Exam 15: Investments

Exam 1: Introducing Financial Statements277 Questions

Exam 2: Financial Statements and the Accounting System237 Questions

Exam 3: Adjusting Accounts for Financial Statements381 Questions

Exam 4: Reporting and Analyzing Merchandising Operations269 Questions

Exam 5: Reporting and Analyzing Inventories236 Questions

Exam 6: Reporting and Analyzing Cash,fraud,and Internal Control210 Questions

Exam 7: Reporting and Analyzing Receivables218 Questions

Exam 8: Reporting and Analyzing Long-Term Assets257 Questions

Exam 9: Reporting and Analyzing Current Liabilities210 Questions

Exam 10: Reporting and Analyzing Long-Term Liabilities231 Questions

Exam 11: Reporting and Analyzing Equity245 Questions

Exam 12: Reporting and Analyzing Cash Flows248 Questions

Exam 13: Analyzing and Interpreting Financial Statements236 Questions

Exam 14: Applying Present and Future Values31 Questions

Exam 15: Investments199 Questions

Exam 16: International Operations28 Questions

Select questions type

Long-term investments in held-to-maturity debt securities are accounted for using the:

(Multiple Choice)

4.8/5  (46)

(46)

A company has net income of $250,000,net sales of $2,000,000,and average total assets of $1,500,000.Its return on total assets equals:

(Multiple Choice)

4.8/5  (38)

(38)

Profit margin reflects the percent of net income in each dollar of net sales.

(True/False)

4.7/5  (37)

(37)

Dividends received from stock investments with insignificant influence are recorded as a reduction in the investment account.

(True/False)

4.8/5  (37)

(37)

MotorCity,Inc.purchased 40,000 shares of Shaw common stock for $232,000.This represents 40% of the outstanding stock.The entry to record the transaction includes a:

(Multiple Choice)

4.8/5  (49)

(49)

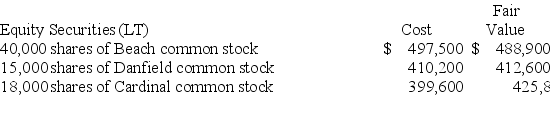

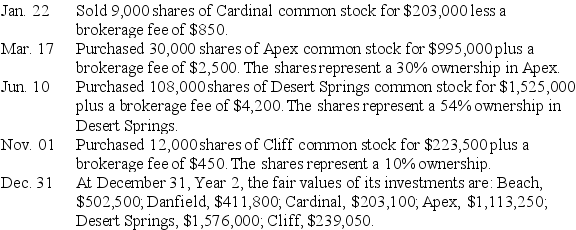

Weston Company had the following long-term equity securities in its portfolio at December 31,Year 1.Weston had several long-term investment transactions during the next year.After analyzing the effects of each transaction,(1)determine the amount Weston should report on its December 31,Year 1 balance sheet for its long-term investments in available-for-sale securities,(2)determine the amount Weston should report on its December 31,Year 2 balance sheet for its long-term investments in equity securities,(3)prepare the necessary adjusting entry to record the fair value adjustment at December 31,Year 2.

(Essay)

5.0/5  (37)

(37)

________ financial statements show the financial position,results of operations,and cash flows of all entities under the parent company's control,including all subsidiaries.

(Short Answer)

4.8/5  (34)

(34)

When the cost of a long-term held-to-maturity debt security is different from the maturity value,the difference is amortized over the remaining life of the security.

(True/False)

4.9/5  (40)

(40)

On January 4,Year 1,Barber Company purchased 5,000 shares of Convell Company for $59,500 plus a broker's fee of $1,000.Convell Company has a total of 25,000 shares of common stock outstanding and it is presumed the Barber Company will have a significant influence over Convell.During each of the next two years,Convell declared and paid cash dividends of $0.85 per share,and its net income was $72,000 and $67,000 for Year 1 and Year 2,respectively.What is the book value of Barber's investment in Convell at the end of Year 2?

(Multiple Choice)

5.0/5  (38)

(38)

On July 31,Potter Co.purchased GigaTech bonds for $16,000.The investment is classified as available-for-sale securities.This is the company's first and only investment in available-for-sale securities.On October 31,which is Potter's year-end,the bonds had a fair value of $20,000.Potter should record a:

(Multiple Choice)

4.8/5  (46)

(46)

Both U.S.GAAP and IFRS permit companies to use fair value in reporting available-for-sale and held-to-maturity securities.

(True/False)

4.8/5  (34)

(34)

Explain how to account for held-to-maturity debt securities at and after acquisition and how they are reported in the financial statements.

(Essay)

4.8/5  (46)

(46)

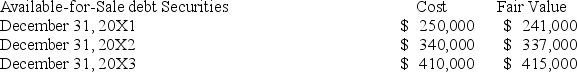

Carpark Services began operations in 20X1 and maintains long-term investments in available-for-sale debt securities.The year-end cost and fair values for its portfolio of these investments follow.The year-end adjusting entry to record the unrealized gain/loss at December 31,20X1 is:

(Multiple Choice)

4.7/5  (35)

(35)

When one company owns more than 50% of another company's voting stock and has control over the investee company,the investee is called the ________.

(Short Answer)

4.8/5  (29)

(29)

On May 1 of the current year,a company paid $200,000 cash to purchase 6%,10-year bonds with a par value of $200,000; interest is paid semiannually each May 1 and November 1.The company intends to hold these bonds until they mature.Prepare the journal entry for the accrual of interest for the year-end December 31.

(Essay)

4.7/5  (32)

(32)

Segmental Manufacturing owns 35% of Glesson Corp.stock.Glesson pays a total of $47,000 in cash dividends for the period.Segmental's entry to record the dividend transaction would include a:

(Multiple Choice)

4.8/5  (45)

(45)

On January 1,Jewel Company buys $200,000 of Marcelo Corp.12%,36-month notes.Interest is paid on the last day of each month.The notes are classified as available-for-sale securities.This is the company's first and only investment in available-for-sale securities.On December 31,the notes have a fair value of $204,000.The amount that Jewel Company should report in the investment section of its year-end December 31 balance sheet for its investment in Marcelo Corp.is:

(Multiple Choice)

4.8/5  (37)

(37)

Cloverton Corporation had net income of $30,000,net sales of $1,000,000,and average total assets of $500,000.Its return on total assets is:

(Multiple Choice)

4.8/5  (35)

(35)

The adjustment to fair value of trading securities is included in the calculation of net income.

(True/False)

4.9/5  (30)

(30)

Showing 81 - 100 of 199

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)