Exam 4: Long-Term Financial Planning and Corporate Growth

Exam 1: Introduction to Corporate Finance256 Questions

Exam 2: Financial Statements, Cash Flow, and Taxes412 Questions

Exam 3: Working With Financial Statements408 Questions

Exam 4: Long-Term Financial Planning and Corporate Growth379 Questions

Exam 5: Introduction to Valuation: the Time Value of Money280 Questions

Exam 6: Discounted Cash Flow Valuation413 Questions

Exam 7: Interest Rates and Bond Valuation393 Questions

Exam 8: Stock Valuation399 Questions

Exam 9: Net Present Value and Other Investment Criteria415 Questions

Exam 10: Making Capital Investment Decisions363 Questions

Exam 11: Project Analysis and Evaluation425 Questions

Exam 12: Lessons From Capital Market History329 Questions

Exam 13: Return, Risk, and the Security Market Line416 Questions

Exam 14: Cost of Capital377 Questions

Exam 15: Raising Capital337 Questions

Exam 16: Financial Leverage and Capital Structure Policy383 Questions

Exam 17: Dividends and Dividend Policy376 Questions

Exam 18: Short-Term Finance and Planning424 Questions

Exam 19: Cash and Liquidity Management374 Questions

Exam 20: Credit and Inventory Management384 Questions

Exam 21: International Corporate Finance369 Questions

Exam 22: Leasing269 Questions

Exam 23: Mergers and Acquisitions335 Questions

Exam 24: Enterprise Risk Management300 Questions

Exam 25: Options and Corporate Securities445 Questions

Exam 26: Behavioural Finance: Implications for Financial Management76 Questions

Select questions type

Financial planning generally considers:

Free

(Multiple Choice)

4.8/5  (33)

(33)

Correct Answer:

B

Which one of the following statements is true concerning the construction of pro forma statements using the percentage of sales approach?

Free

(Multiple Choice)

4.9/5  (31)

(31)

Correct Answer:

E

The sustainable growth rate rises as the _______ declines.

Free

(Multiple Choice)

4.8/5  (29)

(29)

Correct Answer:

D

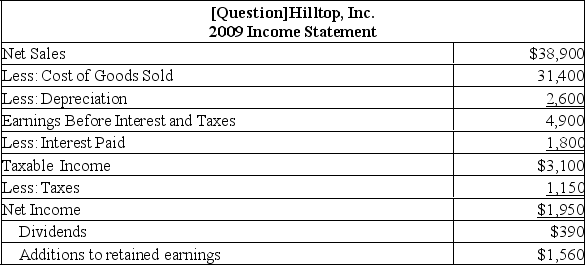

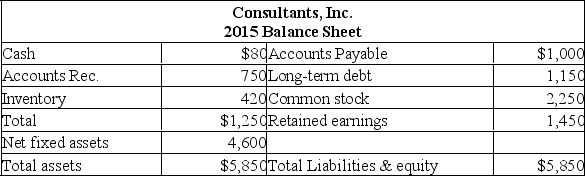

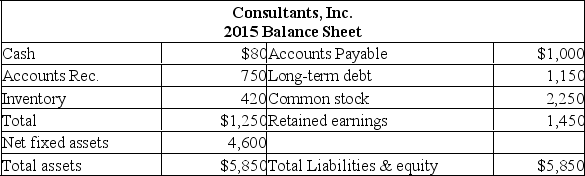

The following balance sheet and income statement should be used:

Hilltop, Inc. is currently operating at 69% of capacity. What is the full-capacity level of sales?

Hilltop, Inc. is currently operating at 69% of capacity. What is the full-capacity level of sales?

(Multiple Choice)

4.9/5  (31)

(31)

Net income = $150; Total assets = $1,000; Total liabilities = $400; Total asset turnover = 4.0

What is the sustainable growth rate assuming dividends paid total $50?

(Multiple Choice)

4.8/5  (35)

(35)

When utilizing the percentage of sales approach, managers can ignore any projected dividends.

(True/False)

4.9/5  (35)

(35)

A firm has a payout ratio of 40 percent and a sustainable growth rate of 8.5%. The capital intensity ratio is 1.1 and the debt-equity ratio is.5. What is the profit margin?

(Multiple Choice)

4.9/5  (30)

(30)

Calculate payout ratio given the following information: cash dividends paid = $19,950; sales = $250,000; cost of goods sold = $100,000; selling and administrative expenses = $50,000; interest expense = $5,000; tax rate = 30%.

(Multiple Choice)

4.8/5  (39)

(39)

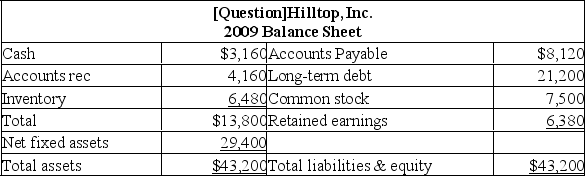

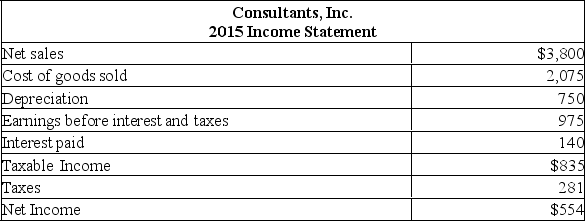

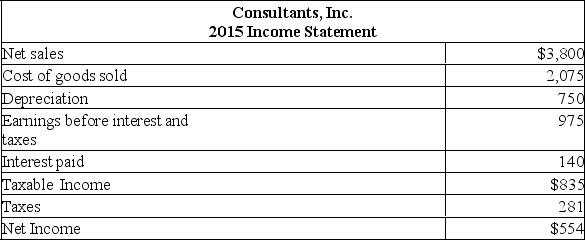

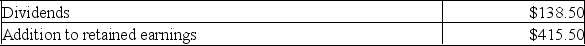

Consultants, Inc. maintains a constant dividend payout ratio. The firm is currently operating at full capacity. What is the maximum rate at which the firm can grow without acquiring any additional external financing?

Consultants, Inc. maintains a constant dividend payout ratio. The firm is currently operating at full capacity. What is the maximum rate at which the firm can grow without acquiring any additional external financing?

(Multiple Choice)

4.8/5  (43)

(43)

The external financing need tends to ______ as the projected growth rate in sales increases.

(Multiple Choice)

4.9/5  (27)

(27)

Calculate the external financing needed given the following information: current sales = $1,000; current sales capacity = 90%; current fixed assets = $1,800; projected future sales = $1,250.

(Multiple Choice)

4.8/5  (30)

(30)

Consultants, Inc. is currently operating at 95% of capacity. What is the required increase in fixed assets if sales are projected to increase by 10%?

Consultants, Inc. is currently operating at 95% of capacity. What is the required increase in fixed assets if sales are projected to increase by 10%?

(Multiple Choice)

4.7/5  (38)

(38)

The composition of the liability and equity sections of a pro forma statement depend most heavily on a firm's:

(Multiple Choice)

4.8/5  (33)

(33)

Which one of the following statements is correct concerning the external financing need (EFN) and the dividend payout ratio? Assume EFN is a positive number.

(Multiple Choice)

4.7/5  (38)

(38)

Calculate retention ratio given the following information: EBIT $100,000; tax rate 30%; dividends paid $24,500.

(Multiple Choice)

4.9/5  (37)

(37)

When fixed assets on a pro forma statement are projected to increase at a rate equivalent to the projected rate of sales growth, it can be assumed that the firm is:

(Multiple Choice)

4.8/5  (31)

(31)

Moore Money Inc. has a profit margin of 11% and a retention ratio of 70%. Last year, the firm had sales of $500 and total assets of $1,000. What is the internal growth rate?

(Multiple Choice)

4.8/5  (38)

(38)

All else the same, lower return on assets (ROA) ratio would likely be associated with a firm which has a high capital intensity ratio, relative to other firms in the same industry.

(True/False)

4.8/5  (34)

(34)

Showing 1 - 20 of 379

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)