Exam 9: The Nature and Creation of Money

Exam 1: Economics: the Study of Choice145 Questions

Exam 3: Demand and Supply251 Questions

Exam 4: Applications of Supply and Demand113 Questions

Exam 5: Macroeconomics: the Big Picture145 Questions

Exam 6: Measuring Total Output and Income161 Questions

Exam 7: Aggregate Demand and Aggregate Supply166 Questions

Exam 8: Economic Growth136 Questions

Exam 9: The Nature and Creation of Money224 Questions

Exam 10: Financial Markets and the Economy175 Questions

Exam 11: Monetary Policy and the Fed178 Questions

Exam 12: Government and Fiscal Policy177 Questions

Exam 13: Consumption and the Aggregate Expenditures Model219 Questions

Exam 14: Investment and Economic Activity138 Questions

Exam 15: Net Exports and International Finance199 Questions

Exam 16: Inflation and Unemployment132 Questions

Exam 17: A Brief History of Macroeconomic Thought and Policy123 Questions

Exam 18: Inequality, Poverty, and Discrimination140 Questions

Select questions type

Use the following to answer questions .

Exhibit: Fed Buys Bonds

Scenario 1: Fed Buys Bonds from Sheila Jones

Consider a banking system in which the reserve requirement is 10%, banks try not to hold excess reserves, consumers and firms hold money only in the form of checking account balances, and all loan proceeds are spent. Suppose initially all banks in the system are loaned up. Now, suppose that the Fed buys a $100,000 bond from Sheila Jones, who banks at the Perez Bank, and that she deposits her check in her checking account at Perez Bank.

-(Exhibit: Fed Buys Bonds) As a result of Sheila's deposit, Perez Bank can increase its loans by

(Multiple Choice)

4.8/5  (45)

(45)

The quantity of reserves that banks must hold against deposits is called

(Multiple Choice)

4.8/5  (44)

(44)

Which of the following best illustrates the unit of account function of money?

(Multiple Choice)

4.8/5  (29)

(29)

Use the following to answer questions .

Exhibit: Fed Sells Bonds

Scenario 2: Fed sells bonds to Henry Hyde

Consider a banking system in which the reserve requirement is 10%, banks try not to hold excess reserves, consumers and firms hold money only in the form of checking account balances, and all loan proceeds are spent. Suppose initially all banks in the system are loaned up. Now, suppose that the Fed sells a $50,000 bond to Henry Hyde, who pays for the bond by writing a check drawn against Jekyll Bank.

-(Exhibit: Fed Sells Bonds) As a result of the open market sale, Jekyll Bank

(Multiple Choice)

4.9/5  (34)

(34)

Banks play two primary roles in the economy: They take in deposits and lend them to borrowers, and they facilitate purchases of goods and services by allowing people to write checks against their deposits.

(True/False)

4.9/5  (41)

(41)

Use the following to answer questions .

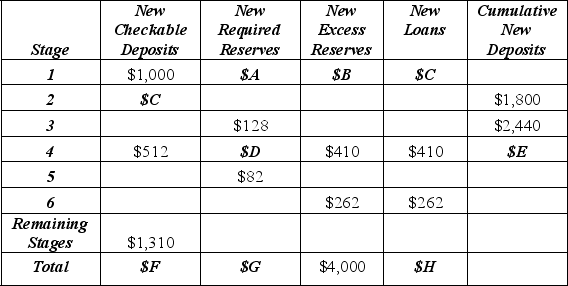

Exhibit: Deposit Expansion Stages

-(Exhibit: Deposit Expansion Stages) New loans made in Stage 1($C) amount to

-(Exhibit: Deposit Expansion Stages) New loans made in Stage 1($C) amount to

(Multiple Choice)

4.8/5  (39)

(39)

Which of the following is a store of value and a common medium of exchange?

(Multiple Choice)

4.8/5  (27)

(27)

The money supply is the total amount of checkable deposits in the economy.

(True/False)

4.8/5  (28)

(28)

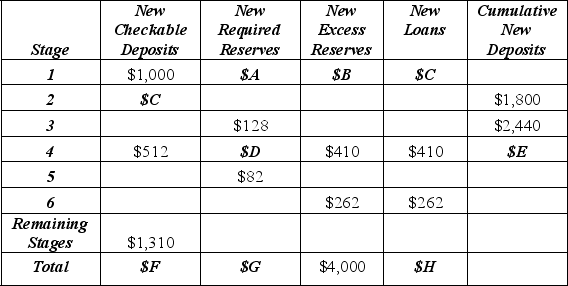

Use the following to answer questions .

Exhibit: Deposit Expansion Stages

-(Exhibit: Deposit Expansion Stages) What is the value of $E in Stage 4?

-(Exhibit: Deposit Expansion Stages) What is the value of $E in Stage 4?

(Multiple Choice)

4.8/5  (32)

(32)

The Federal Depository Insurance Corporation (FDIC) has the power to close a bank when

(Multiple Choice)

4.8/5  (39)

(39)

Any reserves that banks hold in excess of required reserves are called

(Multiple Choice)

4.8/5  (39)

(39)

The maximum amount of increase in the money supply that can be caused by an increase in excess reserves is equal to the

(Multiple Choice)

4.9/5  (29)

(29)

Why might monetary policy authorities be concerned when non-bank financial intermediaries account for a growing share of an economy's financial assets?

(Multiple Choice)

4.8/5  (30)

(30)

Suppose you deposit $1,000 cash in your checking account at a bank. If the bank is loaned up and if the required reserve ratio is 10%, the maximum amount that the bank can lend now, following your deposit is

(Multiple Choice)

4.8/5  (31)

(31)

If banks were required to keep 100% of deposits in reserves, they could

(Multiple Choice)

4.8/5  (29)

(29)

Money that has value apart from its use as money is called

(Multiple Choice)

4.7/5  (30)

(30)

To reduce the political influence on the Board of Governors,

(Multiple Choice)

4.8/5  (30)

(30)

When you discover money in your coat that you placed there last winter, you unexpectedly find you were using money as a(n)

(Multiple Choice)

4.8/5  (27)

(27)

Showing 161 - 180 of 224

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)