Exam 20: Corporations in Financial Difficulty

Exam 7: Intercompany Transfers of Services and Noncurrent Assets47 Questions

Exam 8: Intercompany Indebtedness39 Questions

Exam 8: Appendix a Intercompany Indebtedness40 Questions

Exam 9: Consolidation Ownership Issues51 Questions

Exam 10: Additional Consolidation Reporting Issues44 Questions

Exam 11: Multinational Accounting: Foreign Currency Transactions and Financial Instruments62 Questions

Exam 12: Multinational Accounting: Issues in Financial Reporting and Translation of Foreign Entity Statements65 Questions

Exam 13: Segment and Interim Reporting61 Questions

Exam 14: Sec Reporting49 Questions

Exam 15: Partnerships: Formation, Operation, and Changes in Membership55 Questions

Exam 16: Partnerships: Liquidation59 Questions

Exam 17: Governmental Entities: Introduction and General Fund Accounting79 Questions

Exam 18: Governmental Entities: Special Funds and Governmentwide Financial Statements79 Questions

Exam 19: Not-For-Profit Entities121 Questions

Exam 20: Corporations in Financial Difficulty41 Questions

Select questions type

Which chapters of the Bankruptcy Code deal with corporations?

(Multiple Choice)

4.8/5  (38)

(38)

Briefly explain the three classes of creditors specified in the Bankruptcy Code.

(Essay)

4.9/5  (33)

(33)

A debtor-in-possession balance sheet should report:

I. Liabilities not subject to compromise.

II. Liabilities subject to compromise.

(Multiple Choice)

4.8/5  (28)

(28)

Which of the following could be true of the proceedings under Chapter 11 of the Bankruptcy Code?

(Multiple Choice)

4.7/5  (34)

(34)

All of the following items are reported in a statement of realization and liquidation except:

(Multiple Choice)

4.8/5  (36)

(36)

Chapter 7 of the Bankruptcy Code provides for:

I. Reorganization.

II. Liquidation.

(Multiple Choice)

4.7/5  (42)

(42)

A trustee has been appointed for Smith Company, which is being liquidated under Chapter 7 of the Bankruptcy Code. The following transactions occurred after the assets were transferred to the trustee:

1. Credit sales by the trustee were $100,000. Cost of goods sold were $72,000, consisting of all the inventory transferred from Smith.

2. The trustee sold all $20,000 worth of marketable securities for $15,000.

3. Receivables collected by the trustee:

Old: $28,000 of the $50,000 transferred

New: $65,000

4. Disbursements by the trustee:

Old current payables: $31,000 of the $65,000 transferred

Trustee's expenses: $6,000

5. Recorded $24,000 depreciation on the plant assets of $120,000 transferred from Smith.

Required:

Prepare a statement of realization and liquidation according to the traditional approach illustrated in the chapter.

(Essay)

4.9/5  (40)

(40)

In a statement of realization and liquidation, unusual revenue items are reported under:

(Multiple Choice)

4.8/5  (43)

(43)

Chapter 11 of the Bankruptcy Code provides for:

I. Reorganization.

II. Liquidation.

(Multiple Choice)

4.9/5  (30)

(30)

What is defined as a condition in which a company is unable to meet debts as the debts mature?

(Multiple Choice)

4.8/5  (42)

(42)

The payment to general unsecured creditors is often termed:

(Multiple Choice)

4.7/5  (41)

(41)

Typically, the plan of reorganization must be approved by at least _____ of all creditors, who must hold at least _____ of the dollar amount of the outstanding debt.

(Multiple Choice)

5.0/5  (44)

(44)

What are the conditions necessary for using fresh start reporting in reorganization?

(Essay)

4.9/5  (41)

(41)

In which of the following ways can debt be restructured?

I. Assets can be transferred to the creditor.

II. An equity interest can be granted to the creditor.

III. The terms of the debt can be modified.

(Multiple Choice)

4.8/5  (34)

(34)

Under Chapter 11 proceedings, what represents the fair value of the entity before considering liabilities and approximates the amount a willing buyer would pay for the entity's assets?

(Multiple Choice)

4.9/5  (37)

(37)

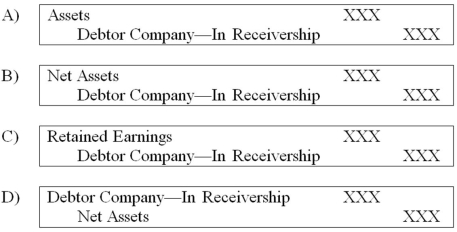

What is the general form of the trustee's opening entry, accepting the assets of the debtor company?

(Multiple Choice)

4.7/5  (40)

(40)

_____ have liens, or security interests, on specific assets.

(Multiple Choice)

4.7/5  (35)

(35)

On a debtor-in-possession income statement, which of the following items should be reported under the heading "Reorganization Items"?

(Multiple Choice)

4.9/5  (40)

(40)

A transfer of assets by a company in financial difficulty is considered a sale if:

I. the transfer includes a recourse provision allowing the buyer to return the asset.

II. the transferee obtains the right to pledge or exchange the transferred assets.

III. the transferred assets have been isolated from the transferor.

IV. the transferor does not maintain effective control over the transferred assets.

(Multiple Choice)

4.7/5  (37)

(37)

Showing 21 - 40 of 41

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)