Exam 16: Fundamentals of Variance Analysis

Exam 1: Cost Accounting: Information for Decision Making145 Questions

Exam 2: Cost Concepts and Behavior153 Questions

Exam 3: Fundamentals of Cost-Volume-Profit Analysis161 Questions

Exam 4: Fundamentals of Cost Analysis for Decision Making150 Questions

Exam 5: Cost Estimation131 Questions

Exam 6: Fundamentals of Product and Service Costing150 Questions

Exam 7: Job Costing159 Questions

Exam 8: Process Costing153 Questions

Exam 9: Activity-Based Costing153 Questions

Exam 10: Fundamentals of Cost Management144 Questions

Exam 11: Service Department and Joint Cost Allocation152 Questions

Exam 12: Fundamentals of Management Control Systems160 Questions

Exam 13: Planning and Budgeting157 Questions

Exam 14: Business Unit Performance Measurement147 Questions

Exam 15: Transfer Pricing147 Questions

Exam 16: Fundamentals of Variance Analysis156 Questions

Exam 17: Additional Topics in Variance Analysis138 Questions

Exam 18: Performance Measurement to Support Business Strategy148 Questions

Select questions type

The difference between operating profits in the master budget and operating profits in the flexible budget is called a sales price variance.

(True/False)

4.8/5  (44)

(44)

The following information is available for Baxter Manufacturing for April:

Actual machine hours 840 Standard machine hours allowed 900 Denominator activity (machine hours) 1,000 Actual fixed overhead costs \3 ,800 Budgeted fixed overhead costs \4 ,000 Predetermined overhead rate ( \ 1 variable +\ 4 fixed) quad5

-

Is the production volume variance for April favorable or unfavorable?

(Multiple Choice)

4.9/5  (34)

(34)

Ole Company manufactures special electrical equipment and parts. Ole employs a standard cost accounting system with separate standards established for each product.

A special transformer is manufactured in the Transformer Department. Production volume is measured by direct labor hours in this department and a flexible budget system is used to plan and control department overhead. Standard costs for the special transformer are determined annually in September for the coming year. The standard cost of a transformer was computed at $57.00 as shown below.

Direct materials: Copper 3spools @ \ 3.00 \ 9.00 Direct labor 4 hours @ \ 7.00 28.00 Variable overhead 4 hours @ \ 3.00 12.00 Fixed overhead 4 hours @ \ 2.00 Total

Overhead rates were based upon normal and expected monthly capacity, both of which were 4,000 direct labor hours. Practical capacity for this department is 5,000 direct labor hours per month. Variable overhead costs are expected to vary with the number of direct labor hours actually used.

During October, 900 transformers were produced. This was below expectations because a work stoppage occurred during contract negotiations with the labor force. Once the contract was settled, the wage rate was increased to $7.25/hour and overtime was scheduled in an attempt to catch up to expected production levels.

The following costs were incurred in October:

Direct materials: Copper: purchased 2,600 spools @\ 3.08/ spool Used: 2,600 spools Direct labor: Repular tirne 2,000hours @\ 7.00 Overtime 1,400 hours @\ 7.25

600 of the 1,400 hours were subject to overtime premium. The total overtime premium is included in variable overhead in accordance with company accounting practices.

Overhead: Variable \1 6,670 Fixed \8 ,800

Required:

Compute each of the following variances, showing all your work. Be sure to indicate whether the variances are favorable or unfavorable.

a. Direct materials price variance.

b. Direct material efficiency (quantity) variance.

c. Direct labor rate variance.

d. Direct labor efficiency variance.

e. Variable overhead spending variance.

f. Variable overhead efficiency variance.

g. Fixed overhead spending (budget) variance.

h. Production volume variance.

(Essay)

4.8/5  (42)

(42)

Which of the following variances will always be favorable when actual sales exceed budgeted sales?

(Multiple Choice)

4.9/5  (38)

(38)

When a manager is concerned with monitoring total cost, total revenue, and net profit conditioned upon the level of productivity, an accountant should normally recommend: (CPA adapted)

Flexible Budgeting Standard Costing

A. Yes No

B. Yes Yes

C. No Yes

D. No No

(Multiple Choice)

4.9/5  (39)

(39)

The following information is available for Baxter Manufacturing for April:

Actual machine hours 840 Standard machine hours allowed 900 Denominator activity (machine hours) 1,000 Actual fixed overhead costs \3 ,800 Budgeted fixed overhead costs \4 ,000 Predetermined overhead rate ( \ 1 variable +\ 4 fixed) quad5

-

What is the production volume variance?

(Multiple Choice)

4.8/5  (38)

(38)

The following information is available for the Danske Company:

Denominator hours for May 15,000 Actual hours worked during May 14,000 Standard hours allowed for May 12,000 Flexible budget fixed overhead cost \4 5,000 Actual fixed overhead costs for May \4 8,000

Danske Company had total underapplied overhead of $15,000. Additional information is as follows:

Variable Overhead: Applied based on standard direct labor hours allowed Budgeted based on standard direct labor hours Fixed Overhead: Applied based on standard direct labor hours allowed Budgeted based on standard direct labor hours \4 2,000 38,000 \3 0,000 27,000

-

What is the fixed overhead price (spending) variance for May?

(Multiple Choice)

4.8/5  (32)

(32)

Data on Gantry Company's direct labor costs are given below:

Standard direct-labor hours 30,000 Actual direct-labor hours 29,000 Direct-labor efficiency variance-favorable \ 4,000 Direct-labor rate variance-favorable \ 5,800 Total direct labor payroll \ 110,200

-

What was Gantry's actual direct labor rate?

(Multiple Choice)

4.7/5  (45)

(45)

Information for Bonanza Company's direct labor cost for February is as follows:

Actual direct labor hours 69,000 Total direct labor payroll \ 483,000 Efficiency variarce \ 6,400 Rate variance \ 41,400

What were the standard direct labor hours for February?

(Multiple Choice)

4.9/5  (33)

(33)

The fixed factory overhead application rate is a function of a predetermined activity level. If standard hours allowed for actual output equal this predetermined activity level for a given period, the volume variance will be: (CPA adapted)

(Multiple Choice)

4.8/5  (36)

(36)

The Fellowes Company has developed standards for direct labor. During June, 75 units were scheduled and 100 were produced. Data related to direct labor are:

Standard hours allowed 3hours per unit Standard wages allowed \ 4.00 per hour Actual direct labor 31 hours (total cost \ 1,209)

What is the direct labor rate variance for June?

(Multiple Choice)

4.7/5  (29)

(29)

The data below relate to a product of AirWay Company.

Standard costs: Labor(3 hours at \ 15 per hour) \ 45 per unit Variable overhead at \ 8 per labor hour 24 per unit Budgeted fixed production costs \ 140,000 per years Budgeted production for the year 4,000 units

Actual results: Production 3,600 Units Labor(10,360hours) \ 160,580 Overhead incurred ( \ 142,700 fixed) \ 222,200

Required:

(Be sure to indicate whether the variances are favorable or unfavorable.)

a. What is the variable overhead efficiency variance?

b. What is the variable overhead price variance?

c. What is the fixed overhead budget variance?

d. What is the fixed production volume variance?

(Essay)

4.8/5  (40)

(40)

Fargo Company manufactures special electrical equipment and parts. Eastern employs a standard cost accounting system with separate standards established for each product.

A special transformer is manufactured in the Transformer Department. Production volume is measured by direct labor hours in this department and a flexible budget system is used to plan and control department overhead. Standard costs for the special transformer are determined annually in September for the coming year. The standard cost of a transformer was computed at $67.00 as shown below.

Drrect materials: Iron 5 sheets @ \ 2.00 \ 10.00 Copper 3 spools @ \ 3.00 9.00 Direct labor 4 hours @ \ 7.00 28.00 Variable overhead 4 hours @ \ 3.00 12.00 Fixed overhead 4 hours @ \ 2.00 Total \ 67.00

Overhead rates were based upon normal and expected monthly capacity, both of which were 4,000 direct labor hours. Practical capacity for this department is 5,000 direct labor hours per month. Variable overhead costs are expected to vary with the number of direct labor hours actually used. During October, 800 transformers were produced. This was below expectations because a work stoppage occurred at the copper supplier and shipments were delayed.

The following costs were incurred in October:

Direct materials: Iron: purchased 4,200 sheets, total cost \ 8,750 Used: 4,200 sheets Copper: purchased 2,600 spools, total cost \ 7,890 Used: 2,600 spools Direct labor: 3,400 hours Total payroll: \ 24,080

Required:

Compute each of the following variances, showing all your work. Be sure to indicate whether the variances are favorable or unfavorable.

a. Direct materials price variance for both iron and copper.

b. Direct material efficiency variance for both iron and copper

c. Direct labor rate variance.

d. Direct labor efficiency variance.

(Essay)

4.8/5  (48)

(48)

Miller Company planned to produce 3,000 units of its single product, Tallium, during November. The standards for one unit of Tallium specify six pounds of materials at $0.30 per pound. Actual production in November was 3,100 units of Tallium. There was a favorable materials price variance of $380 and an unfavorable materials quantity variance of $120. Based on these variances, one could conclude that: (CMA adapted)

(Multiple Choice)

4.9/5  (34)

(34)

Based on past experience, Moss Company has developed the following budget formula for estimating its shipping expenses:

Shipping costs = $16,000 + ($0.50 × lbs. shipped). The company's shipments average 12 lbs. per shipment.

The planned activity and actual activity regarding orders and shipments for the current month are given in the following schedule:

Plan Actual Sales orders 800 780 Shipments 800 820 Units shipped 8,000 9,000 Sales \ 120,000 \ 144,000 Total pounds shipped 9,600 12,300

The actual shipping costs for the month amounted to $21,000. The appropriate monthly flexible budget allowance for shipping costs for the purpose of performance evaluation would be: (CMA adapted)

(Multiple Choice)

4.8/5  (31)

(31)

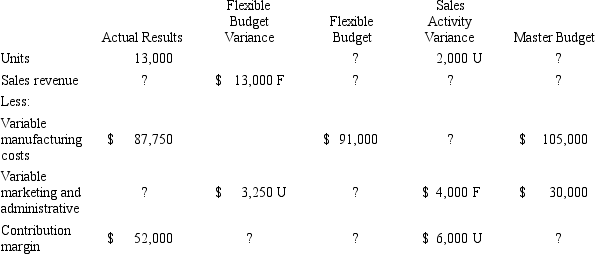

James Manufacturing has the following information available for July:

-

What was James's flexible budget contribution margin for July?

-

What was James's flexible budget contribution margin for July?

(Multiple Choice)

4.8/5  (35)

(35)

The sales activity variance is the result of a difference between budgeted units sold and actual units sold.

(True/False)

4.8/5  (36)

(36)

Information on Kimble Company's direct labor costs for the month of January is as follows:

Actual direct labor hours 34,500 Standard direct labor hours 35,000 Total direct labor payroll \ 241,500 Direct labor efficiency variarice-favorable \ 3,200

-

Is the direct labor rate variance favorable or unfavorable?

(Multiple Choice)

4.8/5  (32)

(32)

Which variance will be unfavorable due to employees working more hours than allowed for the actual number of units produced?

(Multiple Choice)

4.9/5  (43)

(43)

Showing 101 - 120 of 156

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)