Exam 23: State and Local Taxes

Exam 1: An Introduction to Tax113 Questions

Exam 2: Tax Compliance,the Irs,and Tax Authorities112 Questions

Exam 3: Tax Planning Strategies and Related Limitations115 Questions

Exam 4: Individual Income Tax Overview,dependents,and Filing Status125 Questions

Exam 5: Gross Income and Exclusions130 Questions

Exam 6: Individual Deductions98 Questions

Exam 7: Investments74 Questions

Exam 8: Individual Income Tax Computation and Tax Credits154 Questions

Exam 9: Business Income,deductions,and Accounting Methods99 Questions

Exam 10: Property Acquisition and Cost Recovery103 Questions

Exam 11: Property Dispositions110 Questions

Exam 12: Compensation99 Questions

Exam 13: Retirement Savings and Deferred Compensation111 Questions

Exam 14: Tax Consequences of Home Ownership108 Questions

Exam 15: Entities Overview80 Questions

Exam 16: Corporate Operations106 Questions

Exam 17: Accounting for Income Taxes100 Questions

Exam 18: Corporate Taxation: Nonliquidating Distributions100 Questions

Exam 19: Corporate Formation,reorganization,and Liquidation100 Questions

Exam 20: Forming and Operating Partnerships106 Questions

Exam 21: Dispositions of Partnership Interests and Partnership Distributions100 Questions

Exam 22: S Corporations134 Questions

Exam 23: State and Local Taxes117 Questions

Exam 24: The Ustaxation of Multinational Transactions89 Questions

Exam 25: Transfer Taxes and Wealth Planning123 Questions

Select questions type

The payroll factor includes payments to independent contractors.

(True/False)

4.8/5  (36)

(36)

The annual value of rented property is not included in the property factor.

(True/False)

4.8/5  (34)

(34)

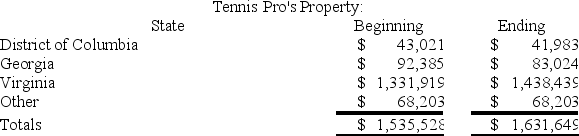

Gordon operates the Tennis Pro Shop in Blacksburg,Virginia.Tennis Pro has property as follows:

What is Tennis Pro's Virginia property numerator and property factor? (Round the property factor to two places.)

What is Tennis Pro's Virginia property numerator and property factor? (Round the property factor to two places.)

(Essay)

4.8/5  (37)

(37)

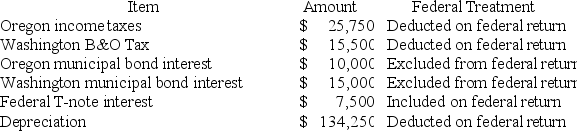

Moss Incorporated is a Washington corporation.It properly included,deducted,or excluded the following items on its federal tax return in the current year:

Moss's Oregon depreciation was $145,500.Moss's federal taxable income was $549,743.Calculate Moss's Oregon state tax base.

Moss's Oregon depreciation was $145,500.Moss's federal taxable income was $549,743.Calculate Moss's Oregon state tax base.

(Essay)

4.9/5  (38)

(38)

Most states have shifted away from an equally weighted three-factor to a heavily weighted sales apportionment formula.

(True/False)

4.9/5  (42)

(42)

Commercial domicile is the location where a business is headquartered and from whence it directs its operations.

(True/False)

4.8/5  (41)

(41)

Big Company and Little Company are both owned by Mrs.Smith.Big and Little file a consolidated federal tax return.Big manufactures office paper and other paper supplies and is based in Washington.Little operates a logging operation in Montana.Sixty percent of Little's sales are made to Big.Ten percent of Big's raw materials come from Little.There are no common officers or board members.There are no common service providers.What are the factors for and against filing a unitary tax return?

(Essay)

4.8/5  (39)

(39)

Tennis Pro is headquartered in Virginia.Assume it has a state income tax base of $200,000.Of this amount,$60,000 was nonbusiness income.Assume that Tennis Pro's Virginia apportionment factor is 73.28 percent.The nonbusiness income allocated to Virginia was $23,000.Assuming a Virginia corporate tax rate of 5.5 percent,what is Tennis Pro's Virginia state income tax liability? (Round your answer to the nearest whole number.)

(Essay)

4.9/5  (39)

(39)

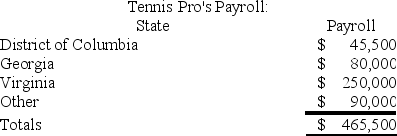

Gordon operates the Tennis Pro Shop in Blacksburg,Virginia.Tennis Pro has payroll as follows:

The other total includes $10,000 of salary of a Virginia employee that works part time in another state.What is Tennis Pro's Virginia payroll numerator and payroll factor? (Round the payroll factor to two places.)

The other total includes $10,000 of salary of a Virginia employee that works part time in another state.What is Tennis Pro's Virginia payroll numerator and payroll factor? (Round the payroll factor to two places.)

(Essay)

4.8/5  (34)

(34)

In Complete Auto Transit the U.S.Supreme Court determined eight criteria for determining whether a state can tax a nondomiciliary company.

(True/False)

4.8/5  (37)

(37)

List the steps necessary to determine an interstate business's state income tax liability.

(Essay)

4.9/5  (43)

(43)

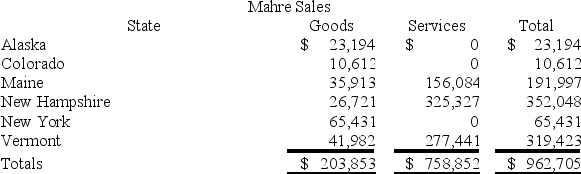

Mahre,Incorporated,a New York corporation,runs ski tours in several states.Mahre also has a New York retail store and an Internet store,which ships to out-of-state customers.The ski tours operate in Maine,New Hampshire,and Vermont,where Mahre has employees and owns and uses tangible personal property.Mahre has real property only in New York.Mahre has the following sales:  Assume the following sales tax rates: Alaska (0 percent),Colorado (7.75 percent),Maine (8.5 percent),New Hampshire (6.75 percent),New York (8 percent),and Vermont (5 percent).How much sales and use tax must Mahre collect and remit in Maine?

Assume the following sales tax rates: Alaska (0 percent),Colorado (7.75 percent),Maine (8.5 percent),New Hampshire (6.75 percent),New York (8 percent),and Vermont (5 percent).How much sales and use tax must Mahre collect and remit in Maine?

(Multiple Choice)

4.8/5  (36)

(36)

Which of the following regarding the state tax base is incorrect?

(Multiple Choice)

4.7/5  (39)

(39)

Interest and dividends are allocated to the state of commercial domicile.

(True/False)

4.9/5  (43)

(43)

Delivery of tangible personal property through common carrier is a protected activity.

(True/False)

4.7/5  (38)

(38)

Immaterial violations of the solicitation rules automatically create income tax nexus.

(True/False)

4.9/5  (36)

(36)

All of the following are false regarding apportionment except?

(Multiple Choice)

4.9/5  (41)

(41)

Public Law 86-272 protects a taxpayer from which of the following taxes?

(Multiple Choice)

4.9/5  (36)

(36)

Showing 21 - 40 of 117

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)