Exam 2: Consolidation of Financial Information

Exam 19: Accounting for Estates and Trusts85 Questions

Exam 18: Accounting and Reporting for Private Not-For-Profit Organizations74 Questions

Exam 17: Accounting for State and Local Governments, Part II51 Questions

Exam 16: Accounting for State and Local Governments, Part I87 Questions

Exam 15: Partnerships: Termination and Liquidation73 Questions

Exam 14: Partnerships: Formation and Operation91 Questions

Exam 13: Accounting for Legal Reorganizations and Liquidations88 Questions

Exam 12: Financial Reporting and the Securities and Exchange Commission79 Questions

Exam 11: Worldwide Accounting Diversity and International Accounting Standards65 Questions

Exam 10: Translation of Foreign Currency Financial Statements101 Questions

Exam 9: Foreign Currency Transactions and Hedging Foreign Exchange Risk108 Questions

Exam 8: Segment and Interim Reporting120 Questions

Exam 7: Consolidated Financial Statements - Ownership Patterns and Income Taxes127 Questions

Exam 6: Variable Interest Entities, Intra-Entity Debt, Consolidated Cash Flows, and Other Issues119 Questions

Exam 5: Consolidated Financial Statements Intra-Entity Asset Transactions126 Questions

Exam 4: Consolidated Financial Statements and Outside Ownership128 Questions

Exam 3: Consolidations - Subsequent to the Date of Acquisition123 Questions

Exam 2: Consolidation of Financial Information124 Questions

Exam 1: The Equity Method of Accounting for Investments123 Questions

Select questions type

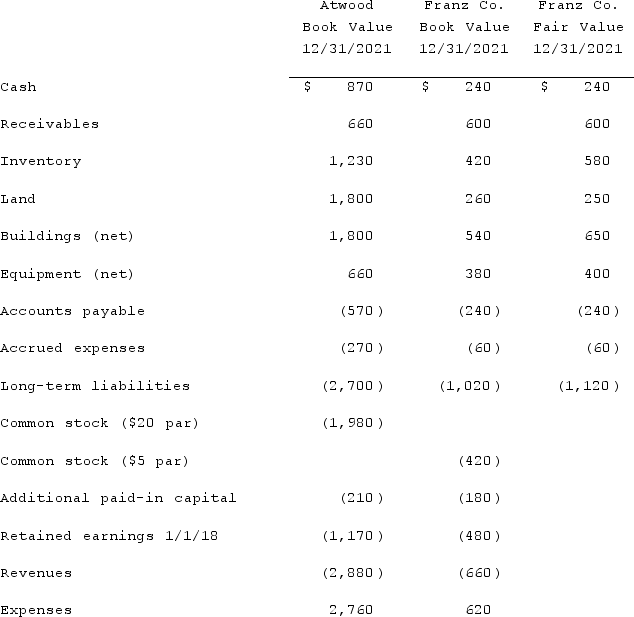

The financial statement amounts for the Atwood Company and the Franz Company as of December 31, 2021, are presented below. Also included are the fair values for Franz Company's net assets (all numbers are in thousands).  Note: Parenthesis indicate a credit balanceAssume an acquisition business combination took place at December 31, 2021. Atwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Franz. Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid.Compute the amount of the consideration transferred by Atwood to acquire Franz.

Note: Parenthesis indicate a credit balanceAssume an acquisition business combination took place at December 31, 2021. Atwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Franz. Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid.Compute the amount of the consideration transferred by Atwood to acquire Franz.

(Multiple Choice)

4.8/5  (37)

(37)

The financial statement amounts for the Atwood Company and the Franz Company as of December 31, 2021, are presented below. Also included are the fair values for Franz Company's net assets (all numbers are in thousands).  Note: Parenthesis indicate a credit balanceAssume an acquisition business combination took place at December 31, 2021. Atwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Franz. Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid.Compute consolidated goodwill at the date of the acquisition.

Note: Parenthesis indicate a credit balanceAssume an acquisition business combination took place at December 31, 2021. Atwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Franz. Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid.Compute consolidated goodwill at the date of the acquisition.

(Multiple Choice)

4.8/5  (30)

(30)

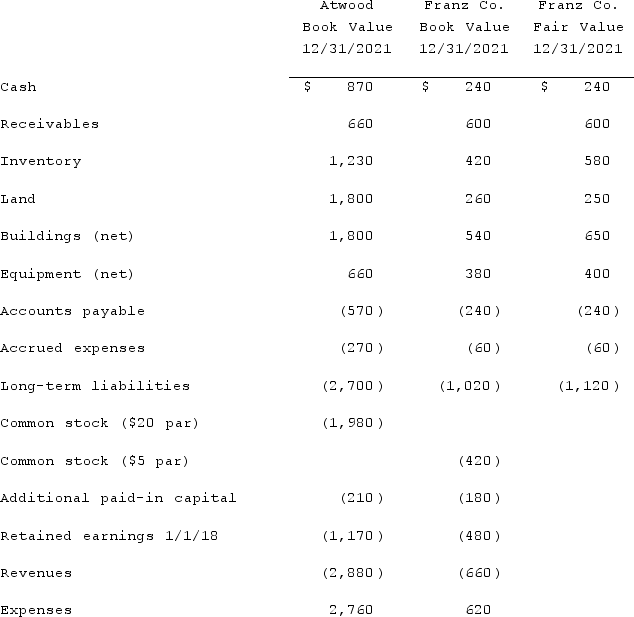

The following are preliminary financial statements for Black Co. and Blue Co. for the year ending December 31, 2021, prior to Black's acquisition of Blue Co.  On December 31, 2021 (subsequent to the preceding statements), Black exchanged 10,000 shares of its $10 par value common stock for all of the outstanding shares of Blue. Black's stock on that date has a fair value of $50 per share. Black was willing to issue 10,000 shares of stock because Blue's land was appraised at $204,000. Black also paid $14,000 to attorneys and accountants who assisted in creating this combination.Required: Assuming that these two companies retained their separate legal identities, prepare a consolidation worksheet as of December 31, 2021.

On December 31, 2021 (subsequent to the preceding statements), Black exchanged 10,000 shares of its $10 par value common stock for all of the outstanding shares of Blue. Black's stock on that date has a fair value of $50 per share. Black was willing to issue 10,000 shares of stock because Blue's land was appraised at $204,000. Black also paid $14,000 to attorneys and accountants who assisted in creating this combination.Required: Assuming that these two companies retained their separate legal identities, prepare a consolidation worksheet as of December 31, 2021.

(Essay)

5.0/5  (39)

(39)

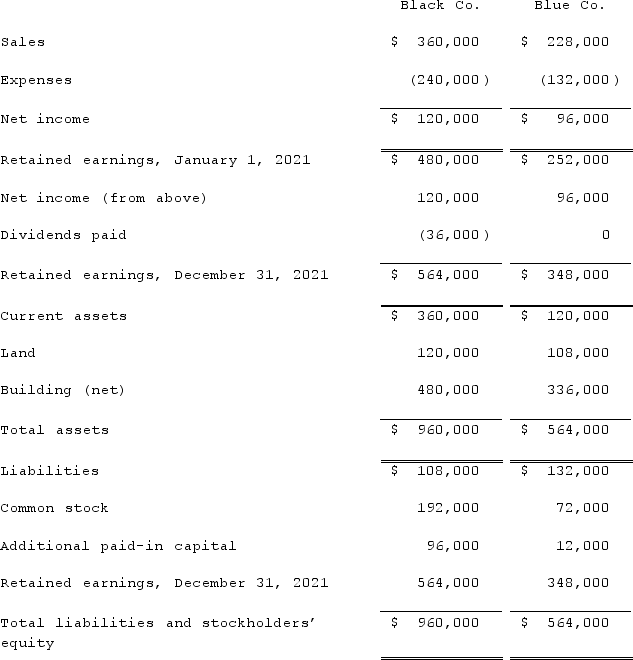

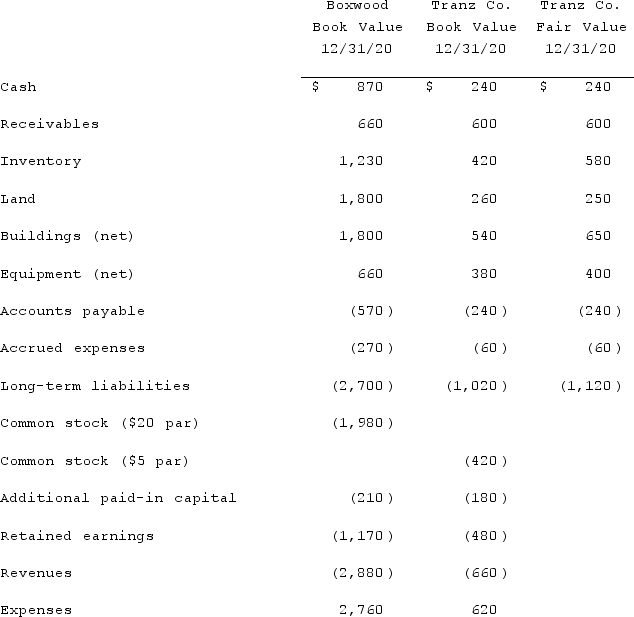

Presented below are the financial balances for the Boxwood Company and the Tranz Company as of December 31, 2020, immediately before Boxwood acquired Tranz. Also included are the fair values for Tranz Company's net assets at that date (all amounts in thousands).  Note: Parenthesis indicate a credit balanceAssume a business combination took place at December 31, 2020. Boxwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Tranz. Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid to effect this acquisition transaction. To settle a difference of opinion regarding Tranz's fair value, Boxwood promises to pay an additional $5.2 (in thousands) to the former owners if Tranz's earnings exceed a certain sum during the next year. Given the probability of the required contingency payment and utilizing a 4% discount rate, the expected present value of the contingency is $5 (in thousands).Compute consolidated goodwill immediately following the acquisition.

Note: Parenthesis indicate a credit balanceAssume a business combination took place at December 31, 2020. Boxwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Tranz. Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid to effect this acquisition transaction. To settle a difference of opinion regarding Tranz's fair value, Boxwood promises to pay an additional $5.2 (in thousands) to the former owners if Tranz's earnings exceed a certain sum during the next year. Given the probability of the required contingency payment and utilizing a 4% discount rate, the expected present value of the contingency is $5 (in thousands).Compute consolidated goodwill immediately following the acquisition.

(Multiple Choice)

4.9/5  (36)

(36)

Showing 121 - 124 of 124

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)