Exam 4: Consolidated Financial Statements and Outside Ownership

Exam 19: Accounting for Estates and Trusts85 Questions

Exam 18: Accounting and Reporting for Private Not-For-Profit Organizations74 Questions

Exam 17: Accounting for State and Local Governments, Part II51 Questions

Exam 16: Accounting for State and Local Governments, Part I87 Questions

Exam 15: Partnerships: Termination and Liquidation73 Questions

Exam 14: Partnerships: Formation and Operation91 Questions

Exam 13: Accounting for Legal Reorganizations and Liquidations88 Questions

Exam 12: Financial Reporting and the Securities and Exchange Commission79 Questions

Exam 11: Worldwide Accounting Diversity and International Accounting Standards65 Questions

Exam 10: Translation of Foreign Currency Financial Statements101 Questions

Exam 9: Foreign Currency Transactions and Hedging Foreign Exchange Risk108 Questions

Exam 8: Segment and Interim Reporting120 Questions

Exam 7: Consolidated Financial Statements - Ownership Patterns and Income Taxes127 Questions

Exam 6: Variable Interest Entities, Intra-Entity Debt, Consolidated Cash Flows, and Other Issues119 Questions

Exam 5: Consolidated Financial Statements Intra-Entity Asset Transactions126 Questions

Exam 4: Consolidated Financial Statements and Outside Ownership128 Questions

Exam 3: Consolidations - Subsequent to the Date of Acquisition123 Questions

Exam 2: Consolidation of Financial Information124 Questions

Exam 1: The Equity Method of Accounting for Investments123 Questions

Select questions type

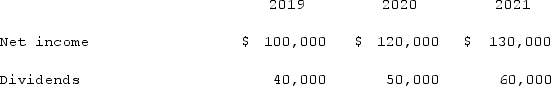

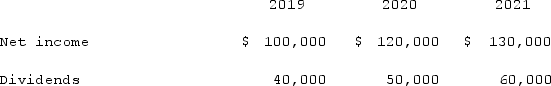

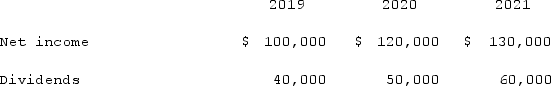

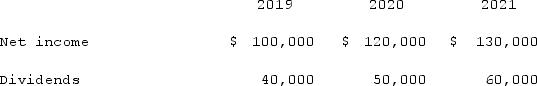

Pell Company acquires 80% of Demers Company for $500,000 on January 1, 2019. Demers reported common stock of $300,000 and retained earnings of $210,000 on that date. Equipment was undervalued by $30,000 and buildings were undervalued by $40,000, each having a 10-year remaining life. Any excess consideration transferred over fair value was attributed to goodwill with an indefinite life. Based on an annual review, goodwill has not been impaired.Demers earns income and pays dividends as follows:  Assume the partial equity method is applied.What is the consolidated balance of the Investment in Demers account at December 31, 2021.

Assume the partial equity method is applied.What is the consolidated balance of the Investment in Demers account at December 31, 2021.

(Multiple Choice)

4.8/5  (36)

(36)

On January 1, 2019, Jannison Inc. acquired 90% of Techron Co. by paying $477,000 cash. There is no active trading market for Techron stock. Techron Co. reported a Common Stock account balance of $140,000 and Retained Earnings of $280,000 at that date. The fair value of Techron Co. was appraised at $530,000. The total annual amortization was $11,000 as a result of this transaction. The subsidiary earned $98,000 in 2019 and $126,000 in 2020 with dividend payments of $42,000 each year. Without regard for this investment, Jannison had income of $308,000 in 2019 and $364,000 in 2020.Prepare a proper presentation of consolidated net income and its allocation for 2019.

(Essay)

4.9/5  (31)

(31)

Pell Company acquires 80% of Demers Company for $500,000 on January 1, 2019. Demers reported common stock of $300,000 and retained earnings of $210,000 on that date. Equipment was undervalued by $30,000 and buildings were undervalued by $40,000, each having a 10-year remaining life. Any excess consideration transferred over fair value was attributed to goodwill with an indefinite life. Based on an annual review, goodwill has not been impaired.Demers earns income and pays dividends as follows:  Assume the partial equity method is applied.How much does Pell record as Income from Demers for the year ended December 31, 2021?

Assume the partial equity method is applied.How much does Pell record as Income from Demers for the year ended December 31, 2021?

(Multiple Choice)

5.0/5  (27)

(27)

In a step acquisition where the parent previously held a noncontrolling interest in the acquired firm, the parent remeasures the prior interest to fair value

(True/False)

4.8/5  (33)

(33)

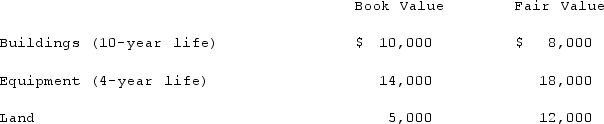

McGuire Company acquired 90 percent of Hogan Company on January 1, 2019, for $234,000 cash. This amount is reflective of Hogan's total acquisition-date fair value. Hogan's stockholders' equity consisted of common stock of $160,000 and retained earnings of $80,000. An analysis of Hogan's net assets revealed the following:  Any excess consideration transferred over fair value is attributable to an unamortized patent with a useful life of 5 years.In consolidation at January 1, 2019, what adjustment is necessary for Hogan's Equipment account?

Any excess consideration transferred over fair value is attributable to an unamortized patent with a useful life of 5 years.In consolidation at January 1, 2019, what adjustment is necessary for Hogan's Equipment account?

(Multiple Choice)

4.7/5  (42)

(42)

Pell Company acquires 80% of Demers Company for $500,000 on January 1, 2019. Demers reported common stock of $300,000 and retained earnings of $210,000 on that date. Equipment was undervalued by $30,000 and buildings were undervalued by $40,000, each having a 10-year remaining life. Any excess consideration transferred over fair value was attributed to goodwill with an indefinite life. Based on an annual review, goodwill has not been impaired.Demers earns income and pays dividends as follows:  Assume the partial equity method is applied.How much does Pell record as Income from Demers for the year ended December 31, 2019?

Assume the partial equity method is applied.How much does Pell record as Income from Demers for the year ended December 31, 2019?

(Multiple Choice)

4.8/5  (34)

(34)

Pell Company acquires 80% of Demers Company for $500,000 on January 1, 2019. Demers reported common stock of $300,000 and retained earnings of $210,000 on that date. Equipment was undervalued by $30,000 and buildings were undervalued by $40,000, each having a 10-year remaining life. Any excess consideration transferred over fair value was attributed to goodwill with an indefinite life. Based on an annual review, goodwill has not been impaired.Demers earns income and pays dividends as follows:  Assume the equity method is applied.What is the consolidated balance of the Investment in Demers account at December 31, 2021.

Assume the equity method is applied.What is the consolidated balance of the Investment in Demers account at December 31, 2021.

(Multiple Choice)

4.9/5  (30)

(30)

LaFevor Co. acquired 70% of the common stock of Dean Corp. on August 1, 2022. For 2022, Dean reported revenues of $960,000 and expenses of $780,000, all reflected evenly throughout the year. The annual amount of amortization related to this acquisition was $21,000.In consolidation, the total amount of expenses related to Dean, and to LaFevor's acquisition of Dean, for 2022 is determined to be

(Multiple Choice)

4.9/5  (40)

(40)

Showing 121 - 128 of 128

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)