Exam 6: Inventories

Exam 1: Accounting in Action257 Questions

Exam 2: The Recording Process206 Questions

Exam 3: Adjusting the Accounts260 Questions

Exam 4: Completing the Accounting Cycle236 Questions

Exam 5: Accounting for Merchandising Operations244 Questions

Exam 6: Inventories235 Questions

Exam 7: Fraud, Internal Control, and Cash232 Questions

Exam 8: Accounting for Receivables239 Questions

Exam 9: Plant Assets, Natural Resources, and Intangible Assets310 Questions

Exam 10: Liabilities309 Questions

Exam 11: Corporations: Organization, Stock Transactions343 Questions

Exam 12: Statement of Cash Flows202 Questions

Exam 13: Financial Statement Analysis271 Questions

Exam 14: Specimen Financial Statements: Apple Inc66 Questions

Exam 15: Specimen Financial Statements: Pepsico, Inc211 Questions

Exam 16: Specimen Financial Statements: the Coca-Cola Company39 Questions

Exam 17: Specimen Financial Statements: Amazoncom, Inc85 Questions

Exam 18: Specimen Financial Statements: Wal-Mart Stores, Inc39 Questions

Select questions type

The following information was available for Pete Company at December 31, 2018: beginning inventory $90,000; ending inventory $70,000; cost of goods sold $984,000; and sales $1,350,000. Pete's days in inventory in 2018 was

(Multiple Choice)

4.9/5  (36)

(36)

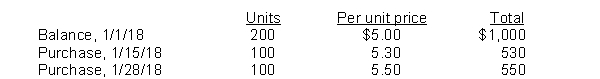

Effie Company uses a periodic inventory system. Details for the inventory account for the month of January, 2018 are as follows:  An end of the month (1/31/18) inventory showed that 160 units were on hand. If the company uses LIFO, what is the value of the ending inventory?

An end of the month (1/31/18) inventory showed that 160 units were on hand. If the company uses LIFO, what is the value of the ending inventory?

(Multiple Choice)

4.9/5  (42)

(42)

Manufacturers usually classify inventory into all the following general categories except

(Multiple Choice)

4.8/5  (41)

(41)

The selection of an appropriate inventory cost flow assumption for an individual company is made by

(Multiple Choice)

4.8/5  (38)

(38)

The factor which determines whether or not goods should be included in a physical count of inventory is

(Multiple Choice)

4.8/5  (44)

(44)

The following accounts are included in the ledger of Wainwright Company:

Advertising expense

Freight-in

Inventory

Purchases

Purchase returns and allowances

Sales revenue

Sales returns and allowances

Which of the accounts would be included in calculating cost of goods sold?

(Essay)

4.7/5  (35)

(35)

Beginning inventory plus the cost of goods purchased equals

(Multiple Choice)

4.8/5  (40)

(40)

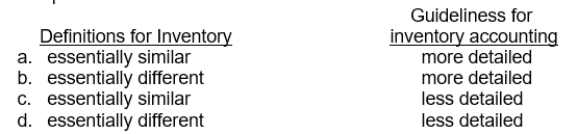

GAAP's definition for inventory and provision of guidelines for inventory accounting, as compared to IFRS are:  IFRS:

IFRS:

(Short Answer)

4.9/5  (37)

(37)

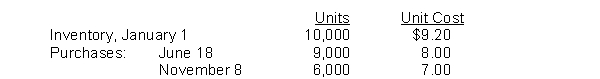

Eneri Company's inventory records show the following data:  A physical inventory on December 31 shows 4,000 units on hand. Eneri sells the units for $13 each. The company has an effective tax rate of 20%. Eneri uses the periodic inventory method. What is the cost of goods available for sale?

A physical inventory on December 31 shows 4,000 units on hand. Eneri sells the units for $13 each. The company has an effective tax rate of 20%. Eneri uses the periodic inventory method. What is the cost of goods available for sale?

(Multiple Choice)

4.9/5  (37)

(37)

Goods in transit should be included in the inventory of the buyer when the

(Multiple Choice)

4.8/5  (39)

(39)

Othello Company understated its inventory by $20,000 at December 31, 2017. It did not correct the error in 2017 or 2018. As a result, Othello's stockholder's equity was:

(Multiple Choice)

4.9/5  (36)

(36)

Which costing method cannot be used to determine the cost of inventory items before lower-of-cost-or-net realizable value is applied?

(Multiple Choice)

4.9/5  (40)

(40)

Under the retail inventory method, the estimated cost of ending inventory is computed by multiplying the cost-to-retail ratio by

(Multiple Choice)

4.8/5  (38)

(38)

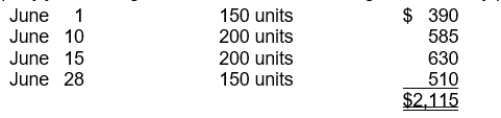

A company just starting business made the following four inventory purchases in June:  A physical count of merchandise inventory on June 30 reveals that there are 250 units on hand. Using the LIFO inventory method, the value of the ending inventory on June 30 is

A physical count of merchandise inventory on June 30 reveals that there are 250 units on hand. Using the LIFO inventory method, the value of the ending inventory on June 30 is

(Multiple Choice)

4.9/5  (40)

(40)

The manager of Brick Company is given a bonus based on income before income taxes. Net income, after taxes, is $11,200 for FIFO and $9,800 for LIFO. The tax rate is 30%. The bonus rate is 20%. How much higher is the manager's bonus if FIFO is adopted instead of LIFO?

(Multiple Choice)

4.8/5  (45)

(45)

Which of the following should be included in the physical inventory of a company?

(Multiple Choice)

4.9/5  (43)

(43)

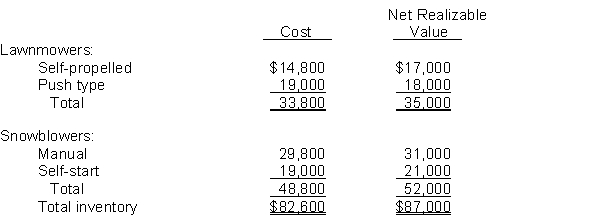

The controller of Alt Company is applying the lower-of-cost-or-net realizable value basis of valuing its ending inventory. The following information is available:  Instructions

Compute the value of the ending inventory by applying the lower-of-cost-or-net realizable value basis.

Instructions

Compute the value of the ending inventory by applying the lower-of-cost-or-net realizable value basis.

(Essay)

4.8/5  (36)

(36)

Under the FIFO method, the costs of the earliest units purchased are the first charged to cost of goods sold.

(True/False)

4.9/5  (36)

(36)

Queen Company is in the electronics industry and the price it pays for inventory is decreasing.

Instructions

Indicate which inventory method will:

a. provide the highest ending inventory.

b. provide the highest cost of goods sold.

c. result in the highest net income.

d. result in the lowest income tax expense.

e. produce the most stable earnings over several years.

(Essay)

4.9/5  (36)

(36)

If a company uses the FIFO cost flow assumption, the cost of goods sold for the period will be the same under a perpetual or periodic inventory system.

(True/False)

4.7/5  (29)

(29)

Showing 181 - 200 of 235

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)