Exam 3: Joborder Costing: Calculating Unit Product Costs

Exam 1: Managerial Accounting and Cost Concepts299 Questions

Exam 2: Costvolumeprofit Relationships260 Questions

Exam 3: Joborder Costing: Calculating Unit Product Costs292 Questions

Exam 4: Variable Costing and Segment Reporting: Tools for Management291 Questions

Exam 5: Activitybased Costing: a Tool to Aid Decision Making213 Questions

Exam 6: Differential Analysis: the Key to Decision Making203 Questions

Exam 7: Capital Budgeting Decisions179 Questions

Exam 8: Master Budgeting236 Questions

Exam 9: Flexible Budgets and Performance Analysis417 Questions

Exam 10: Standard Costs and Variances247 Questions

Exam 11: Performance Measurement in Decentralized Organizations180 Questions

Exam 12: Cost of Quality66 Questions

Exam 13: Analyzing Mixed Costs82 Questions

Exam 14: Activity-Based Absorption Costing20 Questions

Exam 15: the Predetermined Overhead Rate and Capacity42 Questions

Exam 16: Super-Variable Costing49 Questions

Exam 17: Time-Driven Activity-Based Costing: a Microsoft Excel-Based Approach123 Questions

Exam 18: Pricing Decisions149 Questions

Exam 19: the Concept of Present Value16 Questions

Exam 20: Income Taxes and the Net Present Value Method150 Questions

Exam 21: Predetermined Overhead Rates and Overhead Analysis in a Standard Costing System177 Questions

Exam 22: Transfer Pricing102 Questions

Exam 22: Service Department Charges44 Questions

Select questions type

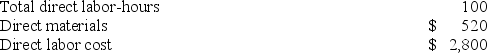

Kubes Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on direct labor-hours. The company based its predetermined overhead rate for the current year on total fixed manufacturing overhead cost of $90,000, variable manufacturing overhead of $3.50 per direct labor-hour, and 30,000 direct labor-hours. The company has provided the following data concerning Job A477 which was recently completed:  The amount of overhead applied to Job A477 is closest to: (Round your intermediate calculations to 2 decimal places.)

The amount of overhead applied to Job A477 is closest to: (Round your intermediate calculations to 2 decimal places.)

(Multiple Choice)

4.7/5  (48)

(48)

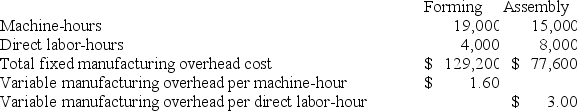

Deloria Corporation has two production departments, Forming and Assembly. The company uses a job-order costing system and computes a predetermined overhead rate in each production department. The Forming Department's predetermined overhead rate is based on machine-hours and the Assembly Department's predetermined overhead rate is based on direct labor-hours. At the beginning of the current year, the company had made the following estimates:  During the current month the company started and finished Job T288. The following data were recorded for this job:

During the current month the company started and finished Job T288. The following data were recorded for this job:

The total amount of overhead applied in both departments to Job T288 is closest to: (Round your intermediate calculations to 2 decimal places.)

The total amount of overhead applied in both departments to Job T288 is closest to: (Round your intermediate calculations to 2 decimal places.)

(Multiple Choice)

4.8/5  (33)

(33)

Most countries require some form of absorption costing for external reports.

(True/False)

4.7/5  (43)

(43)

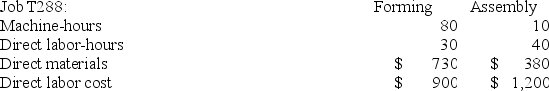

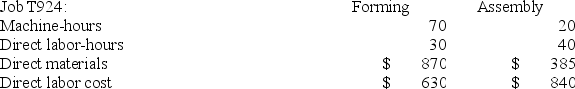

Ahlheim Corporation has two production departments, Forming and Assembly. The company uses a job-order costing system and computes a predetermined overhead rate in each production department. The Forming Department's predetermined overhead rate is based on machine-hours and the Assembly Department's predetermined overhead rate is based on direct labor-hours. At the beginning of the current year, the company had made the following estimates:  During the current month the company started and finished Job T924. The following data were recorded for this job:

During the current month the company started and finished Job T924. The following data were recorded for this job:

The estimated total manufacturing overhead for the Assembly Department is closest to:

The estimated total manufacturing overhead for the Assembly Department is closest to:

(Multiple Choice)

4.9/5  (44)

(44)

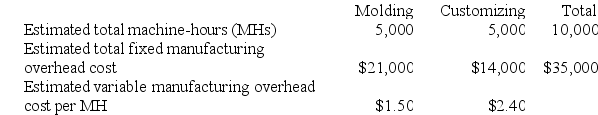

Olmscheid Corporation has two manufacturing departments--Molding and Customizing. The company used the following data at the beginning of the period to calculate predetermined overhead rates:

During the period, the company started and completed two jobs--Job F and Job K. There were no beginning inventories. Data concerning those two jobs follow:

During the period, the company started and completed two jobs--Job F and Job K. There were no beginning inventories. Data concerning those two jobs follow:

Required:

a. Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours. Calculate that overhead rate.

b. Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours. Calculate the amount of manufacturing overhead applied to Job F.

c. Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours. Calculate the amount of manufacturing overhead applied to Job K.

d. Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours. Calculate the total manufacturing cost assigned to Job F.

e. Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours. Calculate the total manufacturing cost assigned to Job K.

f. Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours and uses a markup of 30% on manufacturing cost to establish selling prices. Calculate the selling price for Job F.

g. Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours and uses a markup of 30% on manufacturing cost to establish selling prices. Calculate the selling price for Job K.

h. Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours. If both jobs were sold during the month, what was the company's cost of goods sold for the month?

Required:

a. Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours. Calculate that overhead rate.

b. Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours. Calculate the amount of manufacturing overhead applied to Job F.

c. Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours. Calculate the amount of manufacturing overhead applied to Job K.

d. Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours. Calculate the total manufacturing cost assigned to Job F.

e. Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours. Calculate the total manufacturing cost assigned to Job K.

f. Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours and uses a markup of 30% on manufacturing cost to establish selling prices. Calculate the selling price for Job F.

g. Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours and uses a markup of 30% on manufacturing cost to establish selling prices. Calculate the selling price for Job K.

h. Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours. If both jobs were sold during the month, what was the company's cost of goods sold for the month?

(Essay)

4.7/5  (40)

(40)

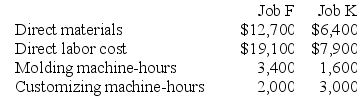

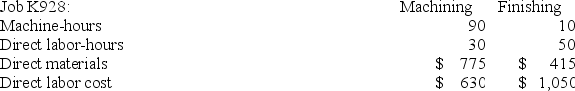

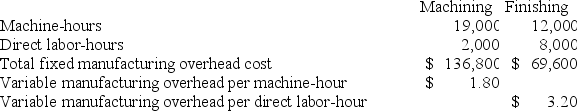

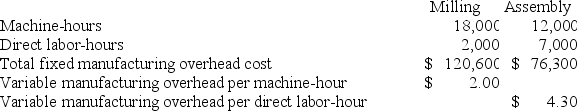

Kalp Corporation has two production departments, Machining and Finishing. The company uses a job-order costing system and computes a predetermined overhead rate in each production department. The Machining Department's predetermined overhead rate is based on machine-hours and the Finishing Department's predetermined overhead rate is based on direct labor-hours. At the beginning of the current year, the company had made the following estimates:  During the current month the company started and finished Job K928. The following data were recorded for this job:

During the current month the company started and finished Job K928. The following data were recorded for this job:

The predetermined overhead rate for the Machining Department is closest to:

The predetermined overhead rate for the Machining Department is closest to:

(Multiple Choice)

4.9/5  (32)

(32)

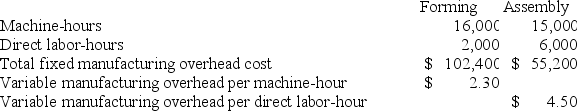

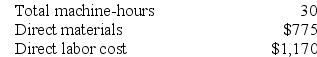

Posson Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on machine-hours. The company based its predetermined overhead rate for the current year on 20,000 machine-hours, total fixed manufacturing overhead cost of $130,000, and a variable manufacturing overhead rate of $3.00 per machine-hour. Job K789, which was for 10 units of a custom product, was recently completed. The job cost sheet for the job contained the following data:

Required:

a. Calculate the predetermined overhead rate for the year.

b. Calculate the amount of overhead applied to Job K789.

c. Calculate the total job cost for Job K789.

d. Calculate the unit product cost for Job K789.

Required:

a. Calculate the predetermined overhead rate for the year.

b. Calculate the amount of overhead applied to Job K789.

c. Calculate the total job cost for Job K789.

d. Calculate the unit product cost for Job K789.

(Essay)

4.8/5  (32)

(32)

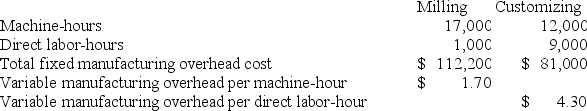

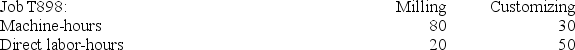

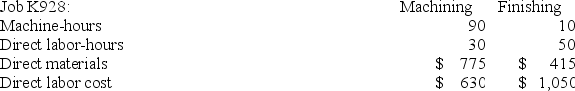

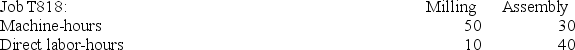

Kroeker Corporation has two production departments, Milling and Customizing. The company uses a job-order costing system and computes a predetermined overhead rate in each production department. The Milling Department's predetermined overhead rate is based on machine-hours and the Customizing Department's predetermined overhead rate is based on direct labor-hours. At the beginning of the current year, the company had made the following estimates:  During the current month the company started and finished Job T898. The following data were recorded for this job:

During the current month the company started and finished Job T898. The following data were recorded for this job:

The estimated total manufacturing overhead for the Milling Department is closest to:

The estimated total manufacturing overhead for the Milling Department is closest to:

(Multiple Choice)

4.8/5  (40)

(40)

Which of the following statements is not correct concerning multiple overhead rate systems?

(Multiple Choice)

4.8/5  (29)

(29)

Kalp Corporation has two production departments, Machining and Finishing. The company uses a job-order costing system and computes a predetermined overhead rate in each production department. The Machining Department's predetermined overhead rate is based on machine-hours and the Finishing Department's predetermined overhead rate is based on direct labor-hours. At the beginning of the current year, the company had made the following estimates:  During the current month the company started and finished Job K928. The following data were recorded for this job:

During the current month the company started and finished Job K928. The following data were recorded for this job:

The amount of overhead applied in the Machining Department to Job K928 is closest to:

The amount of overhead applied in the Machining Department to Job K928 is closest to:

(Multiple Choice)

5.0/5  (47)

(47)

The formula for computing the predetermined overhead rate is:

Predetermined overhead rate = Estimated total amount of the allocation base ÷ Estimated total manufacturing overhead cost

(True/False)

4.9/5  (40)

(40)

Boward Corporation has two production departments, Milling and Assembly. The company uses a job-order costing system and computes a predetermined overhead rate in each production department. The Milling Department's predetermined overhead rate is based on machine-hours and the Assembly Department's predetermined overhead rate is based on direct labor-hours. At the beginning of the current year, the company had made the following estimates:  During the current month the company started and finished Job T818. The following data were recorded for this job:

During the current month the company started and finished Job T818. The following data were recorded for this job:

The total amount of overhead applied in both departments to Job T818 is closest to: (Round your intermediate calculations to 2 decimal places.)

The total amount of overhead applied in both departments to Job T818 is closest to: (Round your intermediate calculations to 2 decimal places.)

(Multiple Choice)

5.0/5  (35)

(35)

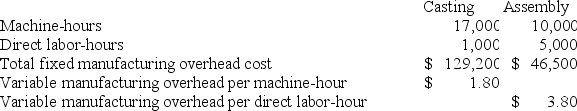

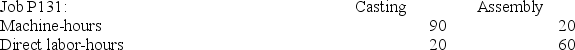

Tiff Corporation has two production departments, Casting and Assembly. The company uses a job-order costing system and computes a predetermined overhead rate in each production department. The Casting Department's predetermined overhead rate is based on machine-hours and the Assembly Department's predetermined overhead rate is based on direct labor-hours. At the beginning of the current year, the company had made the following estimates:  During the current month the company started and finished Job P131. The following data were recorded for this job:

During the current month the company started and finished Job P131. The following data were recorded for this job:

The amount of overhead applied in the Assembly Department to Job P131 is closest to: (Round your intermediate calculations to 2 decimal places.)

The amount of overhead applied in the Assembly Department to Job P131 is closest to: (Round your intermediate calculations to 2 decimal places.)

(Multiple Choice)

4.9/5  (36)

(36)

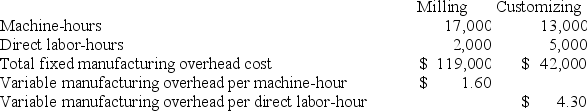

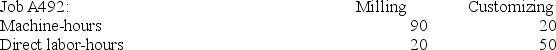

Barbeau Corporation has two production departments, Milling and Customizing. The company uses a job-order costing system and computes a predetermined overhead rate in each production department. The Milling Department's predetermined overhead rate is based on machine-hours and the Customizing Department's predetermined overhead rate is based on direct labor-hours. At the beginning of the current year, the company had made the following estimates:  During the current month the company started and finished Job A492. The following data were recorded for this job:

During the current month the company started and finished Job A492. The following data were recorded for this job:

The amount of overhead applied in the Milling Department to Job A492 is closest to: (Round your intermediate calculations to 2 decimal places.)

The amount of overhead applied in the Milling Department to Job A492 is closest to: (Round your intermediate calculations to 2 decimal places.)

(Multiple Choice)

4.7/5  (35)

(35)

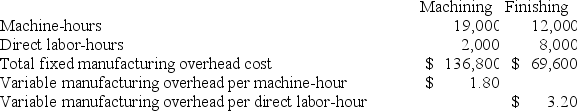

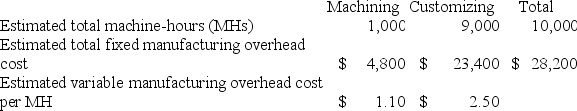

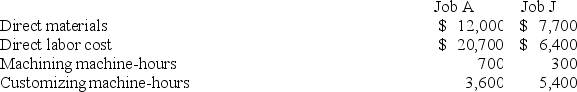

Janicki Corporation has two manufacturing departments--Machining and Customizing. The company used the following data at the beginning of the year to calculate predetermined overhead rates:  During the most recent month, the company started and completed two jobs--Job A and Job J. There were no beginning inventories. Data concerning those two jobs follow:

During the most recent month, the company started and completed two jobs--Job A and Job J. There were no beginning inventories. Data concerning those two jobs follow:

Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both production departments. Further assume that the company uses a markup of 50% on manufacturing cost to establish selling prices. The calculated selling price for Job J is closest to: (Round your intermediate calculations to 2 decimal places.)

Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both production departments. Further assume that the company uses a markup of 50% on manufacturing cost to establish selling prices. The calculated selling price for Job J is closest to: (Round your intermediate calculations to 2 decimal places.)

(Multiple Choice)

4.8/5  (31)

(31)

A job cost sheet is used to record how much a customer pays for the job once the job is completed.

(True/False)

4.8/5  (42)

(42)

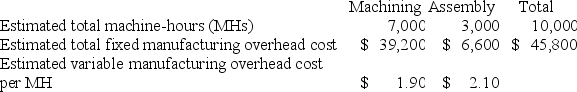

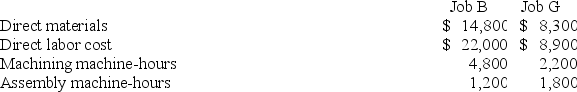

Morataya Corporation has two manufacturing departments--Machining and Assembly. The company used the following data at the beginning of the year to calculate predetermined overhead rates:  During the most recent month, the company started and completed two jobs--Job B and Job G. There were no beginning inventories. Data concerning those two jobs follow:

During the most recent month, the company started and completed two jobs--Job B and Job G. There were no beginning inventories. Data concerning those two jobs follow:

Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours. The amount of manufacturing overhead applied to Job G is closest to: (Round your intermediate calculations to 2 decimal places.)

Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours. The amount of manufacturing overhead applied to Job G is closest to: (Round your intermediate calculations to 2 decimal places.)

(Multiple Choice)

4.8/5  (35)

(35)

The amount of overhead applied to a particular job equals the actual amount of overhead caused by the job.

(True/False)

4.8/5  (42)

(42)

Job-order costing systems often use allocation bases that do not reflect how jobs actually use overhead resources.

(True/False)

5.0/5  (37)

(37)

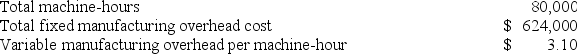

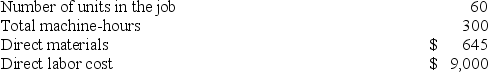

Sivret Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on machine-hours. The company based its predetermined overhead rate for the current year on the following data:  Recently, Job M598 was completed with the following characteristics:

Recently, Job M598 was completed with the following characteristics:

The amount of overhead applied to Job M598 is closest to: (Round your intermediate calculations to 2 decimal places.)

The amount of overhead applied to Job M598 is closest to: (Round your intermediate calculations to 2 decimal places.)

(Multiple Choice)

4.8/5  (37)

(37)

Showing 221 - 240 of 292

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)