Exam 6: Inventories

Exam 1: Accounting in Action257 Questions

Exam 2: The Recording Process206 Questions

Exam 3: Adjusting the Accounts260 Questions

Exam 4: Completing the Accounting Cycle236 Questions

Exam 5: Accounting for Merchandising Operations244 Questions

Exam 6: Inventories235 Questions

Exam 7: Fraud, Internal Control, and Cash232 Questions

Exam 8: Accounting for Receivables239 Questions

Exam 9: Plant Assets, Natural Resources, and Intangible Assets310 Questions

Exam 10: Liabilities309 Questions

Exam 11: Corporations: Organization, Stock Transactions343 Questions

Exam 12: Statement of Cash Flows202 Questions

Exam 13: Financial Statement Analysis271 Questions

Exam 14: Specimen Financial Statements: Apple Inc66 Questions

Exam 15: Specimen Financial Statements: Pepsico, Inc211 Questions

Exam 16: Specimen Financial Statements: the Coca-Cola Company39 Questions

Exam 17: Specimen Financial Statements: Amazoncom, Inc85 Questions

Exam 18: Specimen Financial Statements: Wal-Mart Stores, Inc39 Questions

Select questions type

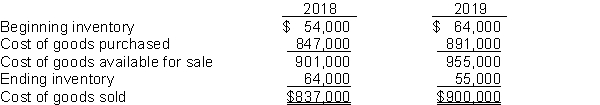

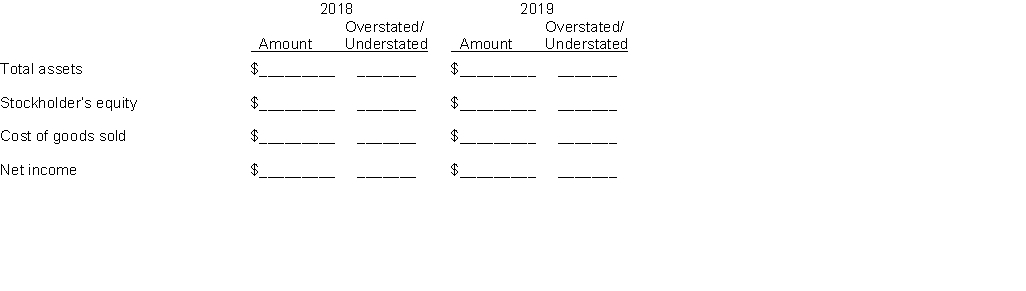

Galena Pharmacy reported cost of goods sold as follows:  Jim Holt, the bookkeeper, made two errors:

(1) 2018 ending inventory was overstated by $7,000.

(2) 2019 ending inventory was understated by $16,000.

Instructions

Assuming the errors had not been corrected, indicate the dollar effect that the errors had on the items appearing on the financial statements listed below. Also indicate if the amounts are overstated (O) or understated (U).

Jim Holt, the bookkeeper, made two errors:

(1) 2018 ending inventory was overstated by $7,000.

(2) 2019 ending inventory was understated by $16,000.

Instructions

Assuming the errors had not been corrected, indicate the dollar effect that the errors had on the items appearing on the financial statements listed below. Also indicate if the amounts are overstated (O) or understated (U).

(Essay)

4.7/5  (37)

(37)

Transactions that affect inventories on hand have an effect on both the balance sheet and the income statement.

(True/False)

4.8/5  (38)

(38)

When valuing ending inventory under a perpetual inventory system, the

(Multiple Choice)

4.7/5  (34)

(34)

For companies that use a perpetual inventory system, all of the following are purposes for taking a physical inventory except

(Multiple Choice)

4.9/5  (40)

(40)

Companies adopt different cost flow methods for each of the following reasons except

(Multiple Choice)

4.8/5  (39)

(39)

Disclosures about inventory should include each of the following except the

(Multiple Choice)

4.9/5  (43)

(43)

Which of the following statements is correct with respect to inventories?

(Multiple Choice)

4.8/5  (33)

(33)

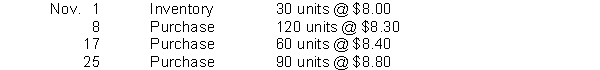

Netta Shutters has the following inventory information.  A physical count of merchandise inventory on November 30 reveals that there are 90 units on hand. Assume a periodic inventory system is used. Ending inventory under LIFO is

A physical count of merchandise inventory on November 30 reveals that there are 90 units on hand. Assume a periodic inventory system is used. Ending inventory under LIFO is

(Multiple Choice)

4.8/5  (46)

(46)

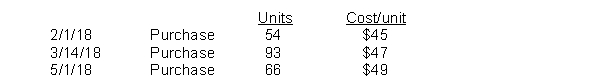

Romanoff Industries had the following inventory transactions occur during 2018:  The company sold 150 units at $70 each and has a tax rate of 30%. Assuming that a periodic inventory system is used, what is the company's after-tax income using LIFO? (rounded to whole dollars)

The company sold 150 units at $70 each and has a tax rate of 30%. Assuming that a periodic inventory system is used, what is the company's after-tax income using LIFO? (rounded to whole dollars)

(Multiple Choice)

4.9/5  (43)

(43)

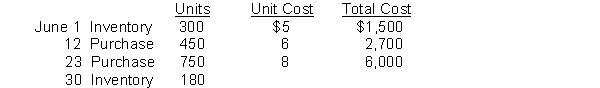

Washington Bottom Company reports the following for the month of June.  Instructions

(a) Compute the cost of the ending inventory and the cost of goods sold under (1) FIFO and (2) LIFO.

(b) Compute the cost of the ending inventory and the cost of goods sold using the average-cost method.

Instructions

(a) Compute the cost of the ending inventory and the cost of goods sold under (1) FIFO and (2) LIFO.

(b) Compute the cost of the ending inventory and the cost of goods sold using the average-cost method.

(Essay)

4.8/5  (36)

(36)

H. Hunter Company's records indicate the following information for the year:  On December 31, a physical inventory determined that ending inventory of $500,000 was in the warehouse. H. Hunter's gross profit on sales has remained constant at 30%. H. Hunter suspects some of the inventory may have been taken by some new employees. At December 31, what is the estimated cost of missing inventory?

On December 31, a physical inventory determined that ending inventory of $500,000 was in the warehouse. H. Hunter's gross profit on sales has remained constant at 30%. H. Hunter suspects some of the inventory may have been taken by some new employees. At December 31, what is the estimated cost of missing inventory?

(Multiple Choice)

4.7/5  (37)

(37)

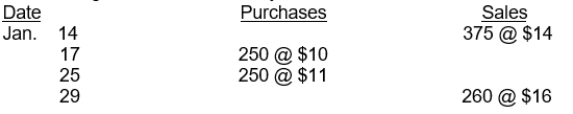

Partridge Bookstore had 500 units on hand at January 1, costing $9 each. Purchases and sales during the month of January were as follows:  Partridge does not maintain perpetual inventory records. According to a physical count, 365 units were on hand at January 31. The cost of the inventory at January 31, under the FIFO method is:

Partridge does not maintain perpetual inventory records. According to a physical count, 365 units were on hand at January 31. The cost of the inventory at January 31, under the FIFO method is:

(Multiple Choice)

4.8/5  (34)

(34)

Inventory items on an assembly line in various stages of production are classified as

(Multiple Choice)

4.8/5  (42)

(42)

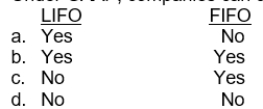

Under GAAP, companies can choose which inventory system?  IFRS:

IFRS:

(Short Answer)

4.9/5  (42)

(42)

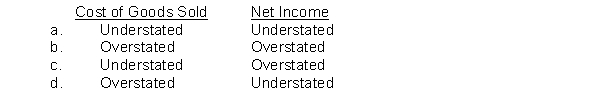

An error in the physical count of goods on hand at the end of a period resulted in a $15,000 overstatement of the ending inventory. The effect of this error in the current period is

(Short Answer)

4.8/5  (40)

(40)

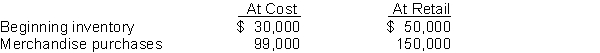

Shoemaker Department Store prepares monthly financial statements but only takes a physical count of merchandise inventory at the end of the year. The following information has been developed for the month of July:  The net sales for July amounted to $142,000.

Instructions

Use the retail inventory method to estimate the ending inventory at cost for July. Show all computations to support your answer.

The net sales for July amounted to $142,000.

Instructions

Use the retail inventory method to estimate the ending inventory at cost for July. Show all computations to support your answer.

(Essay)

4.8/5  (35)

(35)

Accountants believe that the write down from cost to net realizable value should not be made in the period in which the price decline occurs.

(True/False)

4.8/5  (31)

(31)

The more inventory a company has in stock, the greater the company's profit.

(True/False)

4.7/5  (56)

(56)

Showing 121 - 140 of 235

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)