Exam 8: Reporting and Analyzing Long-Term Assets

Exam 1: Introducing Financial Statements277 Questions

Exam 2: Financial Statements and the Accounting System237 Questions

Exam 3: Adjusting Accounts for Financial Statements381 Questions

Exam 4: Reporting and Analyzing Merchandising Operations269 Questions

Exam 5: Reporting and Analyzing Inventories236 Questions

Exam 6: Reporting and Analyzing Cash,fraud,and Internal Control210 Questions

Exam 7: Reporting and Analyzing Receivables218 Questions

Exam 8: Reporting and Analyzing Long-Term Assets257 Questions

Exam 9: Reporting and Analyzing Current Liabilities210 Questions

Exam 10: Reporting and Analyzing Long-Term Liabilities231 Questions

Exam 11: Reporting and Analyzing Equity245 Questions

Exam 12: Reporting and Analyzing Cash Flows248 Questions

Exam 13: Analyzing and Interpreting Financial Statements236 Questions

Exam 14: Applying Present and Future Values31 Questions

Exam 15: Investments199 Questions

Exam 16: International Operations28 Questions

Select questions type

A ________ results from revising estimates of the useful life or salvage value of a plant asset.

(Short Answer)

4.7/5  (33)

(33)

A company purchased a tract of land for its natural resources at a cost of $1,500,000.It expects to mine 2,000,000 tons of ore from this land.The salvage value of the land is expected to be $250,000.If 150,000 tons of ore are mined during the first year,the journal entry to record the depletion is:

(Multiple Choice)

4.8/5  (37)

(37)

A plant asset's useful life is the length of time it is productively used in a company's operations.

(True/False)

4.7/5  (43)

(43)

Mohr Company purchases a machine at the beginning of the year at a cost of $24,000.The machine is depreciated using the double-declining-balance method.The machine's useful life is estimated to be 5 years with a $4,000 salvage value.Depreciation expense in year 2 is:

(Multiple Choice)

4.8/5  (34)

(34)

A new machine costing $1,800,000 cash and estimated to have a $60,000 salvage value was purchased on January 1.The machine is expected to produce 600,000 units of product during its 8-year useful life.Calculate the depreciation expense in the first year under the following independent situations:

1.The company uses the units-of-production method and the machine produces 70,000 units of product during its first year.

2.The company uses the double-declining-balance method.

3.The company uses the straight-line method.

(Essay)

4.9/5  (34)

(34)

Fields Company purchased equipment on January 1 for $180,000.This system has a useful life of 8 years and a salvage value of $20,000.The company estimates that the equipment will produce 40,000 units over its 8-year useful life.Actual units produced are: Year 1 - 4,000 units; Year 2 - 6,000 units; Year 3 - 8,000 units; Year 4 - 5,000 units; Year 5 - 4,000 units; Year 6 - 5,000 units; Year 7 - 7,000 units; Year 8 - 3,000 units.What would be the depreciation expense for the second year of its useful life using the straight-line method?

(Multiple Choice)

4.9/5  (34)

(34)

A company purchased a weaving machine for $190,000.The machine has a useful life of 8 years and a residual value of $10,000.It is estimated that the machine could produce 75,000 bolts of woven fabric over its useful life.In the first year,15,000 bolts were produced.In the second year,production increased to 19,000 units.Using the units-of-production method,what is the amount of accumulated depreciation at the end of the second year?

(Multiple Choice)

4.9/5  (38)

(38)

It is necessary to report both the cost and the accumulated depreciation of plant assets in the financial statements.

(True/False)

4.9/5  (37)

(37)

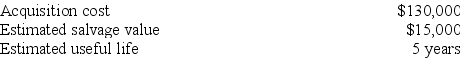

On April 1,Year 1,Raines Co.purchased and placed a plant asset in service.The following information is available regarding the plant asset:

Make the necessary adjusting journal entries at December 31,Year 1,and December 31,Year 2 to record depreciation for each year under the double-declining-balance depreciation method:

Make the necessary adjusting journal entries at December 31,Year 1,and December 31,Year 2 to record depreciation for each year under the double-declining-balance depreciation method:

(Essay)

4.7/5  (35)

(35)

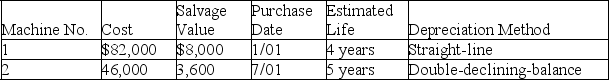

A company's property records revealed the following information about its plant assets:

Calculate the depreciation expense for each machine in Year 1 and Year 2 for the year ended December 31.

Machine 1:

Year 1________ Year 2 ________

Machine 2:

Year 1 ________ Year 2 ________

Calculate the depreciation expense for each machine in Year 1 and Year 2 for the year ended December 31.

Machine 1:

Year 1________ Year 2 ________

Machine 2:

Year 1 ________ Year 2 ________

(Essay)

4.7/5  (40)

(40)

The process of allocating the cost of a plant asset to expense in the accounting periods benefiting from its use is called depreciation.

(True/False)

4.9/5  (40)

(40)

When originally purchased,a vehicle costing $23,000 had an estimated useful life of 8 years and an estimated salvage value of $3,000.After 4 years of straight-line depreciation,the asset's total estimated useful life was revised from 8 years to 6 years and there was no change in the estimated salvage value.The depreciation expense in year 5 equals:

(Multiple Choice)

5.0/5  (38)

(38)

Explain how to calculate total asset turnover.Describe what it reveals about a company's financial condition,whether a higher or lower ratio is desirable,and how it is best applied for comparative purposes.

(Essay)

4.8/5  (34)

(34)

On January 2,2010,a company purchased a delivery truck for $45,000 cash.The truck had an estimated useful life of seven years and an estimated salvage value of $3,000.The straight-line method of depreciation was used.Prepare the journal entries to record depreciation expense and the disposition of the truck on September 1,2014,under each of the following assumptions:

a.The truck and $45,000 cash were given in exchange for a new delivery truck that had a cash price of $60,000.This transaction has commercial substance.

b.The truck and $40,000 cash were exchanged for a new delivery truck that had a cash price of $60,000.This transaction has commercial substance.

(Essay)

4.8/5  (43)

(43)

Depletion is the process of allocating the cost of natural resources to periods when they are consumed.

(True/False)

4.9/5  (38)

(38)

The depreciation method in which a plant asset's depreciation expense for a period is determined by applying a constant depreciation rate to the asset's beginning-of-period book value is called:

(Multiple Choice)

4.8/5  (35)

(35)

Showing 61 - 80 of 257

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)