Exam 5: Accounting for Inventories

Exam 1: Introducing Financial Accounting259 Questions

Exam 2: Accounting for Transactions219 Questions

Exam 3: Preparing Financial Statements235 Questions

Exam 4: Accounting for Merchandising Operations200 Questions

Exam 5: Accounting for Inventories191 Questions

Exam 6: Accounting for Cash and Internal Controls203 Questions

Exam 7: Accounting for Receivables170 Questions

Exam 8: Accounting for Long-Term Assets202 Questions

Exam 9: Accounting for Current Liabilities195 Questions

Exam 10: Accounting for Long-Term Liabilities189 Questions

Exam 11: Accounting for Equity198 Questions

Exam 12: Accounting for Cash Flows175 Questions

Exam 13: Interpreting Financial Statements187 Questions

Exam 14: Time Value of Money57 Questions

Exam 15: Investments and International Operations178 Questions

Exam 16: Accounting for Partnerships122 Questions

Exam 17: Accounting With Special Journals164 Questions

Select questions type

Apply the retail method to the following company information to calculate the cost of the ending inventory for the current period:

Cost Retail Beginning inventory \ 20,224 \ 31,600 Net purchases 59,508 97,000 Sales 89,000

(Essay)

4.9/5  (39)

(39)

When taking a physical count of inventory, the use of prenumbered inventory tickets assists in the control process.

(True/False)

4.7/5  (33)

(33)

Regardless of what inventory method or system is used, cost of goods available for sale must be allocated between ___________________ and ___________________.

(Essay)

4.9/5  (34)

(34)

All incidental costs of inventory acquisition and handling, whether necessary or not, are assigned to inventory.

(True/False)

4.8/5  (47)

(47)

The ______________________ method of assigning costs to inventory and cost of goods sold requires that the cost of goods available for sale be divided by the units of inventory available when each sale takes place.

(Essay)

4.8/5  (26)

(26)

Given the following information, determine the cost of ending inventory at December 31 using the weighted-average perpetual inventory method. Assume this is the first month of the company's operations. December 2: 5 units were purchased at $7 per unit.

December 9: 10 units were purchased at $9.40 per unit.

December 12: 2 units were sold.

(Multiple Choice)

4.9/5  (33)

(33)

Which inventory valuation method assigns a value to the inventory on the balance sheet that approximates current cost and also mimics the actual flow of goods for most businesses?

(Multiple Choice)

4.7/5  (37)

(37)

A company reported the following information regarding its inventory. Beginning inventory: cost is $70,000; retail is $130,000.

Net purchases: cost is $65,000; retail is $120,000.

Sales at retail: $145,000.

The year-end inventory showed $105,000 worth of merchandise available at retail prices. What is the cost of the ending inventory?

(Multiple Choice)

4.7/5  (29)

(29)

Given the following information, determine the cost of goods sold at December 31 using the weighted-average periodic inventory method: December 2: 5 units were purchased at $7 per unit.

December 9: 10 units were purchased at $9.40 per unit.

December 11: 12 units were sold at $35 per unit.

December 15: 20 units were purchased at $10.15 per unit.

December 22: 18 units were sold at $35 per unit.

(Multiple Choice)

4.8/5  (45)

(45)

The _________________ method is commonly used to estimate the value of inventory that has been destroyed, lost or stolen.

(Short Answer)

4.9/5  (37)

(37)

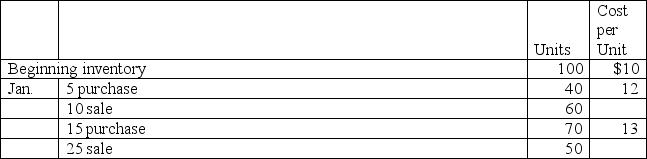

During January, a company that uses a perpetual inventory system had beginning inventory, purchases, and sales as follows. What was the LIFO cost of the company's January 31 inventory?

(Essay)

4.9/5  (31)

(31)

A company had inventory on November 1 of 5 units at a cost of $20 each. On November 2, they purchased 10 units at $22 each. On November 6, they purchased 6 units at $25 each. On November 8, 8 units were sold for $55 each. Using the LIFO perpetual inventory method, what was the value of the inventory on November 8 after the sale?

(Multiple Choice)

4.8/5  (39)

(39)

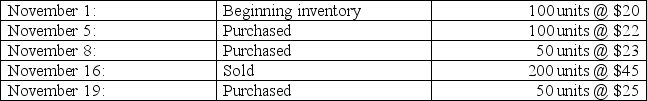

A company uses the periodic inventory system and had the following activity during the current monthly period:.

Using the weighted-average inventory method, the company's ending inventory would be reported at:

Using the weighted-average inventory method, the company's ending inventory would be reported at:

(Multiple Choice)

4.9/5  (34)

(34)

A company normally sells its product for $20 per unit. However, the selling price has fallen to $15 per unit. This company's current inventory consists of 200 units purchased at $16 per unit. Replacement cost has now fallen to $13 per unit. Calculate the value of this company's inventory at the lower of cost or market.

(Multiple Choice)

4.7/5  (35)

(35)

A company's store was destroyed by a fire on February 10 of this year. The only information for the current period that could be salvaged included the following:

Beginning inventory, January 1: $34,000

Purchases to date: $118,000

Sales to date: $140,000

Historically, the company's gross profit ratio has been 30%. Estimate the value of the destroyed inventory using the gross profit method.

(Essay)

4.7/5  (37)

(37)

Whether prices are rising or falling, FIFO always will yield the highest gross profit and net income.

(True/False)

4.9/5  (43)

(43)

A company had inventory of 5 units at a cost of $20 each on November 1. On November 2, they purchased 10 units at $22 each. On November 6, they purchased 6 units at $25 each. On November 8, they sold 18 units for $54 each. Using the LIFO perpetual inventory method, what was the cost of the 18 units sold?

(Multiple Choice)

4.9/5  (36)

(36)

Showing 121 - 140 of 191

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)