Exam 13: Using the Economic Fluctuations Model

Exam 1: The Central Idea100 Questions

Exam 2: Observing and Explaining the Economy129 Questions

Exam 3: The Supply and Demand Model149 Questions

Exam 4: Subtleties of the Supply and Demand Model173 Questions

Exam 5: Macroeconomics: the Big Picture155 Questions

Exam 6: Measuring the Production, Income, and Spending of Nations175 Questions

Exam 7: The Spending Allocation Model166 Questions

Exam 8: Unemployment and Employment213 Questions

Exam 9: Productivity and Economic Growth159 Questions

Exam 10: Money and Inflation153 Questions

Exam 11: The Nature and Causes of Economic Fluctuations182 Questions

Exam 12: The Economic Fluctuations Model206 Questions

Exam 13: Using the Economic Fluctuations Model177 Questions

Exam 14: Fiscal Policy138 Questions

Exam 15: Monetary Policy176 Questions

Exam 16: Capital and Financial Markets189 Questions

Exam 17: Economic Growth Around the World157 Questions

Exam 18: International Trade234 Questions

Exam 19: International Finance125 Questions

Select questions type

Suppose the central bank lowers its target inflation rate from 3 percent to 1.5 percent. Use the aggregate demand/inflation curve and the price adjustment line to show the short-run, medium-run, and long-run effects of this policy change. Assume the economy is initially at the point of long-run equilibrium.

(Essay)

4.9/5  (44)

(44)

Over the past 25 years, price shocks have occurred due to sharp changes in

(Multiple Choice)

4.9/5  (34)

(34)

If exports permanently decline, we would expect, in the medium run,

(Multiple Choice)

4.8/5  (39)

(39)

If a shock to aggregate demand occurs, the period of the initial change in real GDP is called

(Multiple Choice)

4.9/5  (44)

(44)

Recent economic fluctuations in the U.S. economy are best explained by

(Multiple Choice)

4.9/5  (44)

(44)

Graphically show the difference between what is meant by a growth slowdown as opposed to a recession.

(Essay)

4.8/5  (32)

(32)

If the Fed raises interest rates because it believes inflation is too high, this may cause a recession.

(True/False)

4.9/5  (32)

(32)

The tendency of prices to adjust over time is shown by an upward movement along the IA line.

(True/False)

4.9/5  (37)

(37)

Suppose government purchases have decreased. Which of the following is true?

(Multiple Choice)

4.7/5  (36)

(36)

In the economic fluctuations model, the so-called short run normally refers to

(Multiple Choice)

4.8/5  (45)

(45)

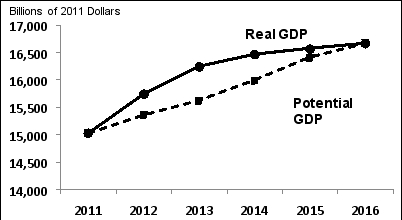

The figure below shows the effect of a 2011 increase in government purchases on the hypothetical path of real GDP compared to the path of potential GDP (the baseline) between 2011 and 2016.  Potential

GDP (A) Using the cirve and line anglysis, expleng what is accurting between 2011 ant

(B) Using the curve and line analysis, exglain what is accurring between 2012 ant 2014 .

(C) Using the curve and line malysis, exglanin what is accuring between 2014 and 2016

Potential

GDP (A) Using the cirve and line anglysis, expleng what is accurting between 2011 ant

(B) Using the curve and line analysis, exglain what is accurring between 2012 ant 2014 .

(C) Using the curve and line malysis, exglanin what is accuring between 2014 and 2016

(Essay)

4.8/5  (35)

(35)

Compared to the baseline, the short-run effect of a monetary policy change to lower inflation is for

(Multiple Choice)

4.7/5  (42)

(42)

A decrease in government purchases causes the interest-sensitive components of aggregate expenditure to increase in the short run.

(True/False)

4.7/5  (35)

(35)

Exhibit 25-3 Inflation (percent) Real GDP (billions of dollars) 4.5 6,700 3.5 6,800 2.5 6,900 1.5 7,000 5 7,100

-Suppose the target rate of inflation is 3 percent and real GDP equals potential GDP. Now, suppose a major oil-producing country decides to increase the supply of oil in order to discipline the other members of the oil-producing cartel. There is a sharp decline in the price of oil, and, in turn, the rate of inflation falls to 2 percent in the short run. The Fed views this decline in inflation as temporary and expects the price adjustment line to shift back up to 3 percent next year, which it does.

(A) Where wril real GDP be in the shart run? If the Fed follows its usual palicy rue, haw will the economy adjust back to potential?

(B) Naw, suppose the Fedi is sure this is a temporary decline in the intlation rate. Therefare, it Aecides not to follow its typical policy rule, but instead maintans the interest rate at the level it was at prior to the shock. What happens ta real GDp? Why? What will the lang-run adyustment be in this ca5e?

(Essay)

4.9/5  (37)

(37)

Suppose, for some hypothetical economy, an electric storm causes 90 percent of the CPU chips in the economy to become useless. Trace out the macroeconomic consequence of this phenomenon. Does this event result in stagflation? Why?

(Essay)

4.9/5  (40)

(40)

If the price of salt quadruples, will this cause a price shock? Explain.

(Essay)

4.9/5  (36)

(36)

Showing 21 - 40 of 177

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)