Exam 11: Accounting Information Systems

Exam 1: Accounting in Business242 Questions

Exam 2: Analyzing and Recording Transactions137 Questions

Exam 3: Adjusting Accounts for Financial Statements205 Questions

Exam 4: Completing the Accounting Cycle and Classifying Accounts140 Questions

Exam 5: Accounting for Merchandising Activities129 Questions

Exam 6: Inventory Costing and Valuation149 Questions

Exam 7: Internal Control and Cash142 Questions

Exam 8: Receivables147 Questions

Exam 9: Property, Plant and Equipment Intangibles203 Questions

Exam 10: Payroll Liabilities61 Questions

Exam 11: Accounting Information Systems102 Questions

Select questions type

An accounting information system uses __________ to provide internal and external users with ________.

(Multiple Choice)

4.8/5  (38)

(38)

When posting from special journals all debit and credit entries are entered as separate amounts.

(True/False)

4.8/5  (31)

(31)

Most transactions for merchandising businesses fall into four groups: sales on credit, purchases on credit, cash receipts, and cash disbursements.

(True/False)

4.9/5  (18)

(18)

A company uses a Sales Journal, a Purchases Journal, a Cash Receipts Journal, a Cash Disbursements Journal, and a General Journal. A sales return for credit on account would be recorded in the

(Multiple Choice)

4.8/5  (39)

(39)

A management information system (MIS) is designed to collect and process data within an organization for the purpose of providing users with information.

(True/False)

4.8/5  (36)

(36)

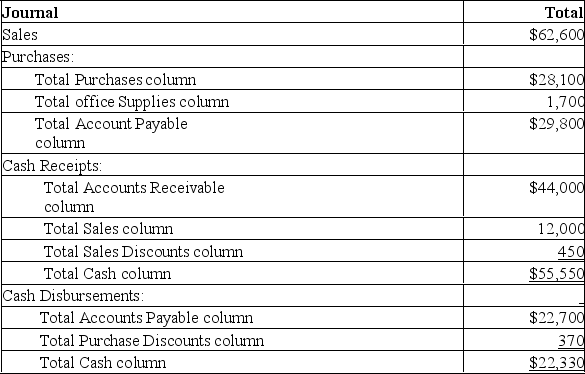

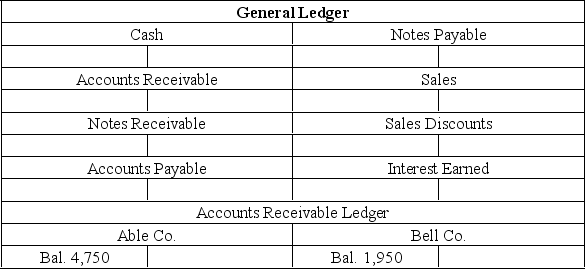

Heidi Company uses a Sales Journal, a Purchases Journal, a Cash Receipts Journal, a Cash Disbursements Journal, and a General Journal. The following are the totals from the special journals for the month ended July 31:

Required:

Post the appropriate amounts to the Accounts Receivable and Accounts Payable controlling T-accounts.

Required:

Post the appropriate amounts to the Accounts Receivable and Accounts Payable controlling T-accounts.

(Essay)

4.8/5  (32)

(32)

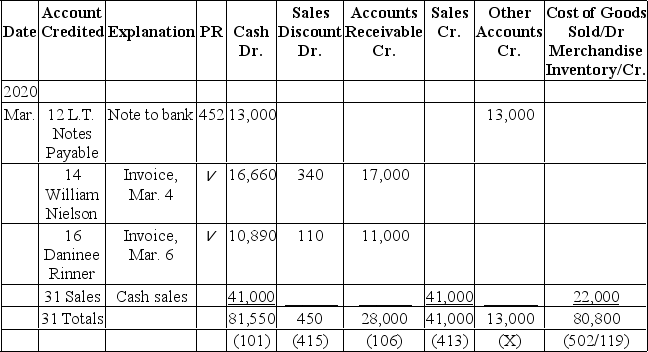

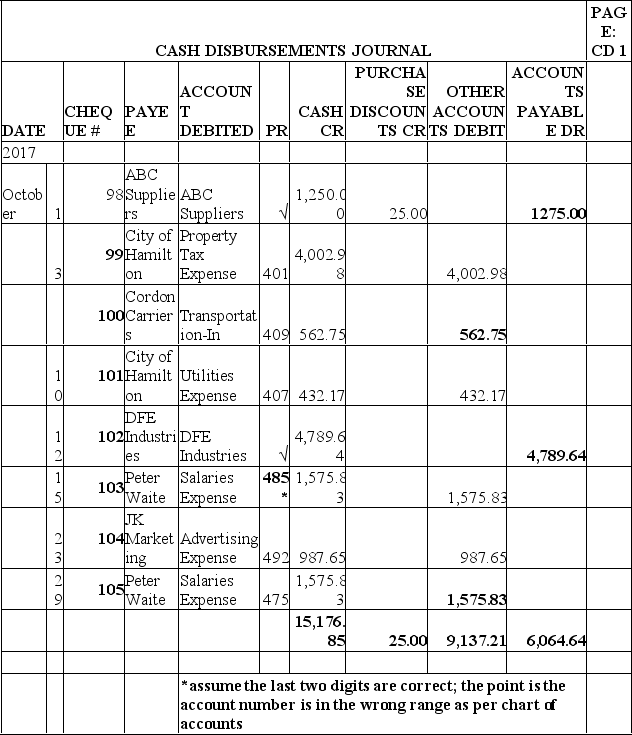

(1) What is the name of the journal illustrated below?

(2) Write an explanation for each entry.

(2) Write an explanation for each entry.

(Essay)

4.7/5  (41)

(41)

The Sales Journal and Cash Receipts Journal may have GST payable and PST payable columns added to them to facilitate recording. In the same manner GST receivable and PST receivable columns may be added to the Purchases Journal and the Cash Disbursements Journal.

(True/False)

4.9/5  (36)

(36)

A management information system (MIS) is designed to collect and process data within an organization for the purpose of providing users with information.

(True/False)

4.8/5  (42)

(42)

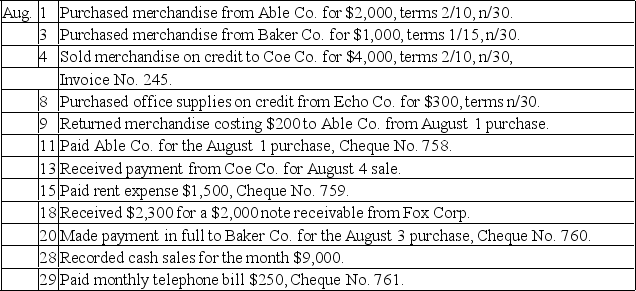

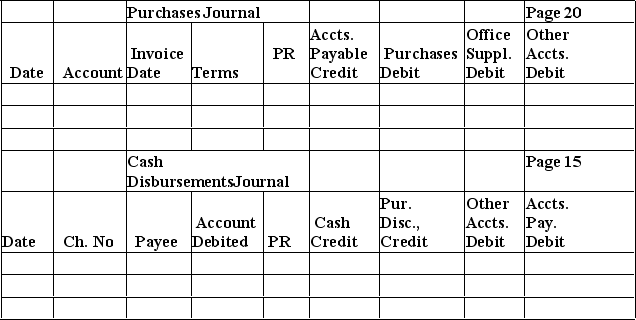

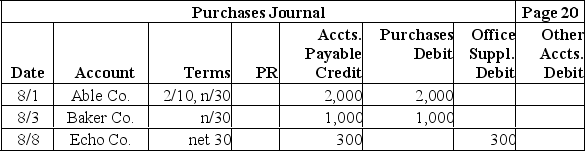

Abercrombie Company uses a periodic inventory system and four special journals: Purchases, Sales, Cash Receipts, and Cash Disbursements. The following transactions were incurred during August:

Record the above transactions in the appropriate journals below. Ignore transactions that should not be posted to the journals provided.

Record the above transactions in the appropriate journals below. Ignore transactions that should not be posted to the journals provided.

(Essay)

5.0/5  (32)

(32)

Accounting information systems are designed to capture information about a company's transactions and to provide output including financial statements and special purpose reports.

(True/False)

4.8/5  (37)

(37)

Enterprise-application software packages keep the programs that manage a company's vital operations.

(True/False)

4.7/5  (42)

(42)

Why do we use invoice date rather than the purchase date when recording transactions in the purchase journal.

(Essay)

4.8/5  (32)

(32)

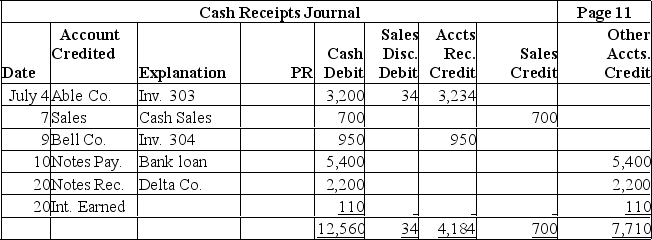

Outdoors Unlimited uses special journals to record its daily transactions. Shown below is a Cash Receipts Journal and selected ledger accounts. Post the Cash Receipts Journal to the appropriate accounts.

(Essay)

4.7/5  (43)

(43)

Each transaction recorded in the Sales Journal includes a debit to Accounts Receivable and a credit to Sales Revenue.

(True/False)

4.9/5  (41)

(41)

A book of original entry that is designed and used for recording only a specified type of transaction is called a

(Multiple Choice)

4.8/5  (29)

(29)

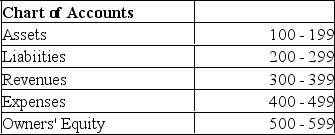

Find the errors in the cash disbursements journal below and rewrite the journal with corrections. The company chart of accounts is as follows:

(Essay)

4.8/5  (38)

(38)

Showing 21 - 40 of 102

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)