Exam 9: The Nature and Creation of Money

Exam 1: Economics: the Study of Choice145 Questions

Exam 3: Demand and Supply251 Questions

Exam 4: Applications of Supply and Demand113 Questions

Exam 5: Macroeconomics: the Big Picture145 Questions

Exam 6: Measuring Total Output and Income161 Questions

Exam 7: Aggregate Demand and Aggregate Supply166 Questions

Exam 8: Economic Growth136 Questions

Exam 9: The Nature and Creation of Money224 Questions

Exam 10: Financial Markets and the Economy175 Questions

Exam 11: Monetary Policy and the Fed178 Questions

Exam 12: Government and Fiscal Policy177 Questions

Exam 13: Consumption and the Aggregate Expenditures Model219 Questions

Exam 14: Investment and Economic Activity138 Questions

Exam 15: Net Exports and International Finance199 Questions

Exam 16: Inflation and Unemployment132 Questions

Exam 17: A Brief History of Macroeconomic Thought and Policy123 Questions

Exam 18: Inequality, Poverty, and Discrimination140 Questions

Select questions type

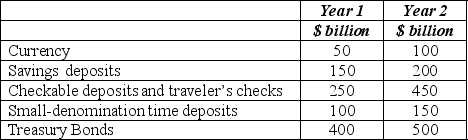

Use the following to answer questions.

Exhibit: Money in the Economy

-(Exhibit: Money in the Economy) In Year 2, if the supply of money measured by M2 was $1,000 billion, then the components of M2 not shown in the table must have totaled

-(Exhibit: Money in the Economy) In Year 2, if the supply of money measured by M2 was $1,000 billion, then the components of M2 not shown in the table must have totaled

(Multiple Choice)

4.9/5  (31)

(31)

Which of the following illustrates the store-of-value function of money?

(Multiple Choice)

4.8/5  (36)

(36)

If you withdraw currency from your savings account, you are

(Multiple Choice)

4.9/5  (34)

(34)

What are the primary tools the Fed can use to conduct monetary policy? Discuss how each tool can be used to expand or contract the economy.

(Essay)

4.8/5  (43)

(43)

Keeping a $20 bill in your purse to purchase a movie DVD when it comes out next month means that money functions as a

(Multiple Choice)

4.8/5  (36)

(36)

How does the Fed decide which monetary measure should be the focus of its monetary policy choices?

(Multiple Choice)

4.8/5  (40)

(40)

Which organization is responsible for managing the nation's money supply?

(Multiple Choice)

4.7/5  (36)

(36)

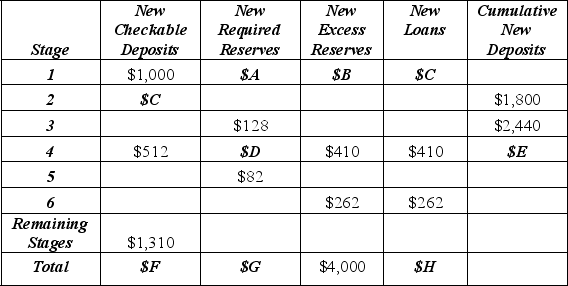

Use the following to answer questions .

Exhibit: Deposit Expansion Stages

-(Exhibit: Deposit Expansion Stages) What is the value of $G (the total new required reserves)?

-(Exhibit: Deposit Expansion Stages) What is the value of $G (the total new required reserves)?

(Multiple Choice)

5.0/5  (30)

(30)

The reserve-requirement ratio is the interest rate the Federal Reserve System charges banks for loans.

(True/False)

4.9/5  (32)

(32)

Money, like other assets such as durable goods, stocks, and bonds is a way of transferring purchasing power from the present to the future but money is different from these other assets because it is a medium of exchange while the other assets are not.

(True/False)

4.7/5  (26)

(26)

The Federal Reserve buys $10,000 of government securities from commercial banks. If the required reserve ratio is 25%, what is the maximum amount of change in the nation's money supply? Assume that no banks keep excess reserves and no individuals or firms hold cash.

(Multiple Choice)

4.7/5  (30)

(30)

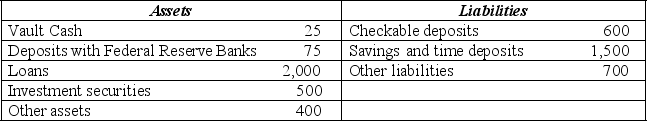

Use the following to answer questions .

Exhibit: Balance Sheet of the Alpha-Beta Bank

-(Exhibit: Balance Sheet of the Alpha-Beta Bank) If the required reserve ratio is 10%, what is the maximum amount of new loans that Alpha-Beta can create?

-(Exhibit: Balance Sheet of the Alpha-Beta Bank) If the required reserve ratio is 10%, what is the maximum amount of new loans that Alpha-Beta can create?

(Multiple Choice)

4.9/5  (27)

(27)

You spend $20 to buy a used textbook at the college bookstore. What function does money perform here?

(Multiple Choice)

4.8/5  (28)

(28)

Open market transactions involve which of the following activities?

I. issuing new Federal Reserve notes

II. buying or selling newly issued government bonds to raise funds for the government

III. buying or selling previously issued government bonds to change the volume of bank reserves

(Multiple Choice)

4.7/5  (33)

(33)

Gresham's Law is the tendency for low-quality money to drive high-quality money out of circulation.

(True/False)

4.8/5  (43)

(43)

The Federal Reserve influences the level of interest rates in the short run by changing the

(Multiple Choice)

4.8/5  (37)

(37)

Suppose the Fed sells $1,000 of government securities to Commercial Banks. Which pair of the T-accounts below shows this transaction?

(Multiple Choice)

4.9/5  (34)

(34)

Showing 181 - 200 of 224

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)