Exam 11: Service Department and Joint Cost Allocation

Exam 1: Cost Accounting: Information for Decision Making145 Questions

Exam 2: Cost Concepts and Behavior153 Questions

Exam 3: Fundamentals of Cost-Volume-Profit Analysis161 Questions

Exam 4: Fundamentals of Cost Analysis for Decision Making150 Questions

Exam 5: Cost Estimation131 Questions

Exam 6: Fundamentals of Product and Service Costing150 Questions

Exam 7: Job Costing159 Questions

Exam 8: Process Costing153 Questions

Exam 9: Activity-Based Costing153 Questions

Exam 10: Fundamentals of Cost Management144 Questions

Exam 11: Service Department and Joint Cost Allocation152 Questions

Exam 12: Fundamentals of Management Control Systems160 Questions

Exam 13: Planning and Budgeting157 Questions

Exam 14: Business Unit Performance Measurement147 Questions

Exam 15: Transfer Pricing147 Questions

Exam 16: Fundamentals of Variance Analysis156 Questions

Exam 17: Additional Topics in Variance Analysis138 Questions

Exam 18: Performance Measurement to Support Business Strategy148 Questions

Select questions type

Dawson Corporation produces a product called Blocker, which gives rise to a by-product called Spotter. The only costs associated with Spotter are additional processing costs of $4 for each unit. Dawson accounts for Spotter's sales first by deducting its separable costs from its sales and then by deducting this net amount from the cost of sales of Blocker. This year, 9,600 units of Spotter were produced. They were all sold for $8 each. Company operating expenses were $250,000 for the year. Sales revenue and cost of goods sold for Blocker were $1,600,000 and $800,000, respectively. (CPA adapted)

Required:

(a) Calculate the company's gross margin under the current accounting method.

(b) Assume the company changes its accounting method and accounts for the by-product's net realizable value as "other revenue." Calculate the gross margin under the new method.

(c) Under what circumstances would method (a) or (b) be preferred?

(Essay)

4.9/5  (42)

(42)

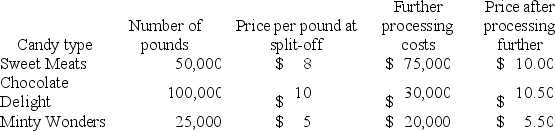

Delite Confectionary Company produces various types of candies. Several candies could be sold at the split-off point or processed further and sold in a different form after further processing. The candies are produced in a joint processing operation with $500,000 of joint processing costs monthly, which are allocated based on pounds produced. Information concerning this process for a recent month appears below:

-

Based on the information presented, which of the products should be processed further?

-

Based on the information presented, which of the products should be processed further?

(Multiple Choice)

4.8/5  (34)

(34)

The characteristic that is most often used to distinguish a product as either a main product or a by-product is the amount of:

(Multiple Choice)

4.8/5  (36)

(36)

Great Falls Company makes two products, Wool Gloves and Wool Mittens. They are initially processed from the same raw material and then, after split-off, further processed separately. Additional information is as follows:

Gloves Mittens Total Final Sales Price \ 9,000 \ 6,000 \ 15,000 Joint Costs Prior to Split-Off Point ? ? \ 6,600 Costs Beyond Split-Off Point \ 3,000 \ 3,000 \ 6,000

What are the joint costs allocated to Gloves and Mittens assuming Great Falls uses the estimated net realizable value approach?

Gloves Mittens

A. \ 3,300 \ 3,300

B. \ 3,960 \ 2,640

C. \ 4,400 \ 2,200

D. \ 4,560 \ 2,040

(Multiple Choice)

4.9/5  (41)

(41)

If two service departments service the same number of departments, which service department's costs should be allocated first when using the step method?

(Multiple Choice)

4.9/5  (40)

(40)

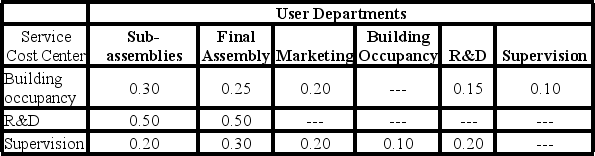

The following is a system of simultaneous linear equations to allocate costs using the reciprocal method. Matrix algebra is not required.

The following costs were incurred in three operating departments and three service departments in Westmoreland Company.

Use of services by other departments is as follows.

-

The equation for department S3 (supervision) is:

-

The equation for department S3 (supervision) is:

(Multiple Choice)

4.8/5  (33)

(33)

Service department costs are allocated to user departments, in part, because:

(Multiple Choice)

4.8/5  (41)

(41)

Yellville Regional Hospital is a small hospital with two service departments and three revenue areas:

Square Laundry Service Department Diret Costs Feet Pounds Housekeeping (HK) \ 80,000 - 16,000 Laundry \ 132,000 500 Revernue Areas: Surgery \ 400,000 1,500 48,000 Serniprivate roorns \ 200,000 2,000 24,000 Maternity \ 150,000 1,000 12,000

The hospital wants to allocate the service department costs to the revenue areas. Housekeeping is allocated based on square footage; Laundry is allocated based on pounds of laundry. The normal capacity for Surgery is 200 hours per month; normal capacity for semiprivate rooms is 600 patient days; and normal capacity for maternity is 200 patient days.

Required:

Determine the overhead rate for the three revenue areas. Allocate the service department costs to the revenue areas using the direct method.

(Essay)

4.8/5  (46)

(46)

There are several methods for allocating service department costs to production departments. The method which recognizes service provided by one service department to another but does not recognize reciprocal interdepartmental service is called: (CMA adapted)

(Multiple Choice)

4.8/5  (34)

(34)

The Delicious Canning Company processes tomatoes into ketchup, tomato juice, and canned tomatoes. During the summer, the joint costs of processing the tomatoes were $420,000. There were no beginning or ending inventories for the summer. Production and sales value information for the summer were as follows:

Product Cases Additional Costs Selling Price Ketchup 100,000 \ 3.00 per case \ 28 per case Juice 150,000 5.00 per case \ 25 per case Canned 200,000 2.50 per case 10 per case

Required:

a. Determine the amount allocated to each product if the estimated net realizable value method is used.

b. Determine the amount allocated to each product if the physical quantities method is used.

(Essay)

4.9/5  (34)

(34)

One reason to allocate service department costs to user departments is to encourage the user departments to monitor their use of the service department costs.

(True/False)

4.7/5  (29)

(29)

The Foxmoor Company produces three products, X, Y, and Z, from a single raw material input. Product Y can be sold at the split-off point for total revenues of $50,000 or it can be processed further at a total cost of $16,000 and then sold for $68,000. Product Y:

(Multiple Choice)

4.8/5  (32)

(32)

Which of the following service departments could logically use space occupied (square footage) to allocate its costs to user departments?

(Multiple Choice)

4.7/5  (38)

(38)

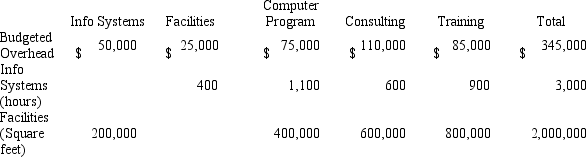

Data Master is a computer software consulting company. Its three major functional areas are computer programming, information systems consulting, and software training. Cynthia Moore, a pricing analyst in the Accounting Department, has been asked to develop total costs for the functional areas. These costs will be used as a guide in pricing a new contract. In computing these costs, Moore is considering three different methods of allocating overhead costs: the direct method, the step method, and the reciprocal method. Moore assembled the following data on overhead from its two service departments, the Information Systems Department and the Facilities Department.

Service Departments User Departments

Information systems are allocated on the basis of hours of computer usage; facilities are allocated on the basis of floor space.

Required:

Allocate the service department costs to the user departments using the reciprocal method. Round to the nearest whole dollar.

Information systems are allocated on the basis of hours of computer usage; facilities are allocated on the basis of floor space.

Required:

Allocate the service department costs to the user departments using the reciprocal method. Round to the nearest whole dollar.

(Essay)

4.9/5  (39)

(39)

Jamison Company has two service departments and two producing departments. Square footage of space occupied by each department follows:

Custodial services 1,000 General administration 3,000 Producing Department A 8,000 Producing Department B

The department costs of Custodial Services are allocated on a basis of square footage of space. If Custodial Services costs are budgeted at $38,000, the amount of cost allocated to General Administration under the direct method would be:

(Multiple Choice)

4.8/5  (37)

(37)

What is the difference between an intermediate cost center and a final cost center?

(Essay)

4.7/5  (45)

(45)

Tenet Engineering, Inc. operates two user divisions as separate cost objects. To determine the costs of each division, the company allocates common costs to the divisions. During the past month, the following common costs were incurred:

Computer services (85% fixed) $ 260,000

Building occupancy 600,000

Personnel costs 110,000

Total common costs $ 970,000

The following information is available concerning various activity measures and service usages by each of the divisions:

Area occupied (square feet) 20,000 40,000 Payroll \ 380,000 \ 180,000 Computer time (hours) 200 220 Computer storage (megabytes) 4,050 -0- Equipment value \ 200,000 \ 250,000 Operating profit (pre-allocations) \ 555,000 \ 495,000

-

Using the most appropriate allocation basis, what is the personnel cost allocated to Division A (rounded to the nearest whole dollar)?

(Multiple Choice)

4.8/5  (36)

(36)

If by-product revenue is treated as other revenue instead of deducted from the net-realizable-value of the main products:

(Multiple Choice)

5.0/5  (34)

(34)

Showing 121 - 140 of 152

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)