Exam 15: Investments and International Operations

Exam 1: Introducing Financial Accounting259 Questions

Exam 2: Accounting for Transactions219 Questions

Exam 3: Preparing Financial Statements235 Questions

Exam 4: Accounting for Merchandising Operations200 Questions

Exam 5: Accounting for Inventories191 Questions

Exam 6: Accounting for Cash and Internal Controls203 Questions

Exam 7: Accounting for Receivables170 Questions

Exam 8: Accounting for Long-Term Assets202 Questions

Exam 9: Accounting for Current Liabilities195 Questions

Exam 10: Accounting for Long-Term Liabilities189 Questions

Exam 11: Accounting for Equity198 Questions

Exam 12: Accounting for Cash Flows175 Questions

Exam 13: Interpreting Financial Statements187 Questions

Exam 14: Time Value of Money57 Questions

Exam 15: Investments and International Operations178 Questions

Exam 16: Accounting for Partnerships122 Questions

Exam 17: Accounting With Special Journals164 Questions

Select questions type

Investments in debt and equity securities that the company actively manages and trades for profit are referred to as short-term investments in:

(Multiple Choice)

4.9/5  (37)

(37)

As a long-term investment, Elmer's Equipment Enterprise purchased 20% of Sticky Supplies Inc.'s 300,000 shares for $350,000 at the beginning of the fiscal year of both companies. On the purchase date, the fair value and book value of Sticky's net assets were equal. During the year, Sticky's earned net income of $430,000 and distributed cash dividends of 0.42 cents per share. The fair value of Sticky's assets at the end of the year totaled $349,450. What is Elmer's balance for this investment at the end of the year, assuming there is no significant control?

(Short Answer)

4.7/5  (39)

(39)

A decrease in the fair market value of a security that has not yet been realized through an actual sale of the security is called a(n):

(Multiple Choice)

4.8/5  (40)

(40)

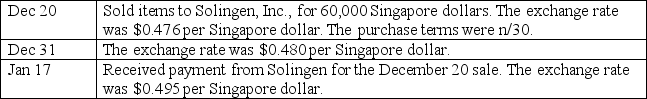

Mian, Inc., sells American gourmet foods to merchandisers in Singapore. Prepare the journal entries for Mian to record the following transactions. Include any year-end adjustments.

(Essay)

4.8/5  (44)

(44)

On April 1 of the current year, a company paid $150,000 to purchase 7%, 10-year bonds that had a par value of $150,000 and paid interest semiannually on October 1 and April 1. The company intends to hold the bonds until they mature. Prepare the journal entry to recognize accrued interest as of December 31 of the current year.

(Essay)

4.9/5  (35)

(35)

Investments in trading securities are always classified as ______________ and are reported as _______________ on the balance sheet.

(Essay)

4.8/5  (41)

(41)

A company should report its portfolio of trading securities at its market value.

(True/False)

4.9/5  (31)

(31)

Vans purchased 40,000 shares of Skechers common stock for $232,000. This represents 40% of the outstanding stock. The entry to record the transaction includes a:

(Multiple Choice)

4.8/5  (40)

(40)

If a long-term investment in an equity security gives the investor significant influence over the investee, the investment is classified as available-for-sale.

(True/False)

4.7/5  (41)

(41)

To prepare consolidated financial statements when a company has an international subsidiary, the international subsidiary's financial statements must be translated into U.S. dollars.

(True/False)

4.8/5  (40)

(40)

On November 12, Kendra, Inc., a U.S. Company, sold merchandise on credit to Nakakura Company of Japan at a price of 1,500,000 yen. The exchange rate was $0.00837 per yen on the date of sale. On December 31, when Kendra prepared its financial statements, the exchange rate was $0.00843. Nakakura Company paid in full on January 12, when the exchange rate was $0.00861. On December 31, Kendra should prepare the following journal entry for this transaction:

(Multiple Choice)

4.9/5  (28)

(28)

Long-term investments in held-to-maturity debt securities are accounted for using the:

(Multiple Choice)

4.8/5  (35)

(35)

A company received dividends of $0.35 per share on 300 shares of stock. The journal entry to record this transaction would be to debit Cash for $105 and credit Dividend Revenue for $105.

(True/False)

4.8/5  (41)

(41)

If a U.S. company makes a credit sale to a foreign company, the sales price must be translated into dollars as of the date of _____________.

(Short Answer)

4.8/5  (32)

(32)

A U.S. company makes a sale to a foreign customer payable in 30 days in the customer's currency. The sale would be recorded by the U.S. company on the date:

(Multiple Choice)

4.8/5  (37)

(37)

A company's return on total assets equals 28%. If total assets and net sales are $4,500,000 and $10,000,000 respectively, how much is net income?

(Multiple Choice)

4.8/5  (36)

(36)

Showing 101 - 120 of 178

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)