Exam 5: Consolidated Financial Statements Intra-Entity Asset Transactions

Exam 19: Accounting for Estates and Trusts85 Questions

Exam 18: Accounting and Reporting for Private Not-For-Profit Organizations74 Questions

Exam 17: Accounting for State and Local Governments, Part II51 Questions

Exam 16: Accounting for State and Local Governments, Part I87 Questions

Exam 15: Partnerships: Termination and Liquidation73 Questions

Exam 14: Partnerships: Formation and Operation91 Questions

Exam 13: Accounting for Legal Reorganizations and Liquidations88 Questions

Exam 12: Financial Reporting and the Securities and Exchange Commission79 Questions

Exam 11: Worldwide Accounting Diversity and International Accounting Standards65 Questions

Exam 10: Translation of Foreign Currency Financial Statements101 Questions

Exam 9: Foreign Currency Transactions and Hedging Foreign Exchange Risk108 Questions

Exam 8: Segment and Interim Reporting120 Questions

Exam 7: Consolidated Financial Statements - Ownership Patterns and Income Taxes127 Questions

Exam 6: Variable Interest Entities, Intra-Entity Debt, Consolidated Cash Flows, and Other Issues119 Questions

Exam 5: Consolidated Financial Statements Intra-Entity Asset Transactions126 Questions

Exam 4: Consolidated Financial Statements and Outside Ownership128 Questions

Exam 3: Consolidations - Subsequent to the Date of Acquisition123 Questions

Exam 2: Consolidation of Financial Information124 Questions

Exam 1: The Equity Method of Accounting for Investments123 Questions

Select questions type

Brooks Co. acquired 90% of Hill Inc. on January 3, 2021. During 2021, Brooks sold goods to Hill for $2,500,000 that cost Brooks $1,850,000. Hill still owned 30% of the goods at the end of the year. Cost of goods sold was $11,200,000 for Brooks and $6,600,000 for Hill. What amount of intra-entity gross profit should be deferred in 2021?

Free

(Multiple Choice)

4.8/5  (38)

(38)

Correct Answer:

D

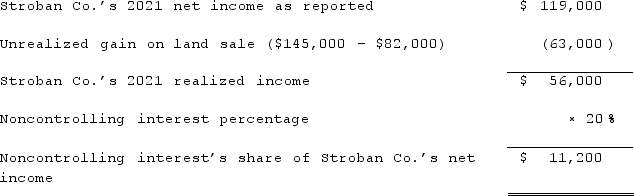

Hambly Corp. owned 80% of the voting common stock of Stroban Co. During 2021, Stroban sold a parcel of land to Hambly. The land had a book value of $82,000 and was sold to Hambly for $145,000. Stroban's reported net income for 2021 was $119,000.Required:Assuming there are no other intra-entity transactions nor excess amortizations, what was the net income attributable to the noncontrolling interest of Stroban?

Free

(Essay)

4.9/5  (33)

(33)

Correct Answer:

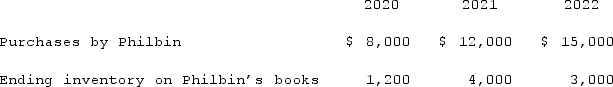

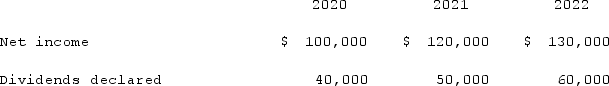

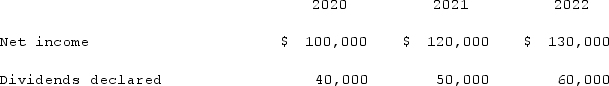

Anderson Company, a 90% owned subsidiary of Philbin Corporation, transfers inventory to Philbin at a 25% gross profit rate. The following data are available pertaining specifically to Philbin's intra-entity purchases from Anderson. Anderson was acquired on January 1, 2020.  Assume the equity method is used. The following data are available pertaining to Anderson's income and dividends.

Assume the equity method is used. The following data are available pertaining to Anderson's income and dividends.  Assuming there are no excess amortizations associated with the consolidation, and no other intra-entity asset transfers, compute the net income attributable to the noncontrolling interest of Anderson for 2022.

Assuming there are no excess amortizations associated with the consolidation, and no other intra-entity asset transfers, compute the net income attributable to the noncontrolling interest of Anderson for 2022.

Free

(Multiple Choice)

4.7/5  (25)

(25)

Correct Answer:

C

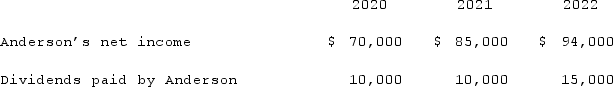

On January 1, 2021, Pride, Inc. acquired 80% of the outstanding voting common stock of Strong Corp. for $364,000. There is no active market for Strong's stock. Of this payment, $28,000 was allocated to equipment (with a five-year life) that had been undervalued on Strong's books by $35,000. Any remaining excess was attributable to goodwill, which has not been impaired.As of December 31, 2021, before preparing the consolidated worksheet, the financial statements appeared as follows:  During 2021, Pride bought inventory for $112,000 and sold it to Strong for $140,000. Only half of the inventory purchase price had been remitted to Pride by Strong at year-end. As of December 31, 2021, 60% of these goods remained in the company's possession.What is the consolidated total for equipment (net) at December 31, 2021?

During 2021, Pride bought inventory for $112,000 and sold it to Strong for $140,000. Only half of the inventory purchase price had been remitted to Pride by Strong at year-end. As of December 31, 2021, 60% of these goods remained in the company's possession.What is the consolidated total for equipment (net) at December 31, 2021?

(Multiple Choice)

4.7/5  (38)

(38)

Prater Inc. owned 85% of the voting common stock of Harkin Corp. During 2021, Prater made several sales of inventory to Harkin. The total selling price was $215,000 and the cost was $105,000. At the end of the year, 40% of the goods were still in Harkin's inventory. Harkin's reported net income was $400,000. Assuming there are no excess amortizations associated with the consolidation, and no other intra-entity asset transfers, what was the net income attributable to the noncontrolling interest in Harkin?

(Multiple Choice)

4.9/5  (37)

(37)

Wilson owned equipment with an estimated life of 10 years when the equipment was acquired for an original cost of $80,000. The equipment had a book value of $50,000 at January 1, 2020. On January 1, 2020, Wilson realized that the useful life of the equipment was longer than originally anticipated, at ten remaining years.On April 1, 2020 Simon Company, a 90% owned subsidiary of Wilson Company, bought the equipment from Wilson for $68,250 and for depreciation purposes used the estimated remaining life as of that date. The following data are available pertaining to Simon's income and dividends declared:  What amount should be recorded on Wilson's books in 2020 as gain on the transfer of equipment, prior to preparing consolidating entries?

What amount should be recorded on Wilson's books in 2020 as gain on the transfer of equipment, prior to preparing consolidating entries?

(Multiple Choice)

4.8/5  (27)

(27)

Stiller Company, an 80% owned subsidiary of Leo Company, purchased land from Leo on March 1, 2020, for $75,000. The land originally cost Leo $60,000. Stiller reported net income of $125,000 and $140,000 for 2020 and 2021, respectively. Leo uses the equity method to account for its investment.On a consolidation worksheet, what adjustment would be made for 2020 regarding the land transfer?

(Multiple Choice)

4.8/5  (32)

(32)

Virginia Corp. owned all of the voting common stock of Stateside Co. Both companies use the perpetual inventory method, and Virginia decided to use the partial equity method to account for this investment. During 2020, Virginia made cash sales of $400,000 to Stateside. The gross profit rate was 30% of the selling price. By the end of 2020, Stateside had sold 75% of the goods to outside parties for $420,000 cash.Prepare any 2021 consolidation worksheet entries that would be required regarding the 2020 inventory transfer.

(Essay)

4.7/5  (32)

(32)

Lewis Corp. acquired all of the voting common stock of Vance Co. on January 1, 2021. Lewis owned land with a book value of $84,000 that was sold to Vance for its fair value of $120,000. How should this transfer be accounted for by the consolidated entity?

(Essay)

4.7/5  (26)

(26)

Yoderly Co., a wholly owned subsidiary of Nelson Corp., sold goods to Nelson near the end of 2021. The goods had cost Yoderly $105,000 and the selling price was $140,000. Nelson had not sold any of the goods by the end of the year.Required:Prepare Consolidation Entry TI and Consolidation Entry G that are required for 2021.

(Essay)

4.7/5  (32)

(32)

Beesly Co. owned all of the voting common stock of Halpert Corp. The corporations' balance sheets dated December 31, 2020, include the following balances for land: -Beesly - $461,000, and -Halpert - $265,000. On the original date of acquisition, the book value of Halpert's land was equal to its fair value. On May 2, 2021, Beesly sold to Halpert a parcel of land with a book value of $75,000. The selling price was $88,000. There were no other transfers, which affected the companies' land accounts during 2020. What is the consolidated balance for land on the 2021 balance sheet?

(Multiple Choice)

4.8/5  (36)

(36)

Malone Co. owned 70% of Bernard Corp.'s common stock. During November 2021, Bernard sold merchandise to Malone for $150,000. At December 31, 2021, 40% of this merchandise remained in Malone's inventory. For 2021, gross profit percentages were 25% of sales for Malone and 30% of sales for Bernard. The amount of intra-entity gross profit remaining in ending inventory at December 31, 2021 that should be eliminated in the consolidation process is:

(Multiple Choice)

4.9/5  (45)

(45)

Stark Company, a 90% owned subsidiary of Parker, Inc., sold land to Parker on May 1, 2020, for $80,000. The land originally cost Stark $85,000. Stark reported net income of $200,000, $180,000, and $220,000 for 2020, 2021, and 2022, respectively. Parker sold the land purchased from Stark for $92,000 in 2022. Both companies use the equity method of accounting.Which of the following will be included in a consolidation entry for 2020?

(Multiple Choice)

4.8/5  (45)

(45)

Stark Company, a 90% owned subsidiary of Parker, Inc., sold land to Parker on May 1, 2020, for $80,000. The land originally cost Stark $85,000. Stark reported net income of $200,000, $180,000, and $220,000 for 2020, 2021, and 2022, respectively. Parker sold the land purchased from Stark for $92,000 in 2022. Both companies use the equity method of accounting.Which of the following will be included in a consolidation entry for 2021?

(Multiple Choice)

4.8/5  (37)

(37)

How do upstream and downstream inventory transfers differ in their effect in a year-end consolidation?

(Essay)

4.9/5  (41)

(41)

Wilson owned equipment with an estimated life of 10 years when the equipment was acquired for an original cost of $80,000. The equipment had a book value of $50,000 at January 1, 2020. On January 1, 2020, Wilson realized that the useful life of the equipment was longer than originally anticipated, at ten remaining years.On April 1, 2020 Simon Company, a 90% owned subsidiary of Wilson Company, bought the equipment from Wilson for $68,250 and for depreciation purposes used the estimated remaining life as of that date. The following data are available pertaining to Simon's income and dividends declared:  Assuming there are no excess amortizations associated with the consolidation, and no other intra-entity asset transfers, compute Wilson's share of income from Simon for consolidation for 2021.

Assuming there are no excess amortizations associated with the consolidation, and no other intra-entity asset transfers, compute Wilson's share of income from Simon for consolidation for 2021.

(Multiple Choice)

4.8/5  (35)

(35)

Walsh Company sells inventory to its subsidiary, Fisher Company, at a profit during 2020. With respect to one-third of the inventory sold to Fisher, Walsh accounts for it using the equity method of accounting.In the consolidation worksheet for 2021, which of the following accounts would be credited to eliminate unrecognized intra-entity gross profit with regard to the 2020 intra-entity transfers?

(Multiple Choice)

4.9/5  (37)

(37)

Charleston Inc. acquired 75% of Savannah Manufacturing on January 4, 2020. During 2020, Charleston sold Savannah $460,000 of goods, which had cost $380,000. Savannah still owned 20% of the goods at the end of the year. In 2021, Charleston sold goods with a cost of $520,000 to Savannah for $700,000, and Savannah still owned 15% of the goods at year-end. What amount of intra-entity gross profit should be deferred in 2021?

(Multiple Choice)

4.7/5  (32)

(32)

Walsh Company sells inventory to its subsidiary, Fisher Company, at a profit during 2020. With respect to one-third of the inventory sold to Fisher, Walsh accounts for it using the equity method of accounting.In the consolidation worksheet for 2020, which of the following accounts would be credited to eliminate the intra-entity transfer of inventory?

(Multiple Choice)

4.9/5  (44)

(44)

On April 7, 2021, Martinez Corp. sold land to Hannon Co., its subsidiary. From a consolidated financial statement point of view, when will the gain on this transfer actually be recognized?

(Essay)

4.7/5  (28)

(28)

Showing 1 - 20 of 126

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)