Exam 20: Income Taxes and the Net Present Value Method

Exam 1: Managerial Accounting and Cost Concepts299 Questions

Exam 2: Costvolumeprofit Relationships260 Questions

Exam 3: Joborder Costing: Calculating Unit Product Costs292 Questions

Exam 4: Variable Costing and Segment Reporting: Tools for Management291 Questions

Exam 5: Activitybased Costing: a Tool to Aid Decision Making213 Questions

Exam 6: Differential Analysis: the Key to Decision Making203 Questions

Exam 7: Capital Budgeting Decisions179 Questions

Exam 8: Master Budgeting236 Questions

Exam 9: Flexible Budgets and Performance Analysis417 Questions

Exam 10: Standard Costs and Variances247 Questions

Exam 11: Performance Measurement in Decentralized Organizations180 Questions

Exam 12: Cost of Quality66 Questions

Exam 13: Analyzing Mixed Costs82 Questions

Exam 14: Activity-Based Absorption Costing20 Questions

Exam 15: the Predetermined Overhead Rate and Capacity42 Questions

Exam 16: Super-Variable Costing49 Questions

Exam 17: Time-Driven Activity-Based Costing: a Microsoft Excel-Based Approach123 Questions

Exam 18: Pricing Decisions149 Questions

Exam 19: the Concept of Present Value16 Questions

Exam 20: Income Taxes and the Net Present Value Method150 Questions

Exam 21: Predetermined Overhead Rates and Overhead Analysis in a Standard Costing System177 Questions

Exam 22: Transfer Pricing102 Questions

Exam 22: Service Department Charges44 Questions

Select questions type

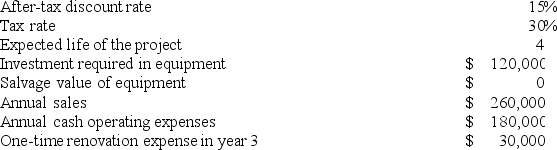

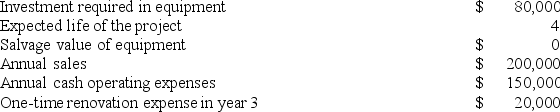

Mester Corporation has provided the following information concerning a capital budgeting project:  The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

Use Exhibit 7B-1 to determine the appropriate discount factor(s) using table.

The net present value of the project is closest to:

The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

Use Exhibit 7B-1 to determine the appropriate discount factor(s) using table.

The net present value of the project is closest to:

(Multiple Choice)

4.9/5  (44)

(44)

Prudencio Corporation has provided the following information concerning a capital budgeting project: After-tax discount rate 13%

Tax rate 30%

Expected life of the project 4

Investment required in equipment $ 160,000

Salvage value of equipment $ 0

Annual sales $ 400,000

Annual cash operating expenses $ 290,000

One-time renovation expense in year 3 $ 40,000

The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The income tax expense in year 3 is:

(Multiple Choice)

4.9/5  (40)

(40)

Halwick Corporation is considering a capital budgeting project that would have a useful life of 4 years and would involve investing $120,000 in equipment that would have zero salvage value at the end of the project. Annual incremental sales would be $360,000 and annual cash operating expenses would be $280,000. The company uses straight-line depreciation on all equipment. Its income tax rate is 30%. The income tax expense in year 2 is:

(Multiple Choice)

4.9/5  (38)

(38)

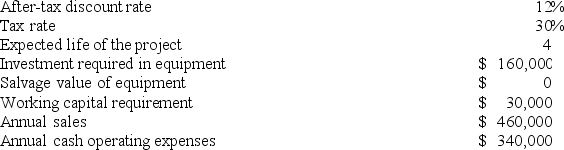

Stockinger Corporation has provided the following information concerning a capital budgeting project:  The company's income tax rate is 30% and its after-tax discount rate is 11%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The total cash flow net of income taxes in year 3 is:

The company's income tax rate is 30% and its after-tax discount rate is 11%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The total cash flow net of income taxes in year 3 is:

(Multiple Choice)

4.8/5  (39)

(39)

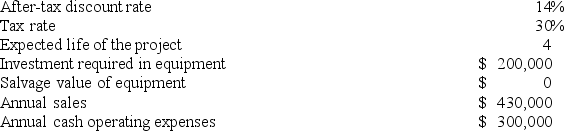

Rollans Corporation has provided the following information concerning a capital budgeting project:  The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The income tax expense in year 2 is:

The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The income tax expense in year 2 is:

(Multiple Choice)

4.8/5  (44)

(44)

Dobrinski Corporation has provided the following information concerning a capital budgeting project:  The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

Use Exhibit 7B-1 to determine the appropriate discount factor(s) using table.

The net present value of the project is closest to:

The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

Use Exhibit 7B-1 to determine the appropriate discount factor(s) using table.

The net present value of the project is closest to:

(Multiple Choice)

4.7/5  (46)

(46)

Roemen Corporation is considering a capital budgeting project that would require investing $160,000 in equipment with a 4 year useful life and zero salvage value. Annual incremental sales would be $410,000 and annual incremental cash operating expenses would be $280,000. An investment of $20,000 in working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The company's tax rate is 30% and the after-tax discount rate is 12%.

Required:

Determine the net present value of the project. Show your work!

(Essay)

4.9/5  (45)

(45)

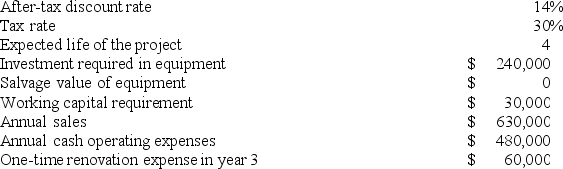

Stockinger Corporation has provided the following information concerning a capital budgeting project:  The company's income tax rate is 30% and its after-tax discount rate is 11%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The total cash flow net of income taxes in year 2 is:

The company's income tax rate is 30% and its after-tax discount rate is 11%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The total cash flow net of income taxes in year 2 is:

(Multiple Choice)

4.8/5  (36)

(36)

Lennox Corporation has provided the following information concerning a capital budgeting project:  The company's tax rate is 30%. The company's after-tax discount rate is 8%. The project would require an investment of $20,000 at the beginning of the project. This working capital would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment.

The total cash flow net of income taxes in year 2 is:

The company's tax rate is 30%. The company's after-tax discount rate is 8%. The project would require an investment of $20,000 at the beginning of the project. This working capital would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment.

The total cash flow net of income taxes in year 2 is:

(Multiple Choice)

4.9/5  (38)

(38)

Vanzant Corporation has provided the following information concerning a capital budgeting project:  The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

Use Exhibit 7B-1, to determine the appropriate discount factor(s) using the tables provided.

The net present value of the entire project is closest to:

The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

Use Exhibit 7B-1, to determine the appropriate discount factor(s) using the tables provided.

The net present value of the entire project is closest to:

(Multiple Choice)

4.7/5  (43)

(43)

Bedolla Corporation is considering a capital budgeting project that would require investing $160,000 in equipment with an expected life of 4 years and zero salvage value. Annual incremental sales would be $430,000 and annual incremental cash operating expenses would be $310,000. The company's income tax rate is 30% and its after-tax discount rate is 8%. The company uses straight-line depreciation. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. Use Exhibit 7B-1, to determine the appropriate discount factor(s) using the tables provided.

The net present value of the entire project is closest to:

(Multiple Choice)

4.7/5  (32)

(32)

Marbry Corporation has provided the following information concerning a capital budgeting project:  The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The income tax expense in year 2 is:

The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The income tax expense in year 2 is:

(Multiple Choice)

4.9/5  (36)

(36)

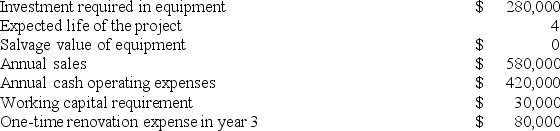

Lafromboise Corporation has provided the following information concerning a capital budgeting project:  The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The income tax expense in year 2 is:

The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The income tax expense in year 2 is:

(Multiple Choice)

4.8/5  (38)

(38)

Cirillo Corporation is considering a capital budgeting project that involves investing $660,000 in equipment that would have a useful life of 3 years and zero salvage value. The net annual operating cash inflow, which is the difference between the incremental sales revenue and incremental cash operating expenses, would be $350,000 per year. The company uses straight-line depreciation and the depreciation expense on the equipment would be $220,000 per year. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The income tax rate is 30%. The after-tax discount rate is 6%.

Required:

Determine the net present value of the project. Show your work!

(Essay)

4.9/5  (39)

(39)

Newfield Corporation has provided the following information concerning a capital budgeting project:

The company uses straight-line depreciation. The depreciation expense will be $30,000 per year. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The income tax rate is 30% and the after-tax discount rate is 13%.

Required:

Determine the net present value of the project. Show your work!

The company uses straight-line depreciation. The depreciation expense will be $30,000 per year. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The income tax rate is 30% and the after-tax discount rate is 13%.

Required:

Determine the net present value of the project. Show your work!

(Essay)

4.9/5  (33)

(33)

Marbry Corporation has provided the following information concerning a capital budgeting project:  The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The income tax expense in year 3 is:

The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The income tax expense in year 3 is:

(Multiple Choice)

4.9/5  (33)

(33)

Waltermire Corporation has provided the following information concerning a capital budgeting project:  The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The total cash flow net of income taxes in year 2 is:

The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The total cash flow net of income taxes in year 2 is:

(Multiple Choice)

4.8/5  (42)

(42)

Bedolla Corporation is considering a capital budgeting project that would require investing $160,000 in equipment with an expected life of 4 years and zero salvage value. Annual incremental sales would be $430,000 and annual incremental cash operating expenses would be $310,000. The company's income tax rate is 30% and its after-tax discount rate is 8%. The company uses straight-line depreciation. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The total cash flow net of income taxes in year 2 is:

(Multiple Choice)

4.7/5  (39)

(39)

Correll Corporation is considering a capital budgeting project that would require investing $240,000 in equipment with an expected life of 4 years and zero salvage value. Annual incremental sales would be $570,000 and annual incremental cash operating expenses would be $420,000. The project would also require a one-time renovation cost of $40,000 in year 3. The company's income tax rate is 30% and its after-tax discount rate is 15%. The company uses straight-line depreciation. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. Use Exhibit 7B-1, to determine the appropriate discount factor(s) using the tables provided.

The net present value of the entire project is closest to:

(Multiple Choice)

4.9/5  (37)

(37)

Last year the sales at Summit Corporation were $400,000 and were all cash sales. The expenses at Summit were $250,000 and were all cash expenses. The tax rate was 30%. The after-tax net cash inflow at Summit last year was:

(Multiple Choice)

4.9/5  (27)

(27)

Showing 101 - 120 of 150

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)