Exam 8: Reporting and Analyzing Long-Term Assets

Exam 1: Introducing Financial Statements277 Questions

Exam 2: Financial Statements and the Accounting System237 Questions

Exam 3: Adjusting Accounts for Financial Statements381 Questions

Exam 4: Reporting and Analyzing Merchandising Operations269 Questions

Exam 5: Reporting and Analyzing Inventories236 Questions

Exam 6: Reporting and Analyzing Cash,fraud,and Internal Control210 Questions

Exam 7: Reporting and Analyzing Receivables218 Questions

Exam 8: Reporting and Analyzing Long-Term Assets257 Questions

Exam 9: Reporting and Analyzing Current Liabilities210 Questions

Exam 10: Reporting and Analyzing Long-Term Liabilities231 Questions

Exam 11: Reporting and Analyzing Equity245 Questions

Exam 12: Reporting and Analyzing Cash Flows248 Questions

Exam 13: Analyzing and Interpreting Financial Statements236 Questions

Exam 14: Applying Present and Future Values31 Questions

Exam 15: Investments199 Questions

Exam 16: International Operations28 Questions

Select questions type

Wickland Company installs a manufacturing machine in its production facility at the beginning of the year at a cost of $87,000.The machine's useful life is estimated to be 5 years,or 400,000 units of product,with a $7,000 salvage value.During its second year,the machine produces 84,500 units of product.Determine the machines' second year depreciation under the straight-line method.

(Multiple Choice)

4.8/5  (43)

(43)

A patent is an exclusive right granted to its owner to manufacture and sell a patented device or to use a process for 20 years.

(True/False)

4.9/5  (41)

(41)

Plant assets can be disposed of by discarding,selling,or exchanging them.

(True/False)

4.7/5  (30)

(30)

A company purchased land on which to construct a new building for a cost of $350,000.Additional costs incurred were:

Real estate broker's commissions………………………….$24,500

Legal fees incurred in purchase of the real estate………… 1,500

Landscaping………………………………………………..8,000

Cost to remove old house located on land…………… 3,000

Proceeds from selling materials salvaged from old house 1,000

What total dollar amount should be charged to Land and what amount should be charged to Building or other accounts?

(Essay)

4.7/5  (32)

(32)

The relevant factors in computing depreciation do not include:

(Multiple Choice)

4.9/5  (46)

(46)

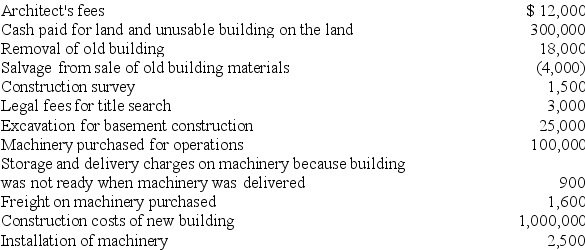

A company made the following expenditures in connection with the construction of a new building:

Prepare a schedule showing the amounts to be recorded as Land,Buildings,and Machinery.

Prepare a schedule showing the amounts to be recorded as Land,Buildings,and Machinery.

(Essay)

4.8/5  (32)

(32)

Victory Company purchases office equipment at the beginning of the year at a cost of $15,000.The machine is depreciated using the straight-line method.The machine's useful life is estimated to be 7 years with a $1,000 salvage value.The journal entry to record the first year's depreciation is:

(Multiple Choice)

4.8/5  (47)

(47)

Depreciation expense is calculated using its cost,estimates of an asset's salvage value,and an estimated useful life.

(True/False)

4.9/5  (34)

(34)

Allyn Company purchased equipment costing $55,000 on January 1,Year 1.The equipment is estimated to have a salvage value of $5,000 and an estimated useful life of 5 years.Double-declining-depreciation is used,and all depreciation has been recorded as of December 31,Year 2.If the equipment is sold on December 31,Year 2 for $15,000,the journal entry to record the sale is:

(Multiple Choice)

4.7/5  (40)

(40)

The Modified Accelerated Cost Recovery System (MACRS)is part of the U.S.federal income tax laws and may be used for financial reporting.

(True/False)

4.7/5  (32)

(32)

The units-of-production method of depreciation charges a constant amount of expense for each unit produced during an asset's useful life.

(True/False)

4.8/5  (31)

(31)

Marlow Company purchased a point of sale system on January 1 for $3,400.This system has a useful life of 10 years and a salvage value of $400.What would be the depreciation expense for the first year of its useful life using the double-declining-balance method?

(Multiple Choice)

4.9/5  (33)

(33)

Natural resources are assets that include standing timber,mineral deposits,and oil and gas fields.

(True/False)

4.9/5  (38)

(38)

Intangible assets are nonphysical assets used in operations that confer on their owners' long-term rights,privileges,or competitive advantages.

(True/False)

4.9/5  (41)

(41)

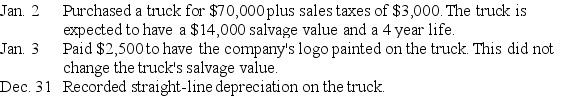

McClintock Co.had the following transactions involving plant assets during Year 1.Unless otherwise indicated,all transactions were for cash.

Prepare the general journal entries to record these transactions.

Prepare the general journal entries to record these transactions.

(Essay)

4.9/5  (42)

(42)

Marlow Company purchased a point of sale system on January 1 for $3,400.This system has a useful life of 10 years and a salvage value of $400.What would be the depreciation expense for the second year of its useful life using the double-declining-balance method?

(Multiple Choice)

4.9/5  (32)

(32)

Which of the following statements regarding increases in the value of plant assets under U.S.GAAP and IFRS is true?

(Multiple Choice)

4.8/5  (37)

(37)

Showing 121 - 140 of 257

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)