?

(Essay)

4.9/5  (50)

(50)

When a taxpayer has NSTCL and NLTCG, the loss is offset against NLTCG from the 28% group, then NLTCG from the 25% group, and finally against NLTCG from the 15% or 20% group.

(True/False)

5.0/5  (45)

(45)

Showing 101 - 120 of 133

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)