Exam 9: Net Present Value and Other Investment Criteria

Exam 1: Introduction to Corporate Finance256 Questions

Exam 2: Financial Statements, Cash Flow, and Taxes412 Questions

Exam 3: Working With Financial Statements408 Questions

Exam 4: Long-Term Financial Planning and Corporate Growth379 Questions

Exam 5: Introduction to Valuation: the Time Value of Money280 Questions

Exam 6: Discounted Cash Flow Valuation413 Questions

Exam 7: Interest Rates and Bond Valuation393 Questions

Exam 8: Stock Valuation399 Questions

Exam 9: Net Present Value and Other Investment Criteria415 Questions

Exam 10: Making Capital Investment Decisions363 Questions

Exam 11: Project Analysis and Evaluation425 Questions

Exam 12: Lessons From Capital Market History329 Questions

Exam 13: Return, Risk, and the Security Market Line416 Questions

Exam 14: Cost of Capital377 Questions

Exam 15: Raising Capital337 Questions

Exam 16: Financial Leverage and Capital Structure Policy383 Questions

Exam 17: Dividends and Dividend Policy376 Questions

Exam 18: Short-Term Finance and Planning424 Questions

Exam 19: Cash and Liquidity Management374 Questions

Exam 20: Credit and Inventory Management384 Questions

Exam 21: International Corporate Finance369 Questions

Exam 22: Leasing269 Questions

Exam 23: Mergers and Acquisitions335 Questions

Exam 24: Enterprise Risk Management300 Questions

Exam 25: Options and Corporate Securities445 Questions

Exam 26: Behavioural Finance: Implications for Financial Management76 Questions

Select questions type

Draw a graph that illustrates two mutually exclusive investments, A and B, with a crossover rate of return equal to 10%, and with A having the higher NPV at a discount rate of zero %. Explain the graph, including under which conditions project A or project B would be chosen using NPV and then using IRR.

Free

(Short Answer)

4.7/5  (29)

(29)

Correct Answer:

The student should replicate Figure 9.7.

The length of time required for an investment to generate cash flows sufficient to recover the initial cost of the investment is called the:

Free

(Multiple Choice)

4.8/5  (34)

(34)

Correct Answer:

C

A project will produce cash inflows of $3,650 a year for four years. The start-up costs are $15,000. In year five, the project will be closed and as a result should produce a cash inflow of $7,500. What is the net present value of this project if the required rate of return is 11.5 %?

Free

(Multiple Choice)

4.8/5  (33)

(33)

Correct Answer:

D

A project is expected to produce cash inflows of $6,500 for three years. What is the maximum amount that can be spent on costs to initiate this project and still consider the project as acceptable, given an 11% discount rate?

(Multiple Choice)

4.8/5  (40)

(40)

Corey is considering two projects both of which have an initial cost of $20,000 and total cash inflows of $25,000. The cash inflows of project A are $3,000, $5,000, $8,000, and $9,000 over the next four years, respectively. The cash inflows for project B are $9,000, $8,000, $5,000, and $3,000 over the next four years, respectively. Which one of the following statements is correct if Corey requires a 10 % rate of return and has a required discounted payback period of 3 years?

(Multiple Choice)

4.8/5  (27)

(27)

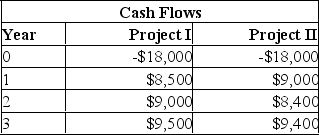

The Commodore Co. is trying to decide between the following two mutually exclusive projects:  The only requirement the company has is that any project that is accepted must produce a minimum rate of return of 11%. What should the company do and why?

The only requirement the company has is that any project that is accepted must produce a minimum rate of return of 11%. What should the company do and why?

(Multiple Choice)

4.9/5  (36)

(36)

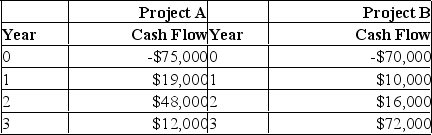

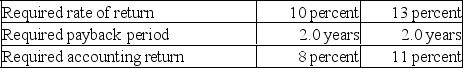

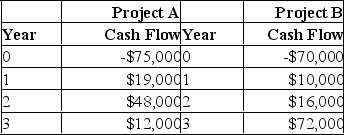

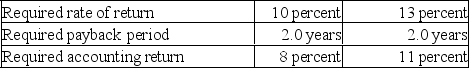

You are considering the following two mutually exclusive projects. Both projects will be depreciated using straight-line depreciation to a zero book value over the life of the project. Neither project has any salvage value.

Based upon the internal rate of return (IRR) and the information provided in the problem, you should:

Based upon the internal rate of return (IRR) and the information provided in the problem, you should:

(Multiple Choice)

4.9/5  (34)

(34)

If a firm uses the _____________ as an investment criterion, one of the risks it takes is that it may ignore some future cash flows.

(Multiple Choice)

4.9/5  (33)

(33)

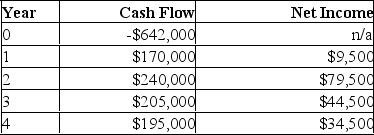

Martin is analyzing a project and has gathered the following data. Based on this data, what is the average accounting rate of return? The firm depreciates its assets using straight-line depreciation to a zero book value over the life of the asset.

(Multiple Choice)

4.8/5  (40)

(40)

AAR and payback use an arbitrary cutoff number in their decision rules.

(True/False)

4.8/5  (31)

(31)

Which of the following decision rules is best for evaluating projects for which cash flows beyond a specified point in time, and the time value of money, can both be ignored?

(Multiple Choice)

5.0/5  (35)

(35)

All else equal, the payback period for a project will decrease whenever the:

(Multiple Choice)

4.8/5  (37)

(37)

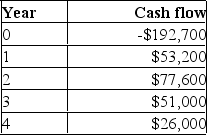

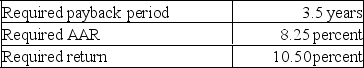

You are analyzing a project and have prepared the following data:

Based on the payback period of _____ years for this project, you should _____ the project.

Based on the payback period of _____ years for this project, you should _____ the project.

(Multiple Choice)

4.8/5  (37)

(37)

A project has an initial investment of $10,000, with $3,500 annual inflows for each of the subsequent four years. If the required return is 15%, what is the NPV?

(Multiple Choice)

4.9/5  (35)

(35)

You are considering the following two mutually exclusive projects. Both projects will be depreciated using straight-line depreciation to a zero book value over the life of the project. Neither project has any salvage value.

Based upon the payback period and the information provided in the problem, you should:

Based upon the payback period and the information provided in the problem, you should:

(Multiple Choice)

4.8/5  (33)

(33)

A project has an initial cash outlay of $29,500. Cash inflows are estimated at $1,200, $6,900, $7,800, $9,500, and $4,800 for years 1 through 5, respectively. What is the net present value of this project given a 7% discount rate?

(Multiple Choice)

4.7/5  (31)

(31)

Payback is frequently used to analyze independent projects because:

(Multiple Choice)

4.8/5  (32)

(32)

Showing 1 - 20 of 415

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)